The world of trading can be both exhilarating and intimidating, especially for novice traders. Simulation platforms offer an invaluable solution, enabling traders to hone their skills without the risk of losing real funds. In this comprehensive guide, we will delve into the various trading simulator options available and provide expert advice to help you maximize your trading journey.

Image: thisisforextrading.blogspot.com

Simulation Platforms: A Gateway to Risk-Free Trading

Trading simulators replicate authentic trading environments, allowing traders to make trades, monitor charts, and analyze market trends without committing any capital. These platforms offer a safe and controlled environment for beginners to learn and experiment with different trading strategies. Experienced traders can also utilize simulators to test new ideas, fine-tune their existing strategies, and adapt to market conditions.

Types of Trading Simulators

There are various types of trading simulators available, each tailored to specific needs and preferences:

- Desktop Simulators: Installed on your computer, these simulators provide robust trading environments with advanced features.

- Web-based Simulators: Accessed through your web browser, these simulators offer convenience and accessibility.

- Mobile Simulators: Designed for smartphones and tablets, these simulators offer trading on the go.

Each simulator type has its advantages and disadvantages, so it’s essential to select one that aligns with your specific requirements.

Strategic Execution: Optimizing Performance on Trading Simulators

Effective trading on simulators requires strategic thinking and diligent execution. Here are some expert tips to help you make the most of your simulations:

Consider your Trading Goals: Define your trading objectives before using a simulator. This will guide your strategy and help you measure your progress.

Dive into Market Research: Conduct thorough market analysis before placing trades. Understand the asset you’re trading, its market dynamics, and potential risks.

Focus on Risk Management: Manage your risk appetite by setting appropriate stop loss and take profit levels. Consider the amount of capital you can afford to lose and trade within those limits.

Learn from Your Mistakes: Simulations provide a safe environment to make mistakes and learn from them. Analyze your trades, identify weaknesses, and adjust your strategy accordingly.

Image: community.optimusfutures.com

Frequently Asked Questions

Q1: Are trading simulators realistic?

A1: While simulators provide accurate market data, they may not fully replicate the real-world complexities and emotional challenges of trading.

Q2: Is it worth investing in paid simulators?

A2: Paid simulators typically offer more advanced features and real-time market data, but their value depends on your individual needs and trading experience.

Q3: How long should I practice on a simulator before starting real trading?

A3: The duration depends on your progress and learning curve. Begin with shorter sessions and gradually increase the time and complexity as you become more confident.

Trading Simulator Options

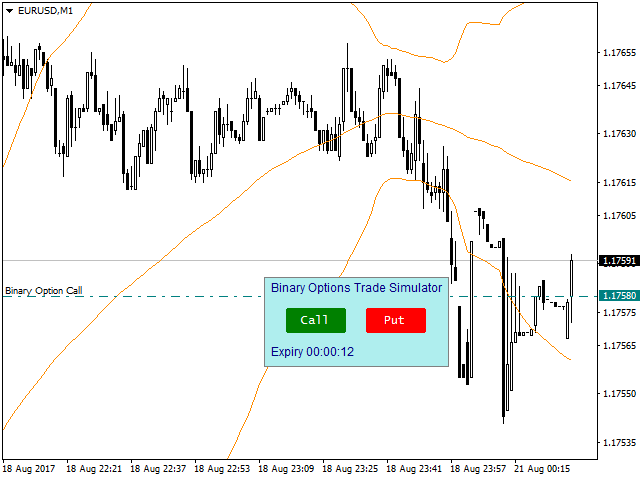

Image: www.mql5.com

Conclusion

Trading simulator options empower traders of all levels to enhance their skills, develop strategies, and navigate the intricate world of trading. By embracing strategic execution and maximizing the benefits of simulations, you can unleash your trading potential and confidently embark on your financial journey. Are you ready to explore the realm of trading simulations?