In the realm of options trading, where risk and reward dance in a delicate balance, strategies like long gamma hold a captivating allure. As an avid trader, I’ll unravel the essence of long gamma, guiding you through its mechanics, applications, and the path to potential profits.

Image: vitocejayem.web.fc2.com

The Enigmatic Long Gamma

What is Long Gamma?

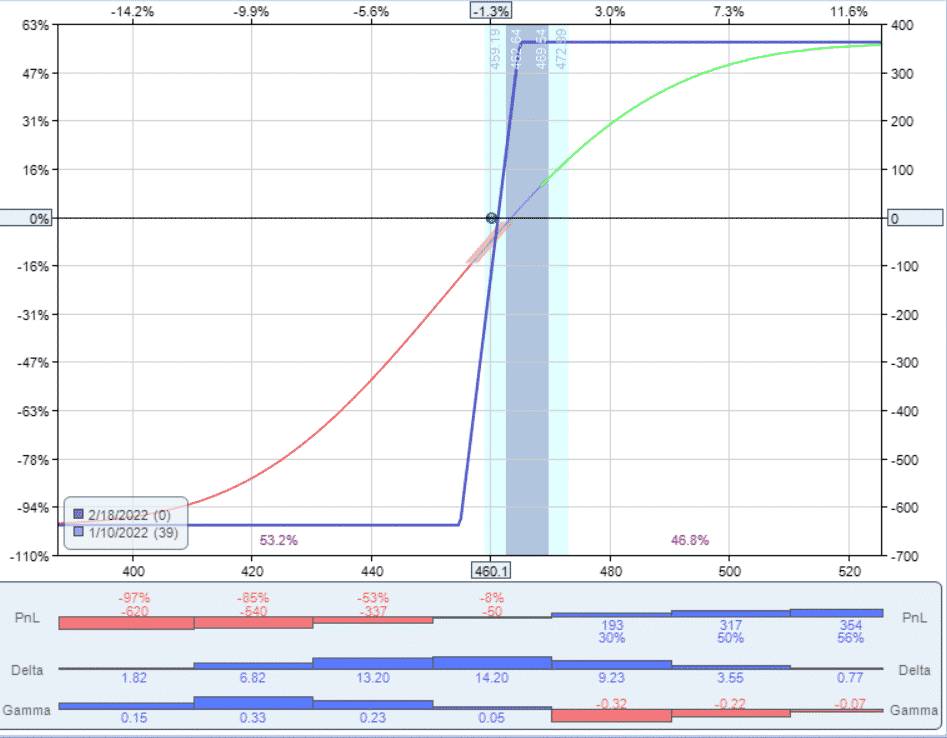

Long gamma refers to a trading strategy where an investor sells options that increase in delta (the rate of sensitivity of an option’s price to changes in the underlying asset’s price) as the price of the underlying asset approaches the option’s strike price. This positive delta has a long gamma effect, amplifying the trader’s profit potential as the underlying asset’s price moves in their favor.

Anatomy of a Long Gamma Strategy

Components of Long Gamma

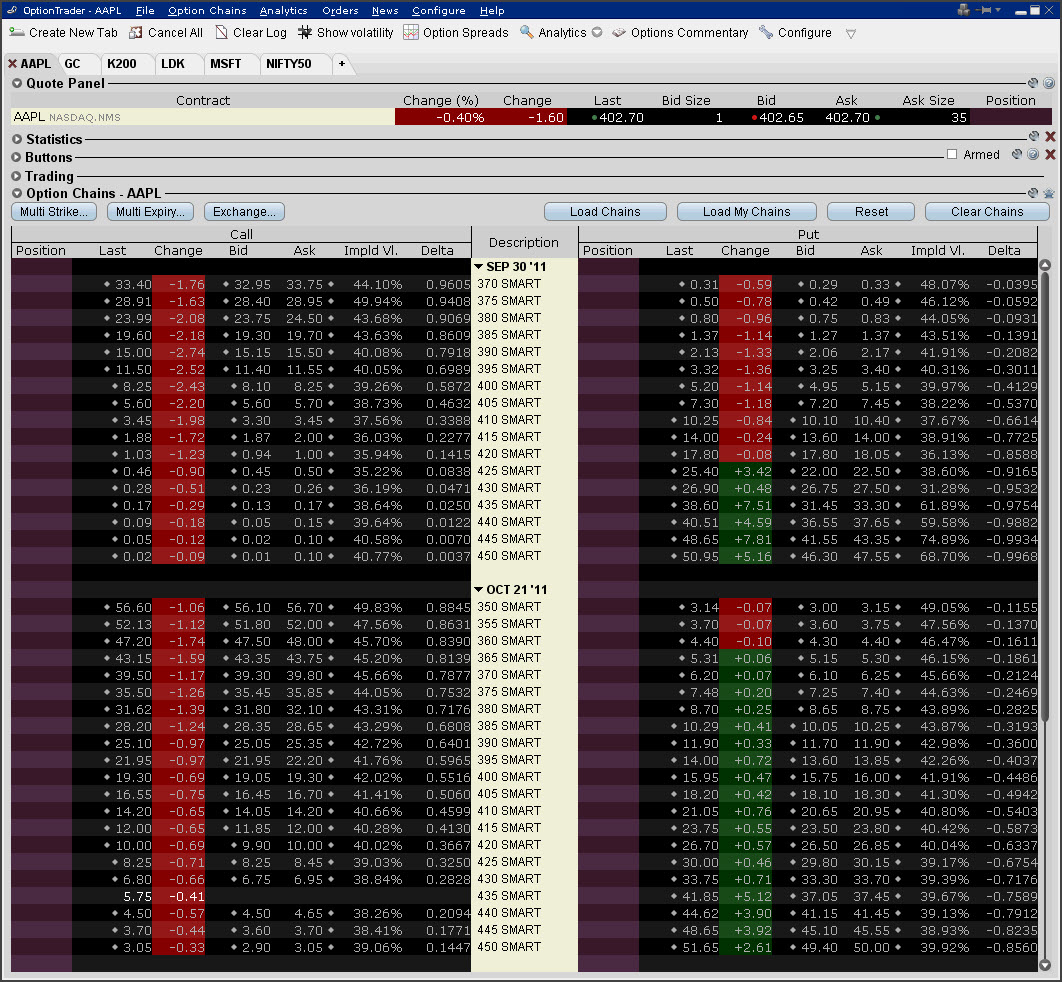

- Selling OTM Options: The trader sells out-of-the-money (OTM) options, which have a strike price significantly different from the current price of the underlying asset.

- Positive Delta: As the price of the underlying asset nears the option’s strike price, the delta of the sold option increases, leading to a long gamma effect.

- Amplitude: The magnitude of the long gamma indicates the acceleration of the option’s delta in relation to the underlying asset’s price.

Benefits of Long Gamma

Long gamma offers several advantages, including:

- Enhanced Leverage: The positive delta provides leveraged exposure to the underlying asset’s price movement, amplifying potential profits.

- Risk Management: Long gamma strategies can mitigate losses when the underlying asset’s price moves against the trader’s expectations.

- Flexible Execution: Traders can adjust their strike prices and expiration dates to tailor the strategy to their risk tolerance.

Image: seboxinero.web.fc2.com

Option Trading Long Gamma

Image: optionstradingiq.com

Expert Tips and Advice

To maximize long gamma strategies, consider these expert tips:

- Market Analysis: Thoroughly analyze the underlying asset’s volatility, trend, and potential for mean reversion.

- Option Selection: Choose OTM options with sufficient time to expiration to allow for the long gamma effect to develop.

- Risk Management: Monitor the strategy closely and adjust positions as market conditions dictate. Remember, no strategy is foolproof.

FAQ on Long Gamma

Q: What is the difference between long gamma and short gamma?

A: Long gamma occurs when an investor sells options that exhibit an increasing delta, while short gamma occurs when they buy options with a decreasing delta.

Q: When is long gamma not suitable?

A: Avoid long gamma strategies when the underlying asset is extremely volatile or the market is trending strongly in one direction.

Q: How can traders limit their risk in long gamma strategies?

A: Employ stop-loss orders, diversify positions, and consider hedging strategies to mitigate potential losses.

Conclusion: Embracing the Power of Long Gamma

Long gamma strategies offer traders the potential for significant profits, but like any financial instrument, come with inherent risks. By understanding the mechanics, benefits, and limitations of long gamma, traders can navigate the choppy waters of options trading with greater confidence. Embrace the challenge, embrace the opportunities, and let the long gamma effect amplify your path to financial success.

Are you ready to delve deeper into the world of option trading and explore the captivating potential of long gamma strategies? Share your thoughts, questions, and experiences below. Let’s foster a community of informed traders and empower one another in the pursuit of knowledge and profit.