Introduction

With the volatility of the stock market reaching new heights, the allure of making a quick buck through options trading has never been more enticing. Options offer a unique way to hedge your bets and potentially reap significant profits, even in turbulent markets. One crucial element to consider in options trading is implied volatility (IV), a key indicator of future price movements. Understanding IV and how to incorporate it into your trading strategies can give you an edge in this complex market.

Image: www.fullquick.com

Implied volatility is a measure of expected price swings in an underlying asset, such as a stock or commodity. It is derived from the prices of options contracts and provides a glimpse into market sentiment about future price fluctuations.

The Importance of Implied Volatility

IV is vital in options trading as it affects the price and potential gains or losses of options contracts. Higher IV generally implies that the market anticipates significant price movements, while lower IV suggests a more stable market. Traders can use IV to gauge the risk and reward potential of an options trade. For instance, options with higher IV may offer greater profit potential but also carry a higher risk.

Additionally, IV impacts the time value of options premiums. Time value is an intrinsic value component that reflects the time remaining until an option expires. Higher IV leads to faster time value decay, which can influence the optimal holding period for an options position.

Understanding IV Trends and Developments

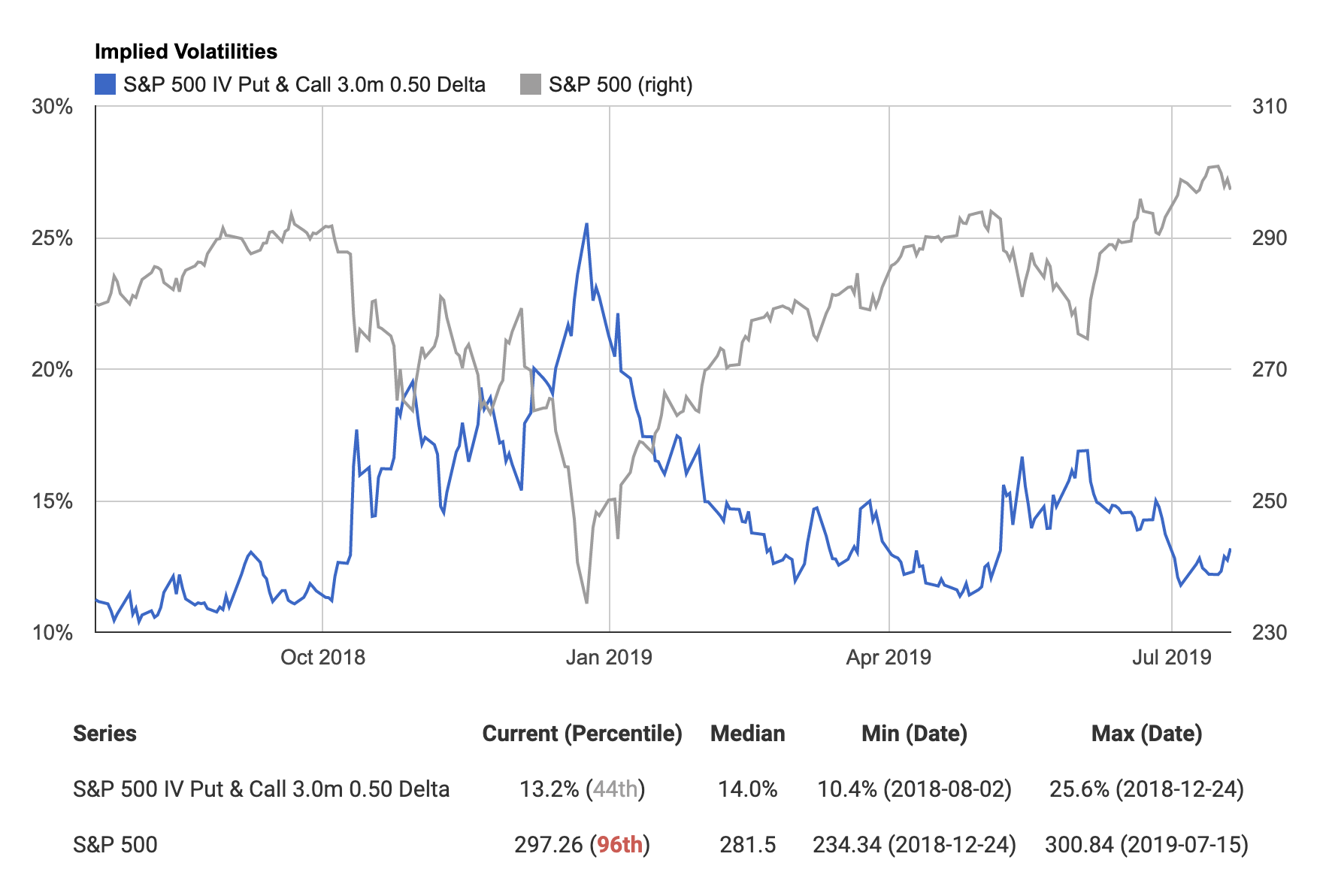

Staying abreast of IV trends and developments is crucial for successful options trading. Market news, economic indicators, and global events can all affect IV. For example, during periods of economic uncertainty or political turmoil, IV tends to surge as investors seek protection or capitalize on market volatility.

It’s essential to monitor IV dynamics and adjust your trading strategies accordingly. By incorporating IV into your analysis, you can make informed decisions about option selection, strike prices, and expiration dates.

Tips and Expert Advice

Seasoned options traders have accumulated years of experience and knowledge that can help you enhance your trading skills. Here are some pro tips:

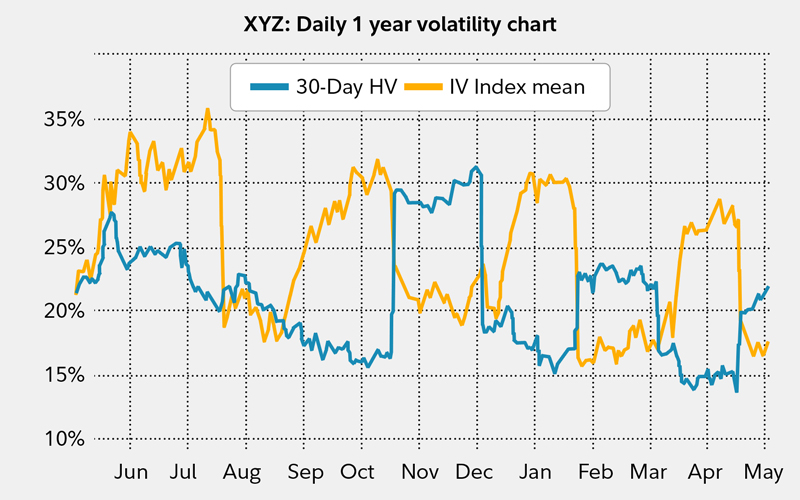

- Consider both IV and historical volatility: Combine implied volatility with historical volatility data to gain a comprehensive understanding of past and expected price movements.

- Understand the concept of “volatility crush”: IV tends to decrease as an option approaches expiration, leading to potential losses if the price movement is not as anticipated.

- Trade options with high liquidity: High-volume options offer better spreads and lower trading costs, increasing your profit potential.

- Use technical analysis to identify trading opportunities: Incorporate technical indicators, such as moving averages and support/resistance levels, into your analysis to pinpoint potential entry and exit points.

Image: xtremetrading.net

Frequently Asked Questions (FAQs)

1. What is the relationship between IV and options premiums?

Answer: Higher IV leads to higher option premiums as it reflects increased market expectations for price fluctuations.

2. How does IV impact options profitability?

Answer: IV affects both the potential profits and losses of options trades. Higher IV generally provides greater profit potential but also carries higher risk due to faster time value decay.

3. How can I use IV to improve my options trading strategies?

Answer: By understanding IV trends and incorporating them into your analysis, you can make more informed decisions about option selection, strike prices, and expiration dates, optimizing your risk-reward ratio.

Trading Options Using Implied Volatility

Image: www.getvolatility.com

Conclusion

Trading options using implied volatility offers both challenges and opportunities in the dynamic stock market. By gaining a comprehensive understanding of IV, staying informed about market trends, and applying expert advice, you can navigate the market’s complexities and increase your chances of success in options trading. Are you ready to embark on the thrilling journey of options trading using implied volatility?