In the fast-paced world of finance, options trading presents a dynamic opportunity for investors to enhance their portfolios and potentially maximize returns. Navigating this complex realm requires a reliable and robust options trading platform. Let’s delve into the top-rated platforms, their features, and how they can empower your investment strategies.

Image: www.interactivebrokers.com.hk

Understanding the Options Trading Platform Ecosystem

Options trading platforms serve as gateways to the options markets, providing traders with the necessary tools and functionality to execute trades, monitor positions, and analyze market data. These platforms offer varying levels of features, user interfaces, and pricing structures, catering to both seasoned traders and beginners alike.

When selecting an options trading platform, consider factors such as commission rates, trading tools, charting capabilities, and customer support. It’s crucial to choose a platform that aligns with your trading style, experience level, and financial objectives.

Unveiling the Champions of Options Trading

Numerous options trading platforms grace the financial landscape, but a select few stand out for their exceptional offerings. Here’s a curated list of the top-rated options trading platforms:

- TD Ameritrade: A well-rounded platform known for its robust trading tools, educational resources, and user-friendly interface.

- Tastyworks: An intuitive platform designed specifically for options traders, offering advanced order types, market scanning, and community forums.

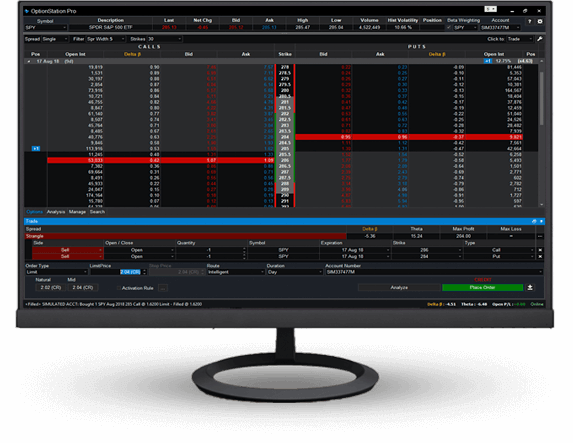

- Interactive Brokers: A sophisticated platform with customizable trading tools, extensive market data, and competitive pricing.

- Thinkorswim (TD Ameritrade): A powerful platform for active traders, featuring advanced charting capabilities, algorithmic trading, and paper trading.

- TradeStation: A comprehensive trading platform with advanced technical analysis tools, customizable charting, and order management features.

Expert Insight: Tips and Advice for Success

Navigating the world of options trading requires a combination of knowledge, skill, and strategic execution. Here are some expert tips to enhance your trading journey:

- Understand the Risks: Options trading carries inherent risks, so it’s essential to thoroughly understand the potential losses before entering the market.

- Master the Basics: Learn the fundamentals of options pricing, volatility, and trading strategies to lay a strong foundation for your trades.

- Plan Your Trades: Develop a comprehensive trading plan that outlines your trading goals, risk tolerance, and entry and exit strategies.

- Manage Your Risk: Utilize stop-loss orders and position sizing to mitigate potential losses and protect your capital.

- Seek Education and Support: Enhance your knowledge through books, online courses, and webinars, and join trading communities for support and insights.

Image: forex-station.com

Frequently Asked Questions: Demystifying Options Trading

Q: What is an options contract?

A: An options contract grants the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price on or before a specific date.

Q: How do I choose the right strike price and expiration date when trading options?

A: The strike price and expiration date influence an option’s premium and potential profit or loss. Consider your trading strategy, market outlook, and time horizon when making these selections.

Q: What is theta decay?

A: Theta decay refers to the gradual decrease in an option’s value as time passes. This time-sensitive factor is crucial when trading options.

Q: Can I lose more money than I invest in options trading?

A: Yes, unlike stock trading, options trading involves the potential for unlimited losses. It’s crucial to meticulously manage your risk and understand the inherent risks before trading.

Q: How do I learn more about options trading?

A: Explore educational resources such as books, online courses, webinars, and trading communities to enhance your knowledge and develop your trading skills.

<h2

Top Rated Options Trading Platform

Image: www.tradestation.io

Conclusion

Choosing the right options trading platform and implementing sound trading strategies can empower your investment journey and potentially yield significant returns. Remember, options trading involves risk, so it’s vital to approach it with knowledge, discipline, and a well-defined trading plan.

If you’re curious about the world of options trading or seeking ways to enhance your trading strategies, we encourage you to explore the resources available and connect with experienced traders to gain valuable insights and support. Embrace the challenges and rewards of options trading with confidence and a thirst for continuous learning.