In the treacherous waters of the financial markets, options traders seek refuge in strategies that offer both profit potential and risk mitigation. Among these instruments, the Condor stands out as a sophisticated yet versatile approach, capable of navigating both bull and bear markets.

Image: lonestarpastor.weebly.com

What is a Condor in Options Trading?

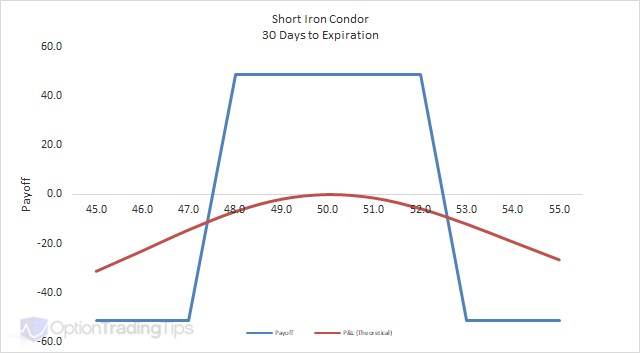

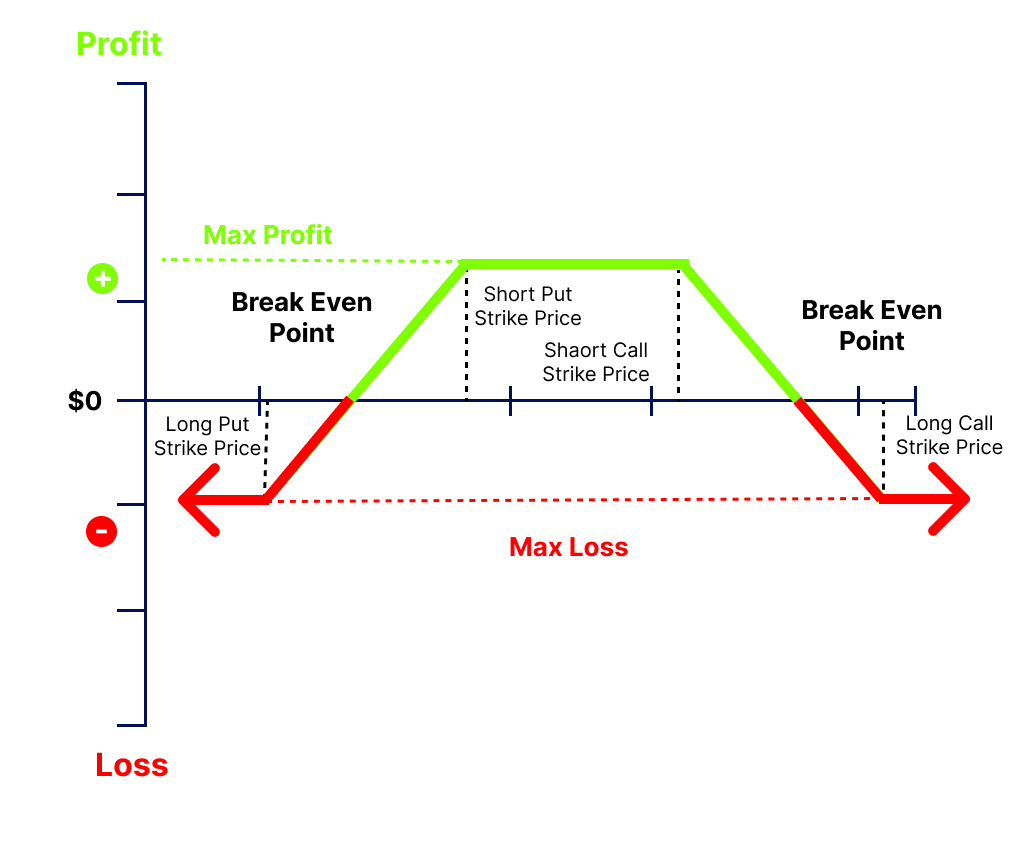

A Condor is a four-legged options strategy that involves buying one option at each of four consecutive strike prices. These options are distributed in two calls and two puts, creating what resembles the outline of a majestic condor gliding through the air.

- Call Condor: Bullish strategy with long call options at the lowest strike price and highest strike price, and short call options at the two middle strike prices.

- Put Condor: Bearish strategy with long put options at the lowest strike price and highest strike price, and short put options at the two middle strike prices.

How Condors Work: Building the Framework

Let’s break down the anatomy of a Call Condor:

- Long Call at Lower Strike Price (Protected): Provides downside protection.

- Short Call at Middle Strike Price 1: Limits potential profit on the protected side.

- Short Call at Middle Strike Price 2: Further limits potential profit while reducing premiums.

- Long Call at Higher Strike Price (Unprotected): Provides upside potential.

Advantages and Disadvantages: Weighing the Pros and Cons

Advantages of Condors:

- Defined and limited risk parameters

- Suitable for both bull and bear markets

- Scalable strategy, allowing for adjustments based on market conditions

- Can generate returns even with moderate market movements

Disadvantages of Condors:

- Complex strategy with multiple moving parts

- High upfront premiums

- Requires a significant market move to achieve profitability

Image: dripivplus.com

Expert Insights: Harnessing the Power of Condors

Renowned options trader Larry Connors offers valuable wisdom on Condors:

“Condor strategies are like Goldilocks portfolios. They like the ‘middle ground’: moderate volatility, moderate trends, and not too much action in either direction.”

Actionable Tips: Maximizing Condor Success

- Determine your market outlook and select the appropriate Condor structure (Call or Put).

- Choose strike prices with sufficient separation to minimize overlap.

- Adjust the legs of the Condor as the market evolves to maintain your desired risk-reward profile.

- Monitor market volatility and make adjustments accordingly to avoid excessive premiums or risks.

What Is A Condor In Options Trading

Image: www.5paisa.com

Conclusion: Soaring with Condors

Condors in options trading present an intriguing and versatile strategy for both experienced and aspiring traders. By understanding their mechanics, advantages, and limitations, traders can harness the power of Condors to navigate market turbulence and position themselves for profit in a variety of market conditions. Like the majestic bird it draws its name from, the Condor strategy offers a soaring journey with calculated risks and the potential for rewarding returns.