Traversing the complexities of financial markets can be a daunting task, especially for novice investors. Leveraging trading options effectively may hold significant rewards, but astute knowledge and understanding are essential for thriving in this realm. Ameritrade, a prominent brokerage house, offers an RV Rank indicator, a valuable tool for traders seeking guidance in assessing option contracts. In this in-depth exploration, we’ll unveil the nuances of RV Rank, unravel its practical applications, and empower you with the knowledge to make informed trading decisions.

Image: www.stockbrokers.com

Ameritrade’s RV Rank, also referred to as Relative Value Rank, serves as a concise indicator that evaluates the relative value of an option contract compared to its immediate peers. It’s predicated on the assumption that options with similar strike prices but different expiration dates are interchangeable. The RV Rank aids in determining whether an option is over or undervalued relative to others in the same series.

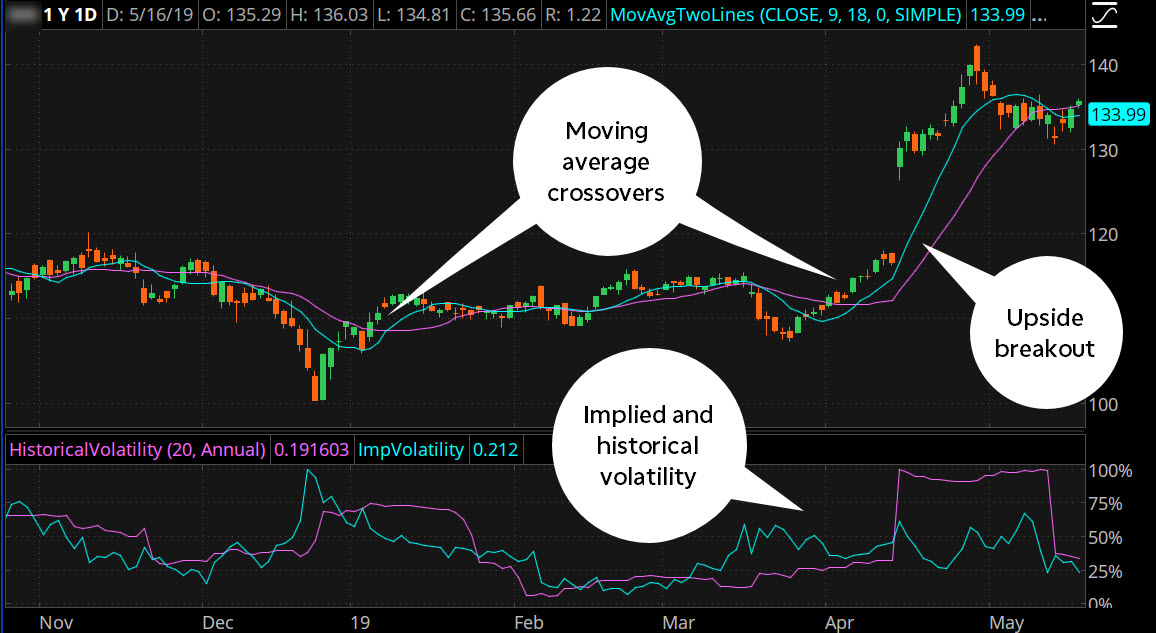

The RV Rank equilibrium point is set at 50. Options with an RV Rank below 50 are considered potentially undervalued, while those above 50 are deemed potentially overvalued. Despite its effectiveness as a comparative measure, it’s crucial to remember that RV Rank by itself should not be the sole determinant in your trading strategy. Supplementary analysis, incorporating factors such as implied volatility, historical trends, and news events, is vital for comprehensive assessment.

Comprehending RV Rank Interpretation

Interpreting RV Rank is relatively straightforward. When an option displays an RV Rank below 50, it signifies that its price may be lower than its peers. This could present an opportunity to acquire the option at a potentially undervalued price, with the anticipation that its value may rise towards the equilibrium point of 50 or above. Conversely, options with RV Ranks exceeding 50 are perceived as potentially overvalued, which may warrant cautious consideration.

RV Rank Applications in Trading Options

Adroitly integrating RV Rank into your option trading strategy can enhance your ability to make informed decisions. Here are a few of its pertinent applications:

- Comparative Analysis: Comparing RV Ranks of different options within the same series helps identify potential value discrepancies.

- Trading Opportunities: Utilizing RV Rank to pinpoint undervalued options can lead to lucrative trading opportunities, while avoiding overvalued options can mitigate potential losses.

- Confirming Intuition: RV Rank can corroborate or challenge your initial assessment of an option’s value, providing an additional layer of confidence in decision-making.

Cautions and Considerations

While RV Rank can be a valuable tool, there are caveats to keep in mind:

- Market Volatility: Extreme market volatility can impact the reliability of RV Rank.

- Not a Price Predictor: RV Rank does not predict future prices, it merely indicates relative value at a given time.

- Not a Recommendation: RV Rank should not be construed as a buy or sell recommendation; it is an indicative measure to aid your analysis.

Conclusion

In the realm of financial markets, knowledge is power, and the RV Rank indicator offered by Ameritrade empowers options traders with a valuable tool for assessing relative value. Understanding the concept, interpretation, and applications of RV Rank can elevate your trading strategy and equip you to make more informed decisions. While it does not guarantee successful trades, it provides critical insights and enhances your ability to navigate the complexities of the options market.

Image: www.ilyaajans.com

Rv Rank In Ameritrade Trading Options

Image: www.stockbrokers.com