In the ever-evolving realm of financial markets, traders constantly seek to discern patterns and unravel the secrets that govern price movements. Among the most fundamental yet profound concepts lies support and resistance, acting as guideposts for charting the course of option trading. Support marks the price floor, beneath which sellers struggle to push prices lower, while resistance forms the price ceiling, deterring buyers from propelling prices higher. Understanding these pivotal levels empowers traders to make informed decisions, optimize profit potential, and mitigate risk amidst the dynamic and alluring world of options.

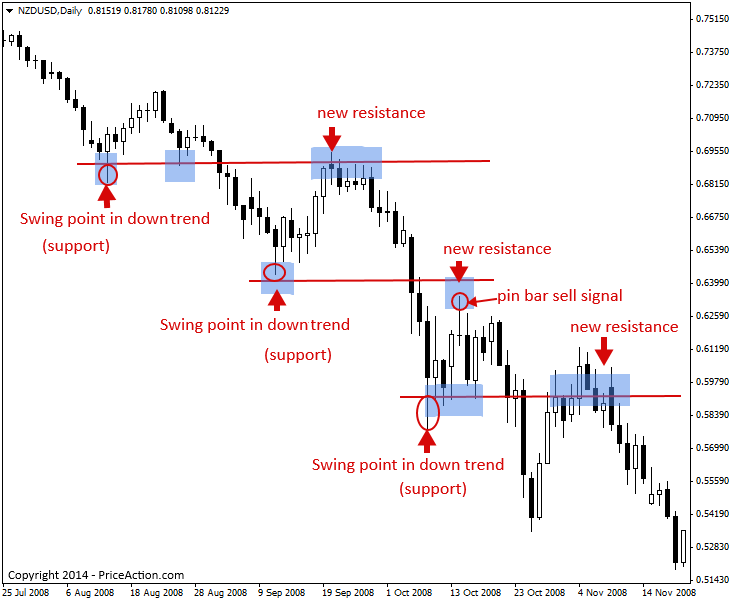

Image: priceaction.com

Option trading, with its inherent leverage and time-bound nature, presents a compelling yet daunting avenue for both seasoned investors and aspiring traders alike. A thorough grasp of support and resistance serves as a beacon of clarity, providing traders with the compass to navigate market fluctuations and harness their transformative potential.

Delving into the Dynamic Duo of Support and Resistance

Support and resistance emerge from the intricate interplay of supply and demand. Support materializes at price levels where buyers emerge in droves, eager to snatch up assets at a perceived bargain, effectively creating a floor beneath which prices seldom plunge. Conversely, resistance materializes at price levels where sellers amass, keen on offloading assets at a perceived peak, thereby creating a ceiling that prices often struggle to breach.

These critical levels are not merely ephemeral notions; they materialize through repeated interactions between buyers and sellers, leaving an enduring imprint on price charts. Traders can identify support and resistance levels by analyzing historical price data, scouring for areas where prices have consistently bounced back or encountered significant roadblocks.

Spotting Support and Resistance: A Trader’s Guide

Discerning support and resistance levels demands a keen eye and an unwavering dedication to market observation. Technical analysis, the art of unearthing patterns and trends within price data, provides an arsenal of indispensable tools to aid traders in this pursuit.

-

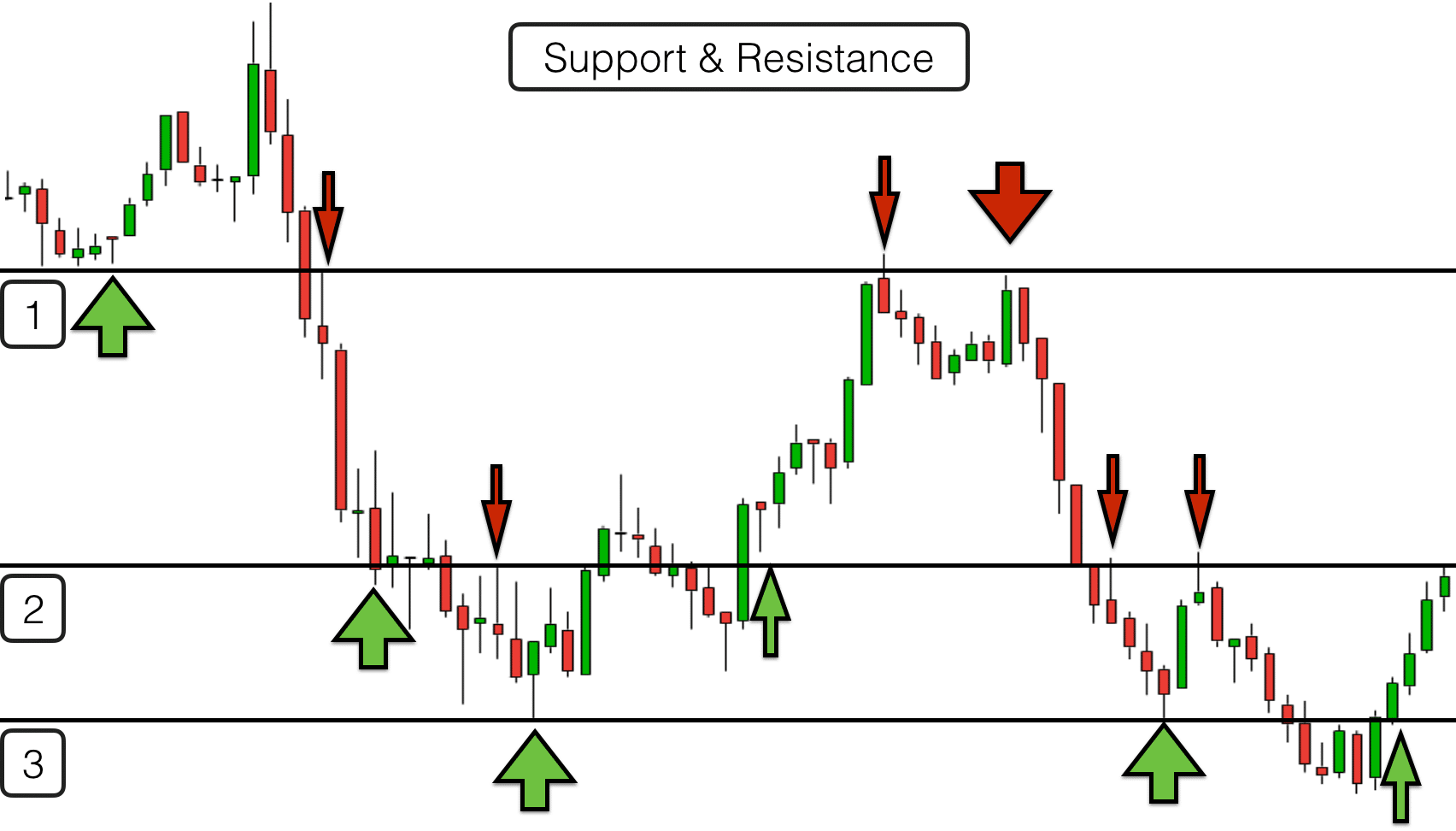

Horizontal Lines: The simplest yet potent method for identifying support and resistance involves drawing horizontal lines at price levels where prices have repeatedly encountered significant buying or selling pressure. These lines act as potent barriers that guide price action, signaling potential reversal points.

-

Moving Averages: Moving averages, calculated by smoothing out price data over a specified period, serve as dynamic support and resistance levels that evolve alongside market trends. When prices cross above or below moving averages, it often signals a shift in market sentiment, offering traders valuable insights into impending support or resistance.

-

Trendlines: Trendlines, drawn along the highs or lows of price movements, depict the prevailing trend and highlight potential areas of support or resistance. Breaks above or below trendlines can indicate a change in trend, offering traders timely cues for adjusting their strategies.

Expert Insights and Tactical Tips

Expert Insight: “Support and Resistance are the Cornerstones of Option Trading”

- “Comprehending support and resistance is the bedrock upon which successful option trading strategies are built,” proclaims Jake Winton, a seasoned options trader and market analyst. “These levels provide pivotal touchpoints for identifying potential areas of price reversals, allowing traders to position themselves accordingly.”

Actionable Tip: “Trade with the Trend for Enhanced Profitability”

- “Aligning your trades with the prevailing trend increases your odds of success,” advises Emily Carter, a renowned financial educator and options specialist. “By buying options that align with an uptrend or selling options in a downtrend, you harness market momentum, enhancing your chances of reaping substantial returns.”

Image: excellenceassured.com

Option Trading Support And Resistance

Conclusion: Unlocking Profitable Option Trading through Support and Resistance

Mastering the art of identifying support and resistance empowers option traders with an unparalleled advantage, enabling them to decipher market dynamics and uncover hidden profit opportunities. By recognizing these pivotal price levels, traders acquire the tools to navigate market fluctuations, make informed trading decisions, and outmaneuver the complexities of the options market