In the intricate world of finance, money management plays a pivotal role in determining the trajectory of your investments. Options trading, with its inherent risks and potential rewards, demands a disciplined approach to managing your financial resources. This comprehensive guide will equip you with the knowledge and strategies to navigate the complexities of options trading while safeguarding your capital.

Image: binaariasetustenvalittajat.logdown.com

Options, in the realm of finance, are contracts that confer the right, but not the obligation, to buy (call) or sell (put) an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). These versatile instruments offer traders the flexibility to speculate on the direction of the underlying asset’s movement, hedge against potential losses, and enhance returns.

At the outset of your options trading journey, it is imperative to establish a robust money management framework. This framework should serve as a guiding principle, providing a roadmap for decision-making and risk management. Here are the core pillars of an effective money management strategy:

-

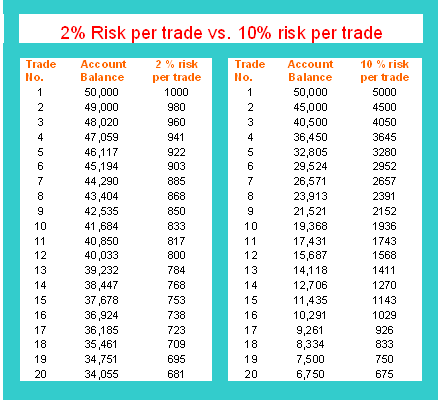

Define Your Risk Tolerance: Determine your appetite for risk based on your financial circumstances, investment horizon, and emotional resilience. Your risk tolerance will influence the types of options strategies you pursue and the allocation of your capital.

-

Set Trading Limits: Establish clear limits on the amount of capital you are willing to risk on each trade. Avoid putting all your eggs in one basket and diversify your portfolio to mitigate potential losses.

-

Use Stop-Loss Orders: Deploy stop-loss orders to automatically exit trades when the underlying asset falls below a predetermined threshold, minimizing losses if the market moves against you.

-

Don’t Overtrade: The allure of potential gains can lead to overtrading, increasing your exposure to risk. Stick to your trading plan and avoid making hasty decisions based on emotions or FOMO (fear of missing out).

-

Continuous Education: The financial landscape is constantly evolving, making continuous education a necessity. Stay abreast of market trends, new strategies, and regulatory changes to enhance your decision-making abilities.

In addition to these fundamental principles, there are advanced techniques that can help you refine your money management approach. Consider the following strategies:

-

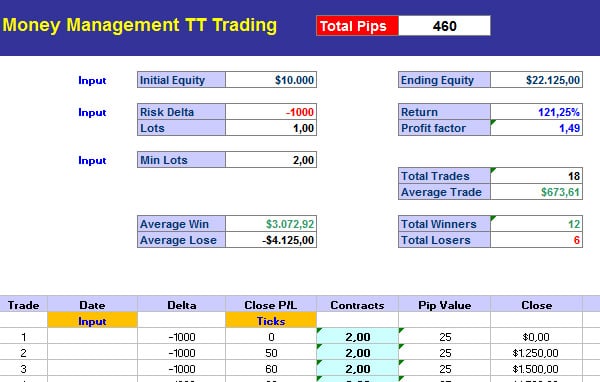

Position Sizing: Calculate the optimal number of contracts to trade based on your risk tolerance, account balance, and stop-loss level. This ensures that your trades are appropriate for your financial capacity.

-

Monte Carlo Simulations: Run simulations to model potential outcomes under various market conditions. This technique helps assess the probability of different scenarios and can inform your risk management decisions.

-

Volatility Risk Management: Volatility, which measures the extent of price fluctuations, is a crucial factor in options trading. Manage volatility risk by using hedging strategies or adjusting your trading approach during periods of high volatility.

Mastering money management in options trading requires discipline, knowledge, and a commitment to continual learning. Embrace a calculated approach, stay informed, and refine your strategies over time to navigate the markets with confidence and enhance your financial outcomes. Remember, successful investing is not about timing the market, but about managing risk and capitalizing on opportunities while preserving your hard-earned wealth.

Image: www.muse.co.th

Money Management Options Trading