Introduction:

Option trading, the act of buying and selling options contracts, has become increasingly popular among investors seeking to expand their portfolios. However, understanding how to calculate option trading profit requires a grasp of the intricacies of the market. This comprehensive guide will delve into the methods used to determine your gains and losses in option trading, empowering you to make informed decisions and optimize your profit potential.

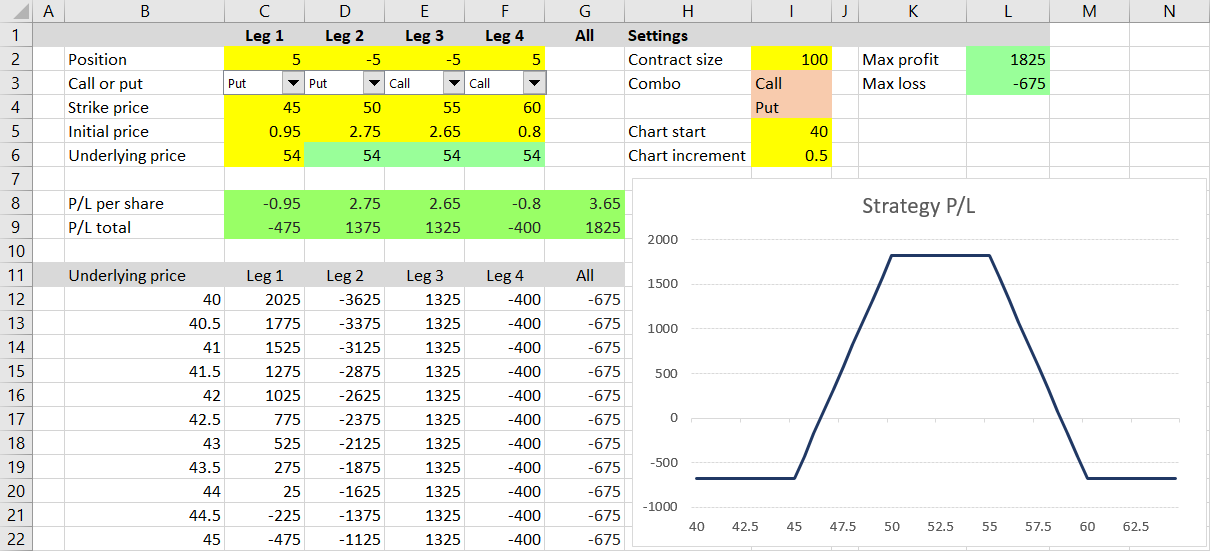

Image: haipernews.com

Basic Principles of Option Pricing:

Options contracts derive their value from the underlying asset, such as stocks or indices. The price of an option is determined by several factors, including the underlying asset’s price, the strike price, the time to expiration, and the implied volatility. The strike price is the price at which the underlying asset can be bought or sold when the option is exercised. Implied volatility measures the market’s expectation of future price fluctuations in the underlying asset.

Types of Options Contracts:

There are two main types of option contracts: calls and puts. Call options give the buyer the right but not the obligation to buy the underlying asset at the strike price by the expiration date. Put options provide the buyer the right but not the obligation to sell the underlying asset at the strike price by the expiration date.

Calculating Profit and Loss:

Profit Calculation:

- Call Option Profit: Subtract the option purchase price and the strike price from the current underlying asset price.

- Put Option Profit: Subtract the option purchase price from the difference between the strike price and the current underlying asset price.

Loss Calculation:

- Call Option Loss: Your loss is the difference between the call option’s purchase price and the current underlying asset price.

- Put Option Loss: Your loss is the difference between the strike price and the current underlying asset price, with the addition of your option purchase price.

Image: katlynefaiza.blogspot.com

Example Calculations:

Let’s consider an example to illustrate these calculations:

-

Call Option: You purchase a call option with a strike price of $100 for a premium of $5. The current underlying asset price is $110.

-

Profit Calculation: $110 – $100 – $5 = $5 profit

-

Put Option: You purchase a put option with a strike price of $100 for a premium of $6. The current underlying asset price is $95.

-

Profit Calculation: $100 – $95 – $6 = $-1 loss

Factors Influencing Profitability:

In addition to the basic calculation methods, other factors can influence your option trading profitability:

- Implied Volatility: Higher implied volatility increases option prices, potentially leading to higher profits (or losses).

- Time to Expiration: As time to expiration shortens, the option’s value decays, which can impact your profit margins.

- Underlying Asset Price: Changes in the underlying asset’s price significantly affect option pricing and profitability.

- Trading Strategy: Different trading strategies, such as covered calls or calendar spreads, require specific profit calculation methods.

Tips for Maximizing Profits:

- Understand Market Dynamics: Conduct thorough research and stay abreast of economic news and events that can influence option prices.

- Set Realistic Profit Goals: Don’t overestimate your potential gains and set achievable profit targets to avoid excessive risk-taking.

- Choose the Right Options: Select options with suitable strike prices, expiration dates, and implied volatility levels based on your market outlook and risk tolerance.

- Manage Risk: Limit the size of your positions and consider hedging strategies to protect your portfolio from market volatility.

- Seek Professional Advice: Consult with experienced financial advisors or option trading brokers for tailored guidance and support.

How To Calculate Option Trading Profit

Conclusion:

Understanding how to calculate option trading profit is crucial for successful trading. By mastering these concepts, investors can make informed decisions, manage risk effectively, and maximize their profit potential. Remember, option trading involves inherent risks, so it’s essential to conduct thorough research, stay updated with market conditions, and consider seeking professional advice when necessary. Armed with the knowledge and techniques outlined in this guide, you can embark on your option trading journey with greater confidence and strive for long-term profitability.