Diving into the World of Options Trading

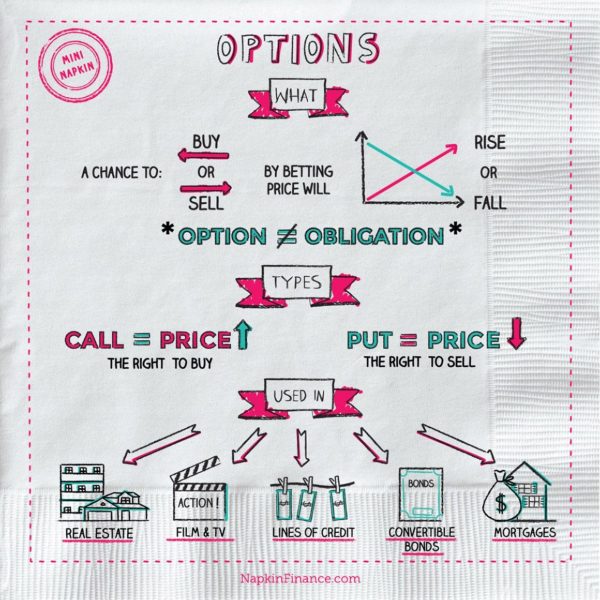

Step into the fast-paced realm of financial markets, where options trading offers a myriad of opportunities for savvy investors. Options contracts give traders the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date).

Image: napkinfinance.com

Options provide investors with the flexibility to capitalize on market movements, hedge against risks, and generate income through premium payments. They are complex but potent financial instruments that can amplify both profits and losses.

Understanding Call and Put Options

Call Options:

A call option grants the holder the right to purchase an asset at the strike price on or before the expiration date. It’s akin to placing a bet that the asset’s price will rise above the strike price. If the price does rise, the holder can exercise the option to buy the asset at a lower price than its market value, netting a profit.

Put Options:

A put option gives the holder the right to sell an asset at the strike price on or before the expiration date. It’s essentially a bet that the asset’s price will fall below the strike price. If the price does fall, the holder can exercise the option to sell the asset at a higher price than its market value, securing a profit.

The Anatomy of an Options Contract

Options contracts consist of several key elements:

- Underlying Asset: The stock, commodity, or index that the option is based on.

- Strike Price: The price at which the buyer has the right to buy or sell the underlying asset.

- Expiration Date: The date beyond which the option cannot be exercised.

- Premium: The price paid by the option buyer to the option seller for the right to exercise the option.

Trading Options

Trading options involves entering into contracts with other traders. The buyer of an option pays a premium to the seller in exchange for the right to exercise the option at any time before expiration. The seller of the option receives the premium but has the obligation to fulfill the contract if the option is exercised.

![Call and Put Option Example [Explained] : r/Basics_For_Trading](https://i.redd.it/d4gyv5o7h2471.png)

Image: www.reddit.com

Expert Tips for Options Trading

1. Understand Your Risk Tolerance: Options trading carries significant risk. Determine your tolerance for fluctuations and losses before investing in options.

2. Start with Simple Strategies: Begin with basic options strategies before venturing into complex ones. Buying calls or selling puts are common entry points for beginners.

3. Study the Underlying Asset: In-depth knowledge of the underlying asset is crucial for successful options trading. Analyze market trends, news, and macroeconomic factors that could impact its price.

4. Set Clear Goals: Define your investment objectives and determine the outcomes you expect from your options trades. Avoid chasing unrealistic profits and focus on managing risk.

Frequently Asked Questions (FAQs)

Q: How do I profit from options trading?

A: You profit by closing out the option position (selling back the option) for a higher price than the premium you paid if you bought the option, or by receiving the premium if you sold the option.

Q: What factors affect the price of an option?

A: The underlying asset’s price, time to expiration, volatility, and interest rates.

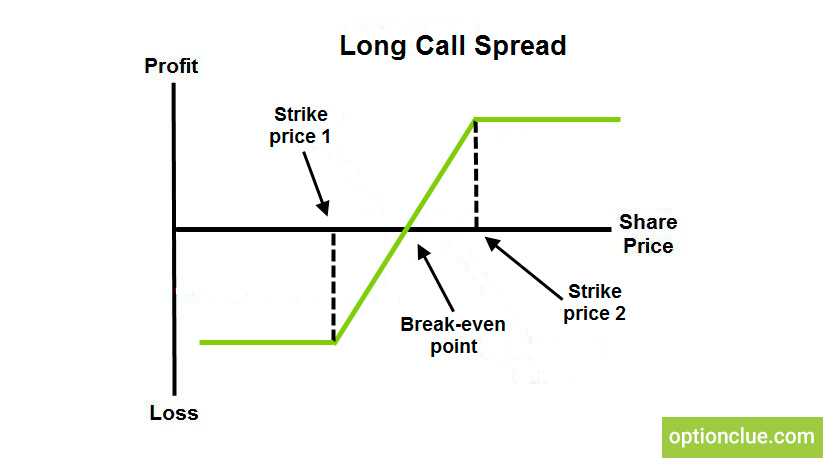

Call And Put Option In Share Trading

Image: optionclue.com

Conclusion: Mastering the Art of Options Trading

Options trading presents a dynamic and multifaceted approach to the financial markets. By understanding the intricacies of call and put options, investors can tailor strategies to meet their risk tolerance and financial goals. Remember, thorough research, risk management, and a strategic mindset are key to navigating the complex world of options.

Are you ready to embark on the exciting journey of options trading? If so, equip yourself with knowledge, seek professional guidance when necessary, and let the adventure begin.