Introduction

Options trading is a complex but powerful tool that can help investors offset risk and generate income. Straddles are a popular option strategy that involves buying both a call and a put option with the same strike price and expiration date. This strategy is often used to hedge against market volatility or to bet on a sideways movement in the underlying asset. In this article, we will provide a comprehensive overview of straddle trading, including its history, mechanics, and the latest trends.

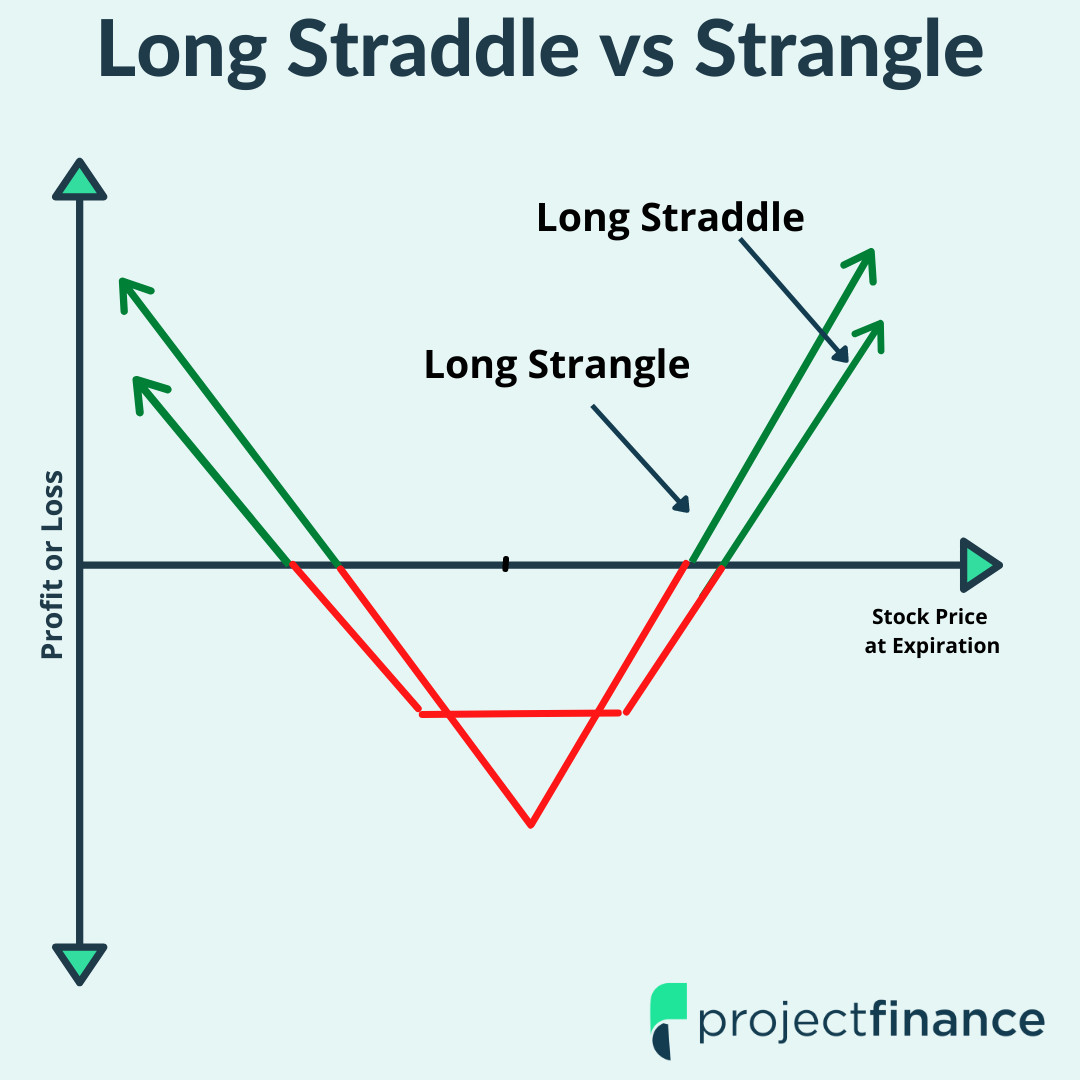

Image: www.projectfinance.com

Understanding Straddle Options

A straddle is an option strategy that involves simultaneously buying a call option and a put option with the same strike price and expiration date. This strategy is designed to profit from large price movements in the underlying asset, regardless of the direction of the move. If the underlying asset price rises, the call option will increase in value, while the put option will decrease in value. Conversely, if the underlying asset price falls, the put option will increase in value, while the call option will decrease in value.

History of Straddle Trading

Straddle trading has been around for centuries, but it became more popular in the early 20th century. In the 1920s, option traders began using straddles to hedge against market risk. Straddles became even more popular in the 1970s and 1980s, as the volatility of the stock market increased. Today, straddles are one of the most commonly used option strategies.

Mechanics of Straddle Trading

Image: www.profiletraders.in

The Pros and Cons of Straddle Trading

- Pros:

- Straddles can help to hedge against market risk.

- Straddles can be used to bet on a sideways movement in the underlying asset.

- Straddles can be used to take advantage of high volatility in the underlying asset.

- Cons:

- Straddles can be expensive to implement.

- Straddles can be risky, especially if the underlying asset price moves suddenly in one direction.

- Straddles can be difficult to manage, especially for beginning option traders.

Latest Trends and Developments in Straddle Trading

Tips and Expert Advice for Straddle Trading

- Only trade straddles if you fully understand the risks involved.

- Use straddles as part of a larger options trading strategy.

- Trade straddles on liquid underlying assets.

- Set stop-loss orders to limit your risk.

- Be patient and do not panic if the underlying asset price does not move in your favor immediately.

FAQ on Straddle Trading

- What is a straddle?

A straddle is an option strategy that involves buying both a call option and a put option with the same strike price and expiration date. - When should I use a straddle?

Straddles can be used to hedge against market risk or to bet on a sideways movement in the underlying asset.

What are the risks of straddle trading?

Straddle trading can be risky, especially if the underlying asset price moves suddenly in one direction.

How can I minimize the risks of straddle trading?

You can minimize the risks of straddle trading by setting stop-loss orders and by trading on liquid underlying assets.

Are straddles a good investment?

Straddles can be a good investment for experienced option traders who are willing to accept a high level of risk.

Option Trading Straddle

Image: charleyeasy.github.io

Conclusion

Straddle trading is a powerful option strategy that can be used to hedge against market risk or to bet on a sideways movement in the underlying asset. However, it is important to remember that straddle trading can be risky, especially for beginning option traders. If you are considering using this strategy, it is important to do your research and to understand the risks involved.

Are you interested in learning more about straddle trading and option trading ? If so, I encourage you to read the following resources:

- The Options Playbook by Brian Overby

- Option Trading for Dummies by Joe Duarte

- The Bible of Option Strategies by Guy Cohen