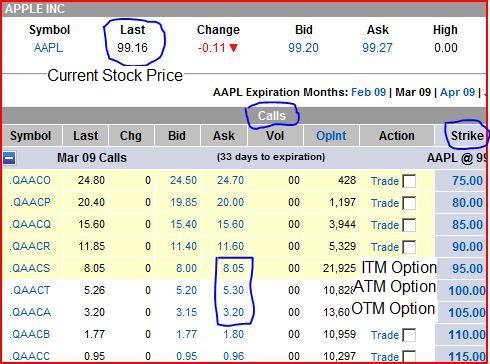

In the dynamic world of options trading, understanding key concepts like the long strike is crucial for success. A long strike refers to the highest strike price available for a specific option. It represents the maximum price at which the underlying asset can be sold or purchased upon option expiration. Grasping the intricacies of the long strike empowers traders with informed decision-making and the ability to exploit market opportunities effectively.

Image: www.rockwelltrading.com

Delving into the Long Strike’s Significance

The long strike is a significant parameter that shapes the risk and reward profile of an options contract. It serves as a benchmark against which traders evaluate the potential profitability and risk associated with different options strategies. A higher long strike implies a greater likelihood of the underlying asset’s price remaining below the strike price until expiration, resulting in the option expiring worthless. Conversely, a lower long strike increases the chances of the asset’s price exceeding the strike price, potentially leading to significant profits.

Understanding the long strike is especially crucial for traders employing covered call writing strategies. In this approach, traders sell (write) call options against an underlying asset they own. The long strike determines the maximum potential profit they can earn from the strategy. A higher long strike offers a higher premium at the time of option sale but limits the potential upside if the asset’s price surges. Conversely, a lower long strike provides a lower premium but offers greater potential for profit should the asset price appreciate significantly.

Leveraging the Long Strike for Profitable Options Trading

The long strike serves as a valuable tool for traders seeking to develop effective options trading strategies. Here are some actionable tips to harness its power:

-

Research and Analysis: Conduct thorough research on the underlying asset and market conditions to determine the appropriate long strike. Consider factors like historical price movements, volatility, and economic indicators.

-

Risk Management: Assess the potential risk associated with different long strikes and align them with your risk tolerance and investment objectives. Higher long strikes offer lower risk but limited potential reward, while lower long strikes increase risk but provide greater profit opportunities.

-

Strategy Alignment: Choose the long strike strategically based on your intended trading strategy. For income-generating strategies like covered calls, higher long strikes reduce the likelihood of being assigned (exercised early) and maximize premium income. For speculative strategies, lower long strikes provide greater profit potential but involve higher risk.

-

Price Monitoring: Regularly monitor the underlying asset’s price in relation to the long strike. If the price approaches the strike price, consider adjusting your position or closing the trade to manage risk and maximize profits.

Image: crypto.com

What Is The Long Strike In Options Trading

Image: www.learn-stock-options-trading.com

Conclusion

Embracing the concept of the long strike empowers options traders with a profound understanding of risk and reward dynamics. By incorporating the insights provided in this article, traders can make informed decisions, implement effective strategies, and navigate the complexities of the options market with greater confidence. Remember, the path to success in options trading lies in continuous learning, meticulous analysis, and the strategic application of key principles.