Options trading can be a lucrative way to make money, but it’s important to understand how to calculate your profit before you get started. In this article, we’ll explain the basics of option pricing and show you how to calculate your profit on an option trade.

Image: www.macroption.com

What is Option Pricing?

An option is a contract that gives you the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date. The price of an option is determined by a number of factors, including:

- The price of the underlying asset

- The strike price (the price at which you can buy or sell the underlying asset)

- The time to expiration

- The volatility of the underlying asset

- The interest rate

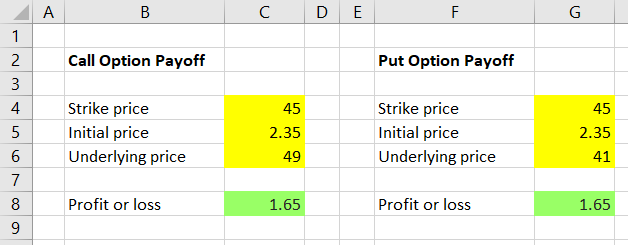

Calculating Option Profit

To calculate your profit on an option trade, you need to know the following information:

- The price of the option when you bought it

- The price of the option when you sold it (or the expiration price)

- The number of contracts you traded

Once you have this information, you can use the following formula to calculate your profit:

Profit = (Sale price - Purchase price) x Number of contractsFor example, let’s say you bought 10 contracts of an option for $1.00 per contract. You later sold the options for $1.50 per contract. Your profit on the trade would be:

Profit = ($1.50 - $1.00) x 10 = $50Tips for Calculating Option Profit

Here are a few tips for calculating your option profit:

- Be sure to include all of the costs of the trade, such as commissions and fees.

- Use a calculator or spreadsheet to help you with the calculations.

- Don’t forget to take into account the time value of money. The time value of money is the value of money today compared to the value of money in the future. This is an other important factor that can affect your option profit.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Image: www.investopedia.com

Expert Advice

Here is some expert advice on calculating option profit:

<

>

“It’s important to understand the risks involved in option trading before you get started. Options can be a complex investment, and it’s possible to lose money if you don’t know what you’re doing.”

<blockquote

“If you’re not comfortable calculating your own option profit, you can use a broker or online tool to help you.”

FAQ

Here are some frequently asked questions about calculating option profit:

Q: What is the most important factor to consider when calculating option profit?

A: The most important factor to consider when calculating option profit is the price of the underlying asset.

Q: How can I reduce the risk of losing money on an option trade?

A: You can reduce the risk of losing money on an option trade by doing your research and understanding the risks involved.

Q: What are some tips for increasing my profit on an option trade?

A: Some tips for increasing your profit on an option trade include buying options when the price of the underlying asset is low and selling options when the price of the underlying asset is high.

How Do U Calculate An Option Trading Profit

Image: app.bangnovan.com

Conclusion

Calculating option profit is a relatively simple process, but it’s important to understand the factors that can affect your profit before you get started. By following the tips and advice in this article, you can increase your chances of making a profit on your option trades.

Are you interested in learning more about option trading? Leave a comment below and I’ll be happy to help.