Introduction

In the realm of options trading, the concept of skew holds immense significance. If you’ve ever wondered what skew entails, this article will guide you through its intricacies, providing an all-encompassing explanation of its definition, historical evolution, and practical implications in options trading. So, sit back, relax, and let’s delve into the enigmatic world of skew.

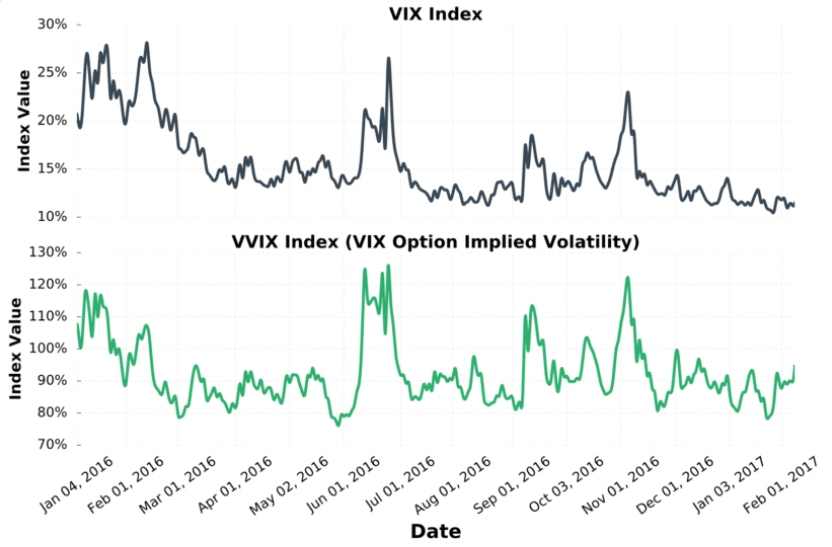

Image: www.projectfinance.com

Defining Skew

Essentially, skew refers to the non-linear relationship between implied volatility and strike price for a given option contract. Implied volatility measures the market’s expectation of future price movement for the underlying asset. Traditionally, implied volatility tends to increase as strike prices move away from the at-the-money (ATM) strike, reflecting the higher uncertainty associated with extreme price movements. However, skew challenges this assumption, introducing a curvature or “slope” to the implied volatility curve.

Factors Influencing Skew

Numerous factors contribute to skew, including:

- Market sentiment: Pessimistic market sentiment can lead to higher skew as investors bid up premiums for out-of-the-money put options, seeking protection against potential downside risks.

- Volatility expectations: Expectations of future volatility can impact skew. When market participants anticipate increased volatility, they tend to buy out-of-the-money call options, resulting in elevated skew.

- Supply and demand: The interplay of supply and demand can influence skew. When supply exceeds demand for particular strike prices, premiums may decline, contributing to a lower skew.

- Dividend yield: For stocks paying dividends, the dividend yield can affect skew. Typically, premiums for out-of-the-money call options on dividend-paying stocks are lower, leading to a flatter skew curve.

Trading Skew

Traders can exploit skew to their advantage through various strategies:

- Selling skew: This strategy involves selling options that have relatively high implied volatility compared to other strikes, leveraging the market’s underestimation of skew.

- Buying skew: Conversely, buying options that exhibit a lower implied volatility compared to other strikes capitalizes on the market’s overestimation of skew.

- Volatility arbitrage: This technique involves simultaneously buying and selling options with different strike prices and time to expiration to exploit the volatility spread.

Image: www.theskew.online

Tips and Expert Advice

To succeed in trading skew, consider the following tips:

- Thoroughly research skew: Understand its historical patterns and the factors that influence it.

- Identify market inefficiencies: Pinpoint deviations from expected skew levels, creating trading opportunities.

- Monitor market conditions: Stay updated with market news and events that may impact skew.

- Use volatility modeling: Employ advanced statistical models to assess implied volatility and identify potential skew trading opportunities.

Remember, trading skew can be complex and involves inherent risk. It’s crucial to approach it with a comprehensive understanding of options and advanced trading strategies. Seek professional guidance if necessary.

FAQ on Skew

Q: What is positive skew?

A: Positive skew occurs when implied volatility is higher for out-of-the-money call options compared to out-of-the-money put options.

Q: What is negative skew?

A: Negative skew arises when implied volatility is lower for out-of-the-money call options compared to out-of-the-money put options.

Q: How does skew impact option premiums?

A: Skew directly influences option premiums, with positive skew leading to higher call option premiums and lower put option premiums, while negative skew reverses this effect.

What Is Skew In Options Trading

Image: brainly.com

Conclusion

Skew in options trading is a multifaceted concept that offers both opportunities and risks for traders. By leveraging a thorough understanding of skew’s definition, drivers, and trading strategies, you can enhance your options trading endeavors and potentially maximize your profits. As always, knowledge is power in the financial markets, so continue exploring and deepening your understanding of this intriguing aspect of options trading.

Are you an avid reader keen on delving further into the world of options trading and skew? Do you crave more nuanced insights into its complexities and practical applications? If so, I encourage you to reach out to me for further guidance and personalized advice. Let’s navigate the options market together, maximizing your success and unlocking its abundant opportunities.