Introduction:

In the dynamic realm of options trading, where risk and reward dance hand in hand, the concept of gamma value holds immense significance. Gamma, a Greek letter used to measure an option’s sensitivity to changes in its underlying asset’s price, plays a pivotal role in deciphering market movements and formulating astute trading strategies. Embark on a journey to unravel the intricacies of gamma value, its practical applications, and expert insights to elevate your options trading acumen.

Image: optionstradingiq.com

Delving into Gamma:

-

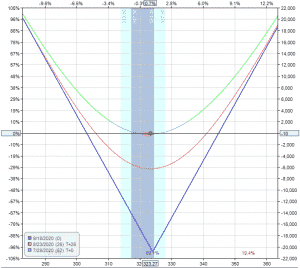

Understanding the Definition: Gamma measures the rate of change in an option’s delta with respect to a unit change in the underlying asset’s price. In other words, it quantifies the acceleration of an option’s responsiveness to price fluctuations.

-

Historical Roots: The concept of gamma arose alongside the Black-Scholes model, a mathematical framework for pricing options. However, it only gained widespread recognition with the introduction of delta-hedging strategies.

-

Formula and Implications: Gamma is calculated as the second derivative of the option’s price function with respect to the underlying asset’s price. Positive gamma implies an increase in delta as the underlying price rises, while negative gamma indicates a decrease.

-

Insightful Applications: Gamma value serves as a crucial metric for fine-tuning delta-hedging strategies. Traders can adjust their hedge ratios based on gamma to maintain neutral exposure to market fluctuations.

-

Understanding Gamma’s Impact: Higher gamma values signify more rapid changes in the option’s delta, indicating greater sensitivity to underlying price movements. Conversely, lower gamma indicates a more stable delta.

Navigating the Gamma Landscape:

-

Gamma and Option Types: Gamma is particularly relevant for at-the-money options, where price changes exert a significant impact on delta. It plays a lesser role in the dynamics of deep in-the-money or out-of-the-money options.

-

Harvesting Volatility: Options with positive gamma benefit from increased volatility, as the faster delta changes lead to amplified gains. However, they can also result in substantial losses during price declines.

-

Gamma’s Expression: Gamma value is typically represented as a number of shares per dollar change in the underlying asset’s price. This ratio illustrates the number of shares the option’s delta will change for each dollar movement in the underlying.

-

Timing Sensitivity: Gamma is highly sensitive to the time to expiration of an option. As the option nears expiration, its gamma typically decays, reducing its responsiveness to price changes.

Expert Insights: Leveraging the Power of Gamma:

-

Garrett Kane, an options trading expert, emphasizes the importance of understanding gamma’s impact on delta-hedging strategies. He advises traders to monitor gamma closely and adjust hedging positions accordingly to minimize risk.

-

Mark Sebastian, a renowned author and trader, recommends using gamma to identify potential trading opportunities. By isolating stocks with high gamma values, traders can anticipate significant price movements and position themselves for potential gains.

-

Jeff Augen, a veteran options trader, suggests employing gamma-neutral strategies to reduce risk. These strategies involve pairing options with different gamma profiles to offset price fluctuations and enhance overall portfolio stability.

Image: optionshawk.com

Gamma Value In Options Trading

Image: www.sofi.com

Conclusion:

Mastering gamma value is akin to unlocking a hidden treasure map in the labyrinthine maze of options trading. By deciphering its intricacies, traders gain a profound understanding of market dynamics and can craft informed strategies that navigate both bullish and bearish waters with agility. Embracing gamma’s insights empowers traders to optimize delta-hedging, exploit volatility, and uncover a wealth of trading opportunities. Embrace the power of gamma and ascend to new heights in the dynamic realm of options trading.