A Comprehensive Guide to Understanding the Basics

Options trading is a complex, yet lucrative financial instrument that allows investors to speculate on the future direction of a stock’s price without owning the underlying shares. Traditionally, options trading was perceived as a risky undertaking reserved for seasoned investors with deep pockets. However, with the advent of fractional shares and online trading platforms, retail investors are increasingly drawn to the world of options trading.

:max_bytes(150000):strip_icc()/BuyingCalls-7ff771dfbc724b95b8533a77948d7194.png)

Image: www.investopedia.com

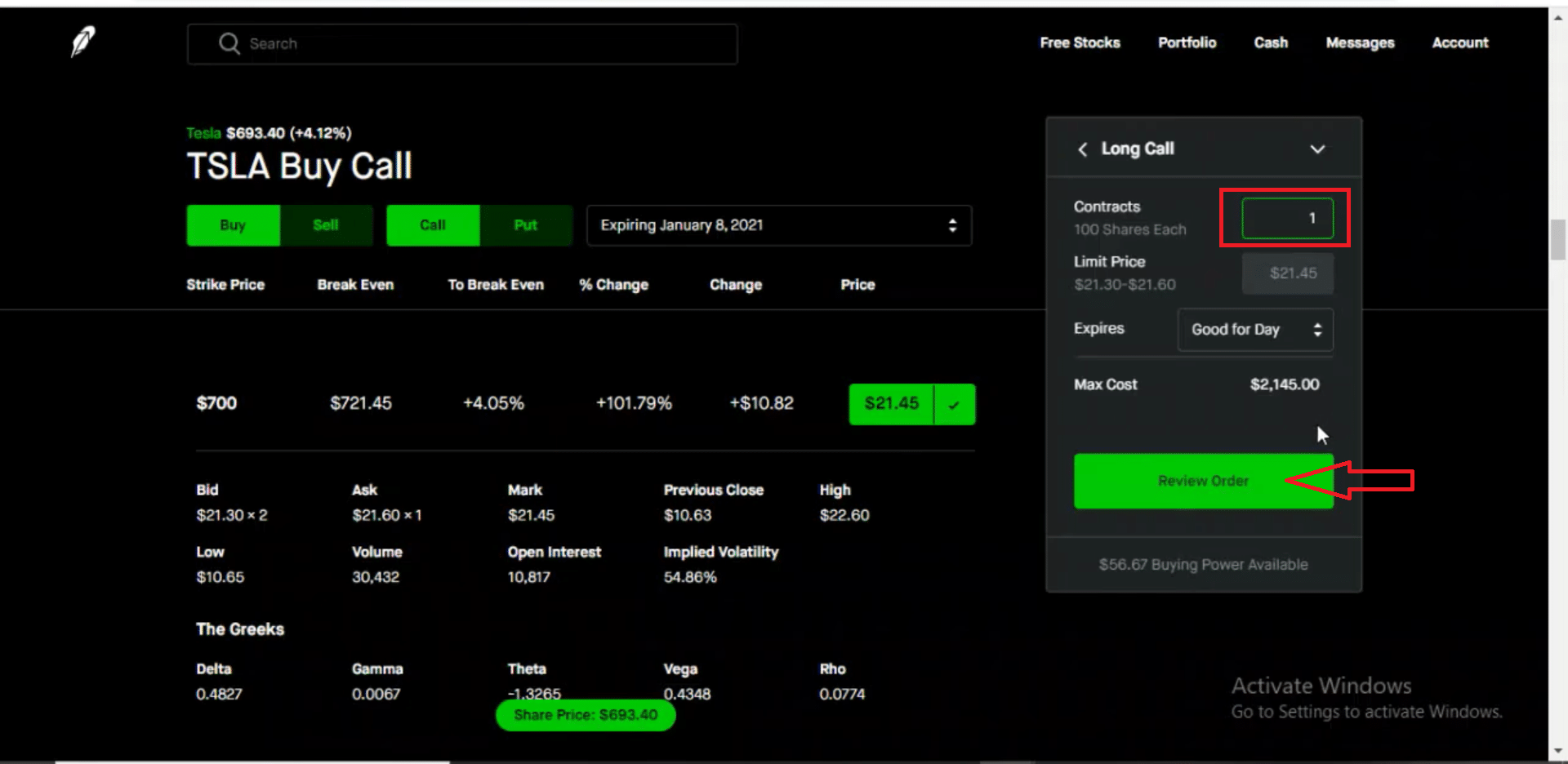

One of the most common questions among aspiring options traders is whether they need to own 100 shares of the underlying stock to trade options. The answer is a resounding no. Unlike stock purchases, options trading does not require investors to acquire the actual shares of the underlying company. Instead, options contracts represent a right to buy (call options) or sell (put options) a specific number of shares at a predetermined price (strike price) on or before a set date (expiration date). This flexibility allows investors to capitalize on market movements without the need for substantial upfront capital.

How Options Trading Works

To understand the mechanics of options trading, let’s consider a hypothetical example. Suppose an investor believes that the stock price of Apple (AAPL) will rise in the coming months. Instead of purchasing 100 shares of AAPL at the current market price of $150 per share (total investment: $15,000), they could purchase an AAPL call option with a strike price of $152.5 and an expiration date three months from now. This option contract would give the investor the right to buy 100 shares of AAPL at $152.5 per share on or before the expiration date.

The premium for this call option might be $5 per share, meaning the investor would pay a total of $500 (5 x 100) to acquire the contract. If the AAPL stock price rises to $157.5 by the expiration date, the investor could exercise their option and purchase 100 shares of AAPL at $152.5 per share. They could then immediately sell those shares on the open market for a profit of $5 per share, resulting in a total profit of $500.

The Advantages of Options Trading

Options trading offers several advantages over traditional stock trading, including:

- Leverage: Options provide a way for investors to gain leveraged exposure to the underlying stock, allowing them to magnify potential returns with a smaller initial investment.

- Flexibility: Options contracts offer diverse strategies that can accommodate various market conditions and investment goals. Investors can choose from a wide range of strike prices and expiration dates to tailor their trades to their risk tolerance and time horizon.

- Income Generation: Options trading allows investors to generate income through premium sales, even if the underlying stock price does not move significantly. By selling call or put options, investors can collect premium payments while giving up the right to buy or sell the underlying shares.

- Risk Management: Options can be used as hedging instruments to protect existing stock positions or to mitigate risk in a broader portfolio. For example, investors can purchase put options to offset potential losses on long stock positions, or they can sell call options to profit from a stock’s decline.

Is Options Trading Right for You?

While options trading offers numerous opportunities, it is crucial to recognize that it is not suitable for all investors. Options are inherently more complex and risky than stocks, and they require a deep understanding of market dynamics, options pricing models, and risk management techniques.

Aspiring options traders should thoroughly educate themselves before entering the market. This includes studying options terminology, strategies, and risk factors. It is also advisable to consult with a financial advisor or broker if you require personalized guidance.

Image: www.transparenttraders.me

Options Trading Do I Need 100 Shares

Image: marketxls.com

Conclusion

Options trading can be a powerful tool for sophisticated investors seeking to amplify returns, enhance their hedging capabilities, or generate income. However, it is essential to approach options trading with caution and a comprehensive understanding of the risks involved. By carefully evaluating market trends, developing sound strategies, and managing risk effectively, investors can harness the potential of options trading to achieve their financial goals.