In the realm of financial markets, options trading stands out as a potent instrument, empowering investors with the potential to amplify gains and mitigate risks. Understanding the intricate mechanics of options is paramount for navigating the complexities of this alluring yet demanding domain.

Image: www.bank2home.com

Options, in essence, represent contracts that grant the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) within a specified time frame (expiration date). This versatile tool equips investors with the flexibility to speculate on price movements or hedge against potential losses.

Options Strategies: A Realm of Limitless Possibilities

The world of options trading is replete with a myriad of strategies, each tailored to specific objectives and risk appetites. Covered calls and protective puts are but a glimpse into this vast repertoire. Covered calls involve selling call options while owning the underlying asset, aiming to generate premium income or limit upside potential. Conversely, protective puts grant the right to sell an asset at a predetermined price, guarding against potential price declines.

However, options trading is not without its inherent risks. Misjudging market movements can lead to substantial losses, underscoring the need for a comprehensive understanding of options and their dynamics. It is imperative to recognize that options are not suitable for all investors, particularly those with a low tolerance for risk or limited investment knowledge.

Navigating the Options Market: Essential Considerations

Embarking on options trading requires a firm grasp of key concepts and an appreciation for the interplay between different factors. The underlying asset’s price, volatility, time to expiration, and interest rates all exert a profound influence on option pricing and behavior.

Traders must also be attuned to the intricacies of option Greeks, a set of metrics that measure the sensitivity of option prices to changes in underlying variables. Delta, gamma, theta, and vega provide valuable insights into the potential impact of market movements on option value.

Real-World Applications: Maximizing Potential, Mitigating Risks

Options trading offers a diverse array of practical applications, empowering investors to pursue a wide range of financial goals. Savvy investors utilize options to hedge against potential losses, speculate on price movements, generate income through premium collection, and even construct complex trading strategies.

In an uptrending market, call options allow investors to amplify gains by leveraging their right to purchase the underlying asset at a predetermined price. Conversely, in downtrending markets, put options offer a valuable tool to hedge against price declines, providing downside protection for portfolios.

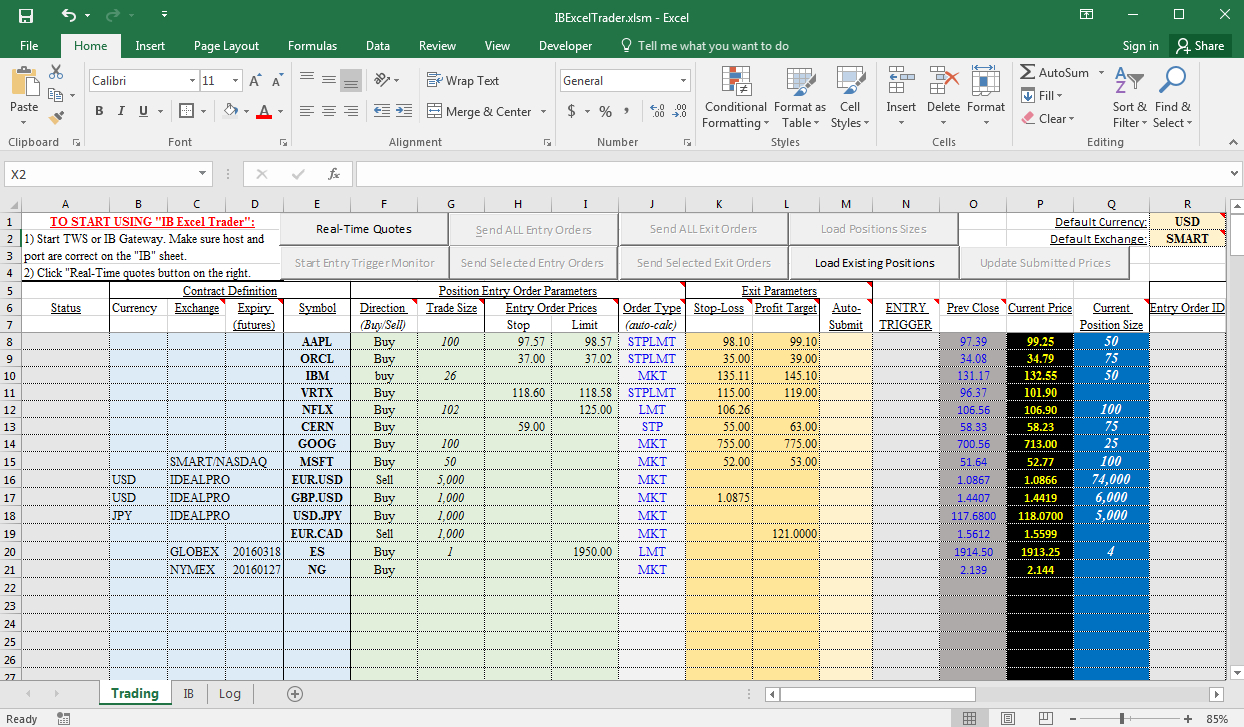

Image: db-excel.com

Options Trading ĸƖ‡Ç¿»È¯‘

Image: tikloenglish.weebly.com

Conclusion: Unlocking the Power of Options Trading

While options trading presents both opportunities and risks, it remains a potent tool in the hands of knowledgeable investors. By mastering the concepts, strategies, and risks associated with options, individuals can harness the potential of this versatile instrument to enhance their financial endeavors. Whether seeking to amplify gains, hedge against losses, or simply explore the intricacies of financial markets, options trading offers a gateway to a world of limitless possibilities.