Prologue

In 2017, I embarked on a thrilling journey into the world of cryptocurrency options trading. Cardano (ADA), a pioneering blockchain platform renowned for its advanced technology and unwavering commitment to research, instantly captured my attention. In this article, I will delve deep into the realm of Cardano options trading, empowering you with the knowledge to navigate this dynamic market.

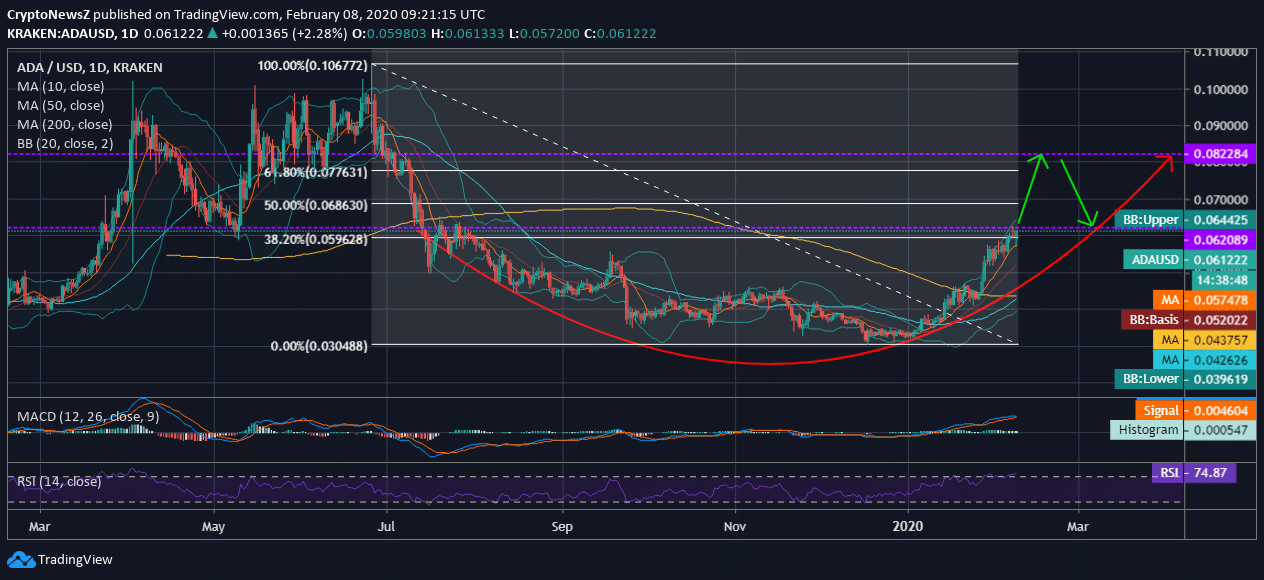

Image: www.cryptonewsz.com

What is Cardano Options Trading?

Options trading in the context of Cardano involves contracts that grant the buyer (holder) the right, but not the obligation, to either buy or sell a predetermined amount of ADA at a specified price (strike price) on or before a specified date (expiration date). This flexibility allows traders to speculate on the future price movements of ADA, potentially profiting from both bullish and bearish market conditions.

Unveiling the Two Variants of Options

Cardano options trading encompasses two distinct types of options:

1. Call Options:

Call options convey to the buyer the right to purchase ADA at the strike price on or before the expiration date. These options are commonly employed when traders anticipate a rise in the price of ADA.

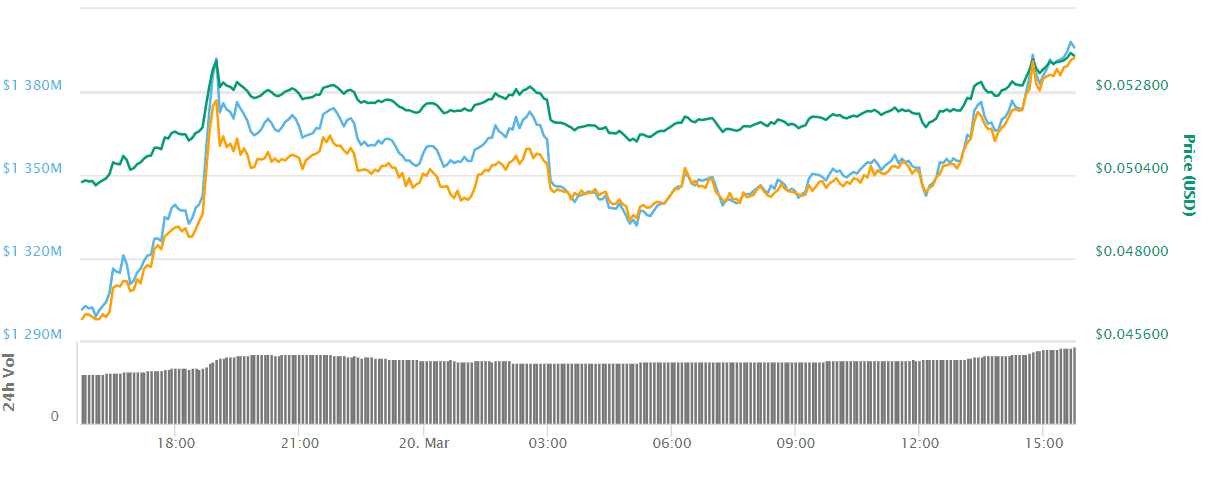

Image: www.cryptonewsz.com

2. Put Options:

Put options provide the buyer the right to sell ADA at the strike price on or before the expiration date. They serve as a valuable tool for hedging or profiting from a potential decline in ADA’s price.

Navigating the Nuances of Option Metrics

A thorough grasp of key option metrics is imperative for successful trading. These metrics include:

- Strike Price: The predetermined price at which the buyer can exercise the right to buy or sell ADA.

- Premium: The price paid to the option seller for the contract.

- Expiration Date: The date on which the option contract expires.

- Time to Expiration: The duration remaining before the option expires.

Delving into the Mechanics of Cardano Options Trading

The mechanics of Cardano options trading encompass the following steps:

- Choose an Exchange: Select a reputable cryptocurrency exchange that supports Cardano options trading.

- Analyze Market Data: Conduct thorough research on historical price data, market sentiment, and news to make informed trading decisions.

- Select Option Type: Determine whether to purchase a call option (bullish) or a put option (bearish) based on your market analysis.

- Set Strike Price: Choose a strike price that aligns with your price projection for ADA.

- Determine Expiration Date: Select an expiration date that provides sufficient time for your prediction to materialize.

- Pay the Premium: Execute the trade by paying the agreed-upon premium to the option seller.

Tips and Expert Advice for Cardano Options Trading

As an experienced trader, I strongly recommend implementing these strategies:

- Conduct Diligent Research: Thoroughly analyze market conditions, option metrics, and historical data to make well-informed trading decisions.

- Manage Risk: Employ risk management techniques such as stop-loss orders and position sizing to mitigate potential losses.

- Monitor Market Trends: Stay abreast of the latest market developments, news events, and technical indicators to adjust your trading strategies accordingly.

Frequently Asked Questions (FAQs)

Q: What are the benefits of Cardano options trading?

A: Options trading provides several advantages, including flexibility in speculation, potential profits in various market conditions, and hedging capabilities.

Q: How can I determine the value of an option contract?

A: The value of an option contract is influenced by several factors, including the underlying asset’s price, time to expiration, volatility, and interest rates.

Q: What are some risks associated with Cardano options trading?

A: Options trading involves substantial risk and requires a comprehensive understanding of the market and risk management principles. Potential risks include premium loss, unlimited downside potential in case of incorrect predictions, and time decay.

Cardano Options Trading

Image: cryptopotato.com

Conclusion

Cardano options trading offers a multifaceted approach to speculating on the price movements of ADA. By embracing the strategies outlined above and seeking professional guidance when necessary, you can confidently navigate this exciting and potentially rewarding market.

Do you find the topic of Cardano options trading captivating? Share your thoughts and questions in the comments section below. Together, we can unlock the intricacies of this innovative trading instrument.