In the volatile world of finance, it’s essential to have sophisticated tools at your disposal to navigate market fluctuations effectively. Volatility skew option trading, a powerful strategy, offers investors the opportunity to capitalize on the relationship between the implied volatility of options with different strike prices and expiration dates. Understanding the dynamics of volatility skew is crucial for investors seeking to mitigate risk and enhance returns.

Image: www.optiontradingtips.com

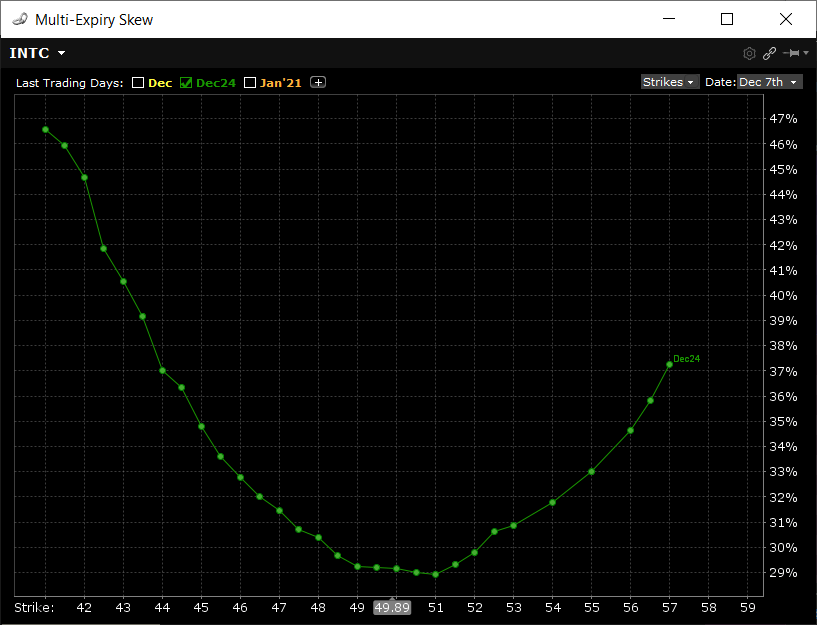

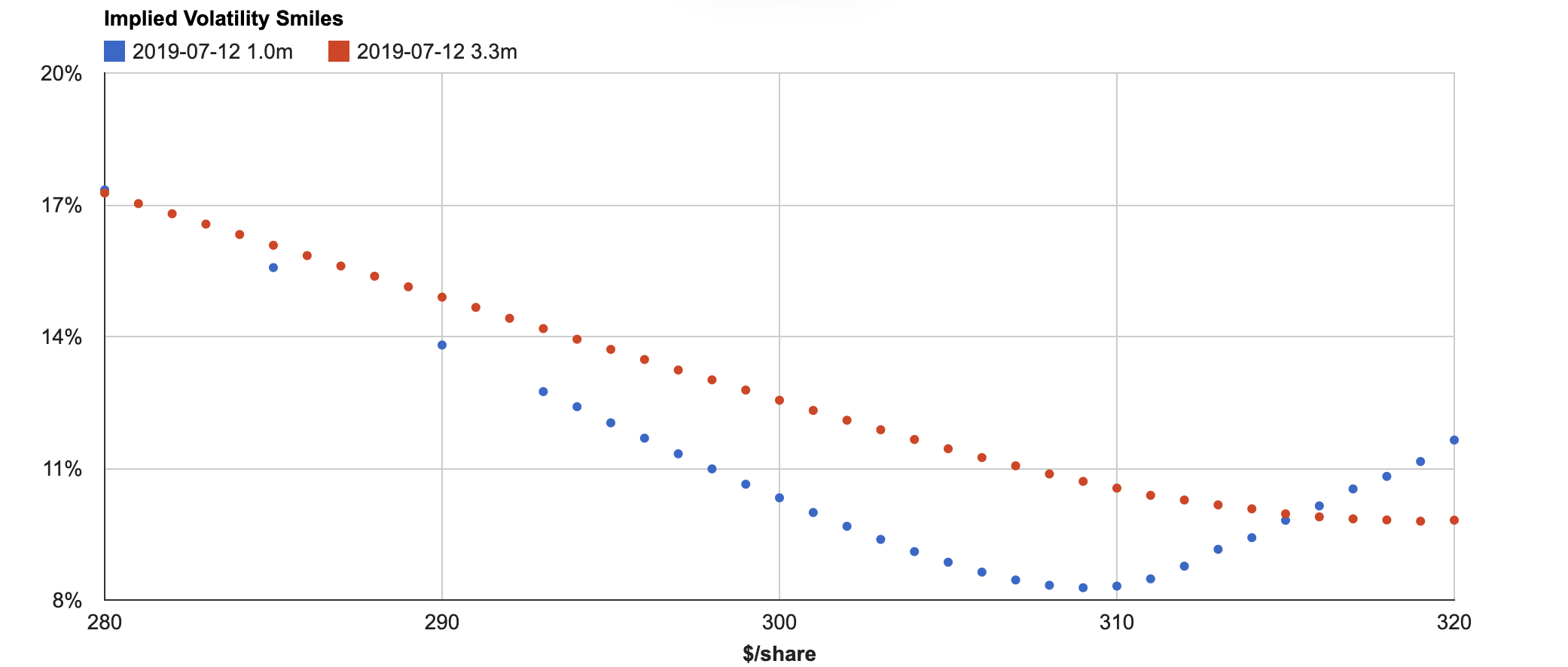

Volatility skew refers to the phenomenon where the implied volatility of out-of-the-money options (options with strike prices significantly below or above the underlying asset’s current price) is higher than that of at-the-money options (options with strike prices close to the underlying asset’s current price). This difference in implied volatility creates opportunities for investors to implement trading strategies such as selling options with high implied volatility and buying options with low implied volatility.

Mastering Volatility Skew for Enhanced Investments

Volatility skew trading, while complex, can yield significant rewards for investors who master its nuances. One key element is identifying the factors influencing volatility skew, including market sentiment, economic conditions, and the underlying asset’s characteristics. Understanding how these factors affect volatility skew enables investors to make informed trading decisions.

Furthermore, choosing the appropriate options for volatility skew trading is crucial. Investors should consider factors such as the expiration date, strike price, and implied volatility of options to construct a portfolio that aligns with their risk tolerance and investment goals. Careful portfolio management, including regular monitoring and adjustment of positions, is also essential to maximize returns and minimize losses.

Trending Developments: The Evolution of Volatility Skew Trading

The realm of volatility skew option trading is constantly evolving, with new trends and developments shaping the market landscape. The increasing popularity of exchange-traded funds (ETFs) that track volatility indexes has made it easier for investors to gain exposure to volatility skew. Technological advancements in trading platforms and data analytics tools have also enhanced investors’ ability to analyze and implement volatility skew strategies.

Amidst these developments, investors must stay abreast of the latest market trends and news. By actively monitoring industry forums, financial news sources, and social media platforms, investors can stay informed about the evolving dynamics of volatility skew trading. This knowledge empowers them to adapt their strategies and capitalize on emerging opportunities.

Tips and Expert Advice for Volatility Skew Traders

Harnessing the power of volatility skew option trading requires a combination of skill, experience, and informed decision-making. Here are some tips and expert advice to enhance your trading prowess:

Image: www.getvolatility.com

Frequently Asked Questions on Volatility Skew Option Trading

Q: What is the primary objective of volatility skew option trading?

A: The primary goal of volatility skew option trading is to capitalize on the difference in implied volatility between out-of-the-money and at-the-money options.

Q: What factors determine the volatility skew of an option?

A: Multiple factors influence volatility skew, including market sentiment, economic conditions, and the underlying asset’s characteristics.

Q: How can I identify suitable options for volatility skew trading?

A: Consider factors such as the expiration date, strike price, and implied volatility of options when selecting options for your volatility skew trading strategy.

Q: Are there significant risks associated with volatility skew option trading?

A: Volatility skew option trading involves the potential for significant losses. Implementing a robust risk management strategy is crucial to mitigate these risks.

Q: How do I stay informed about the latest developments in volatility skew option trading?

A: Actively monitor industry forums, financial news sources, and social media platforms to stay abreast of the evolving dynamics of volatility skew trading.

Volatility Skew Option Trading

Image: explosiveoptions.net

Conclusion

Volatility skew option trading offers investors a powerful tool to navigate market fluctuations and enhance returns. By comprehending the concept of volatility skew, identifying the influencing factors, and mastering the art of option selection and portfolio management, investors can harness the potential of this advanced trading strategy. Remember, staying informed about market trends and seeking expert advice is crucial for successful volatility skew trading.

Are you ready to delve into the intriguing world of volatility skew option trading? Share your thoughts and questions in the comments section below. Let’s embark on this exciting journey together!