Introduction

Options trading, a sophisticated financial strategy, involves the buying and selling of contracts that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price and date. Understanding the tax implications of options trading is crucial for investors to maximize their profits and avoid costly pitfalls.

Image: www.taxpolicycenter.org

This comprehensive guide will delve into the tax rates on options trading, encompassing current regulations, historical changes, and practical considerations. We’ll explore the different types of options, their tax treatment, and strategies to optimize your tax liability.

Understanding Options Trading Taxation

Options contracts are classified as either short-term (less than one year) or long-term (one year or more). The holding period determines the tax rate applicable to the gain or loss incurred.

Short-Term Options Trading

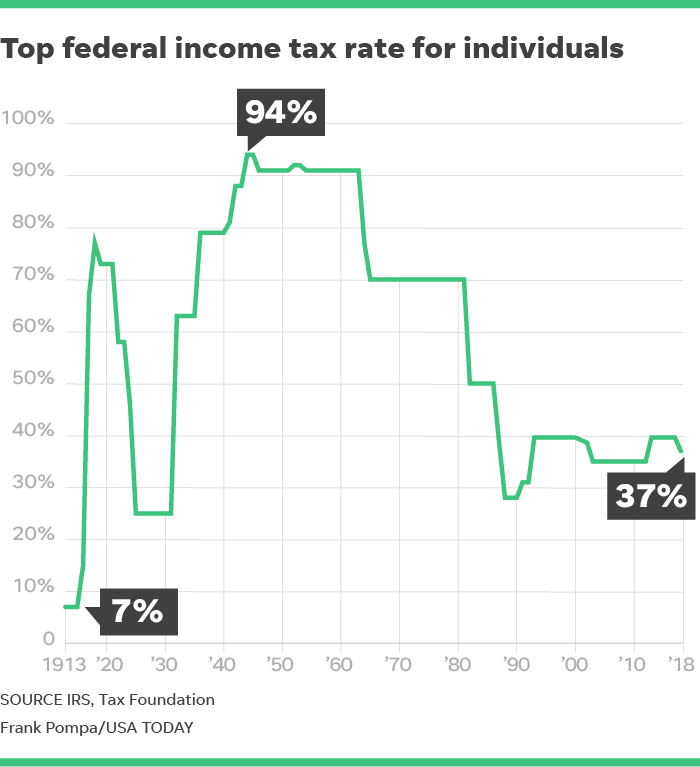

Short-term options trading gains are taxed as ordinary income, typically at a higher rate than long-term capital gains. The precise rate depends on your individual income tax bracket. As of 2023, the ordinary income tax rates range from 10% to 37%.

Long-Term Options Trading

Long-term options trading gains, on the other hand, are taxed at more favorable capital gains rates. For most investors, the long-term capital gains tax rates are 0%, 15%, or 20%, depending on their taxable income and filing status.

Image: www.axiory.com

Tax Treatment of Different Options Types

The tax treatment of options contracts varies based on whether they are call options (giving the right to buy) or put options (giving the right to sell).

Calls and Puts: Gains

When an option is exercised or sold at a profit, the gain is taxed as either ordinary income or capital gains, depending on the holding period.

Calls and Puts: Losses

If an option expires worthless or is sold at a loss, the loss is typically recognized as a capital loss. Capital losses can be used to offset capital gains, reducing your overall tax liability.

Tax Strategies for Options Traders

Investors can employ various strategies to minimize their tax liability while engaging in options trading. Here are a few effective techniques:

Sell Call Options on Assets You Own

Selling call options on assets you already own generates premium income, which is taxed as capital gains. This strategy allows you to potentially offset capital gains from the underlying asset’s future sale with the premium income.

Exercise Options Before Expiration

Exercising an option before its expiration date ensures that any gain or loss is treated as short-term, which may be more beneficial in certain cases.

Hold Options for Over a Year

Long-term capital gains rates are significantly lower than ordinary income tax rates. Holding options for more than a year can reduce your tax liability if you anticipate a profit.

Tax Rates On Options Trading

Image: www.publicopiniononline.com

Conclusion

Navigating the tax implications of options trading requires a comprehensive understanding of the relevant regulations and strategies. By grasping the intricacies of short-term and long-term tax treatment, investors can optimize their returns and minimize their tax burdens. This guide has provided a solid foundation for you to delve deeper into the world of options trading taxation. By staying informed and consulting with tax professionals when needed, you can confidently embark on this rewarding financial endeavor.