In the realm of options trading, the condor roll is a sophisticated strategy that allows traders to adjust their risk profile while maintaining a neutral market outlook. By combining four options contracts with different strike prices and expiration dates, the condor roll provides a defined risk and reward scenario that can adapt to changing market conditions.

Image: www.shareplanner.com

Introducing the Condor Roll Strategy

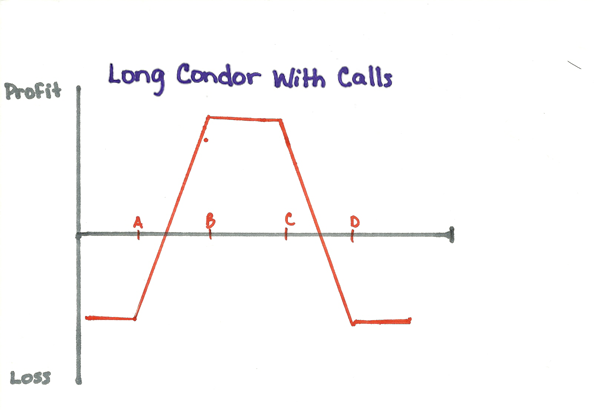

The condor roll is a four-legged options strategy comprised of:

- Long call at the lowest strike price

- Short calls at the two middle strike prices

- Long call at the highest strike price

Each call option has the same expiration date, and the strike prices are evenly spaced apart. The trader’s neutral view on the underlying asset’s price movement is reflected in the equidistant strike prices, suggesting that the strategy is not designed to profit from significant price fluctuations.

Function and Utility of the Condor Roll

The condor roll offers several advantages to options traders:

- Defined Risk: The strategy’s structure ensures a maximum potential loss that is limited to the net premium paid for initiating the trade.

- Adjustable Risk-Reward Ratio: Depending on the width of the strike price range and the time to expiration, the condor roll can be customized to suit the trader’s risk tolerance and profit potential.

- Neutral Market Outlook: The condor roll is ideal for traders who anticipate a sideways or non-volatile market movement within a defined time frame.

Expert Insights and Practical Tips

Seasoned option traders often provide valuable insights and tips for executing successful condor rolls:

- Select Strike Prices Carefully: Determine the appropriate strike prices based on the underlying asset’s expected volatility and market conditions.

- Manage Risk with Margin: Use margin to enhance the condor roll’s risk-to-reward ratio while closely monitoring account equity.

- Monitor Market Conditions: Continuously monitor market movements and adjust the condor roll as needed based on price changes and market sentiment.

Image: irudivupic.web.fc2.com

Condor Roll Frequently Asked Questions

Q: Is the condor roll a long or short strategy?

A: The condor roll is considered a neutral strategy, as it involves both long and short call options that balance each other out.

Q: What is the potential profit and loss from a condor roll?

A: The maximum potential profit is limited to the net premium received at the trade’s inception. The maximum potential loss is also limited to the same net premium.

Q: When is the best time to use a condor roll?

A: The condor roll is typically used in sideways or non-trending market conditions, where the trader anticipates minimal price movement.

In Option Trading What Is A Condor Roll

Image: mavink.com

Conclusion

The condor roll is a versatile options strategy that provides traders with a sophisticated approach to risk management while capitalizing on market neutrality. By carefully selecting strike prices and managing risk effectively, traders can harness the potential benefits of the condor roll to achieve their trading objectives.

Are you intrigued by the intricacies of the condor roll strategy? Join the discussion and share your insights to further explore the world of options trading.