In the realm of options trading, understanding implied volatility (IV) is crucial for making informed decisions. IV, a measure of the market’s expectation of future price swings, significantly impacts option premiums and trading strategies.

Image: www.getvolatility.com

Determining the ideal IV for options trading requires careful consideration of various factors. This comprehensive guide explores the complexities of IV and provides practical guidance for identifying the optimal IV for your trading goals.

The Role of Implied Volatility in Options Trading

Implied volatility is a forward-looking metric that reflects the anticipated volatility of an underlying asset over the option’s remaining life. Higher IV indicates a higher expectation of future price volatility, leading to higher option premiums. Conversely, lower IV suggests a more stable price environment and lower option premiums.

Options traders utilize IV to determine the potential profitability of their strategies. Overpriced options with inflated IV levels may offer less value than their intrinsic value, while undervalued options with lower IV levels may present opportunities for profitable trades.

Factors Influencing Implied Volatility

The determination of IV is multifaceted, influenced by a combination of qualitative and quantitative factors. Market sentiment, news events, economic data, historical volatility patterns, and time to expiration all contribute to IV levels.

Strong market trends, positive or negative, tend to elevate IV as investors expect continued price movements. Major news announcements, such as earnings reports or geopolitical events, can also lead to significant IV fluctuations. Economic indicators, like inflation rates or interest rate changes, can affect IV by influencing future growth prospects and market stability.

Identifying the Ideal Implied Volatility

The optimal IV for options trading depends on several key factors, including trading strategy, time horizon, and risk tolerance. Here are some guidelines to consider when assessing IV levels:

- Strategy Type: Different options strategies have varying sensitivities to IV. Long option strategies benefit from elevated IV, while short option strategies prefer lower IV levels.

- Time Horizon: Options with longer time to expiration tend to have higher IV than short-term options. This is because there is more time for the underlying asset to experience significant price fluctuations.

- Risk Tolerance: Traders should adjust their ideal IV based on their risk tolerance. Those seeking higher returns may opt for options with higher IV, while those prioritizing capital preservation may favor options with lower IV.

Image: optionsfinanceprofits.com

Tips for Utilizing Implied Volatility

Here are a few practical tips for leveraging IV in your options trading:

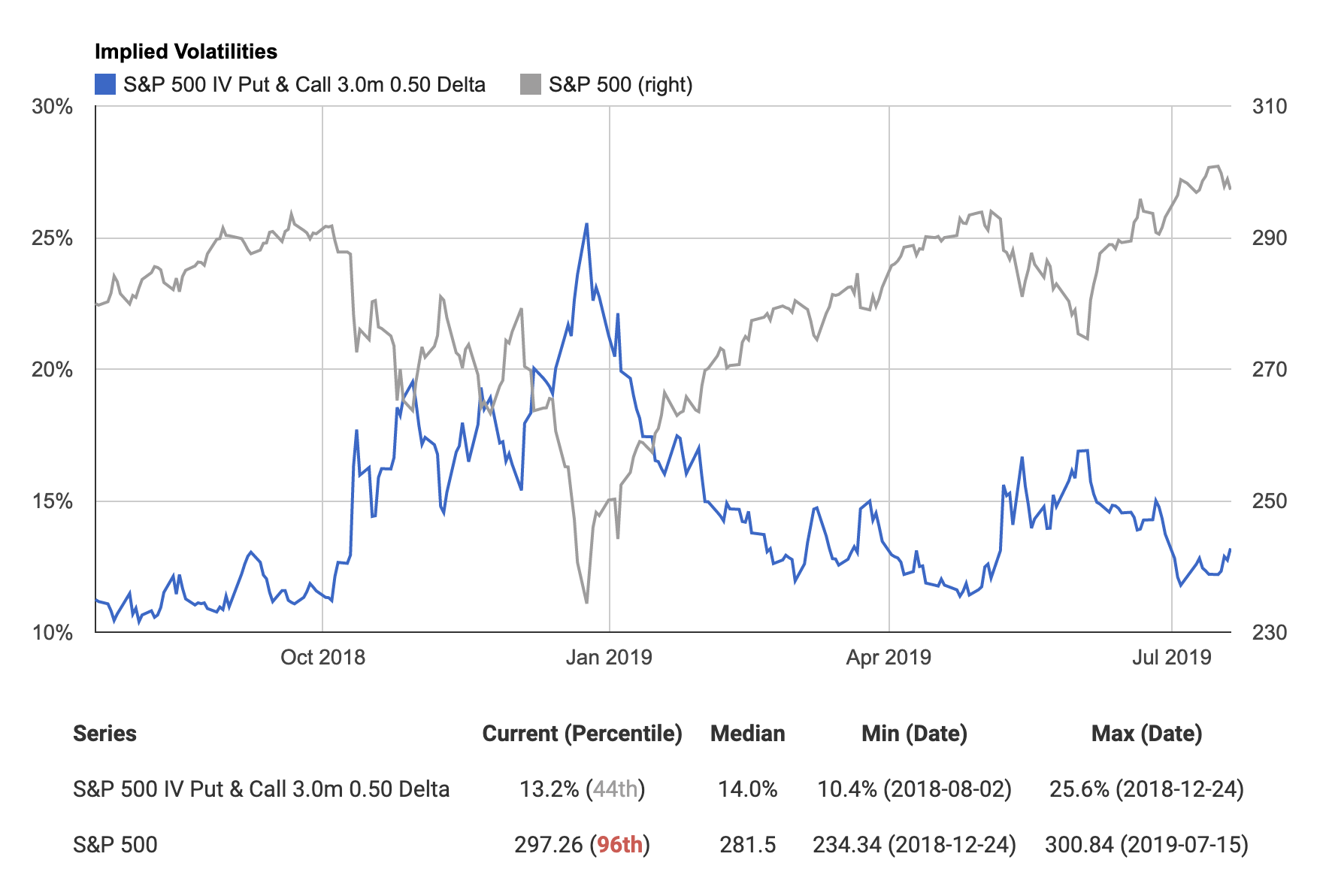

- Monitor IV Levels: Regularly track IV changes for the underlying assets you are interested in. This information can help you identify potential trading opportunities.

- Analyze Historical Volatility: Examine historical volatility patterns to assess the typical IV range for a particular asset. This data can provide a baseline for comparison and help you identify unusual IV spikes or troughs.

- Consider IV Rank: Calculate the IV rank, which compares current IV to historical IV levels. A high IV rank indicates that the option is relatively expensive compared to its historical average, while a low IV rank suggests it is undervalued.

Frequently Asked Questions (FAQs) about Implied Volatility

- Q: What is the ideal implied volatility for options trading?

A: The ideal IV depends on factors such as strategy, time horizon, and risk tolerance. - Q: How does IV affect option premiums?

A: Higher IV leads to higher option premiums, while lower IV results in lower premiums. - Q: Why is IV important in options trading?

A: IV provides insights into the market’s expectations of future price volatility, which can guide trading decisions. - Q: How can I track IV changes?

A: Financial websites and broker platforms offer real-time and historical IV data for various assets. - Q: What factors influence implied volatility?

A: IV is influenced by market sentiment, news events, economic data, historical volatility, and time to expiration.

When Trading Options What Is The Ideal Implied Volatility

Image: www.dumblittleman.com

Conclusion

Mastering the concept of implied volatility is essential for successful options trading. By understanding the factors that influence IV and applying the tips and guidance provided, traders can improve their decision-making and increase their chances of profitable returns.

I would like to know if you found this article helpful. Please feel free to share your thoughts and opinions in the comment section below.