Trading Bitcoin is one of the most lucrative ways to invest in the digital currency market. Alternatively, you can also speculate on price movements without exposing yourself to the risks of owning the actual asset. Many investors turn to options trading for this due to its inherent flexibility and the potential for leveraged gains. Options trading can be a powerful tool for investors, but it’s essential to understand the intricacies involved. This guide will provide a comprehensive overview of Bitcoin options trading, equip you with expert advice, and demystify the complexities associated with it.

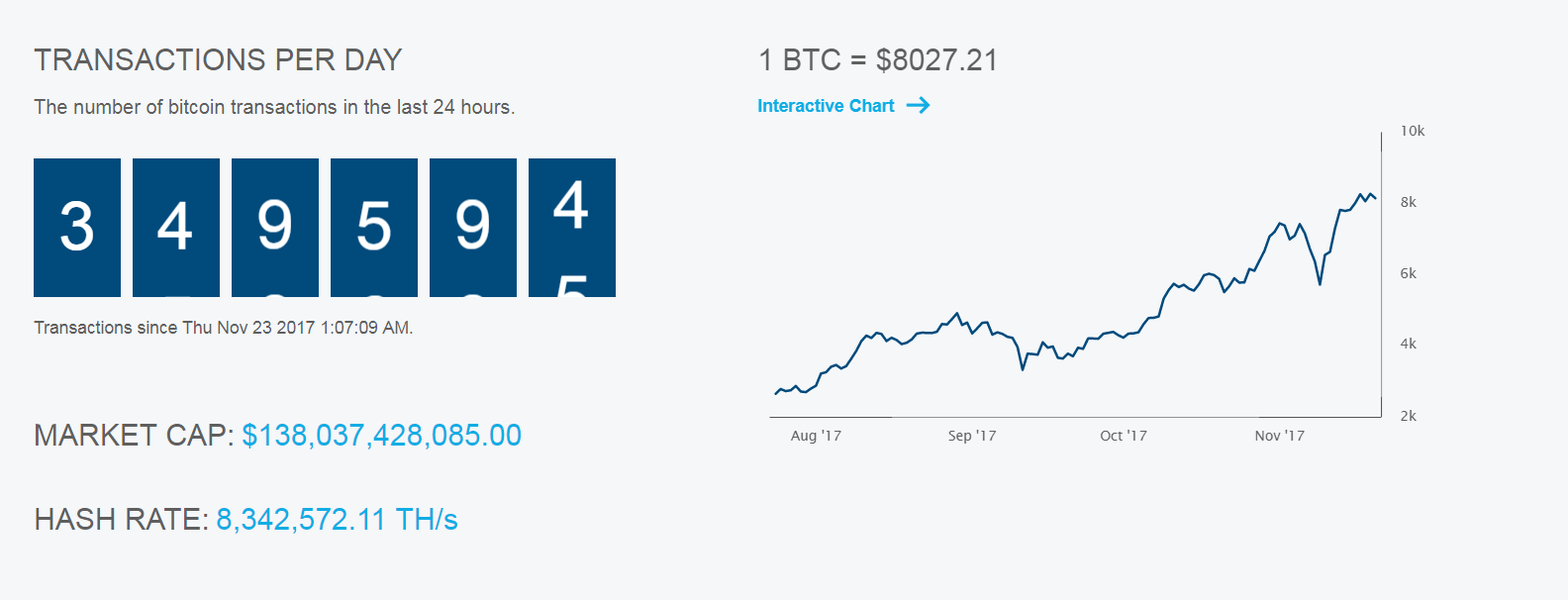

Image: www.tradingview.com

Options Trading: A Gateway to Bitcoin Price Speculation

An option contract grants the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) on or before a particular date (expiration date). In the case of Bitcoin options trading, the underlying asset is Bitcoin, offering investors a unique opportunity to speculate on price movements without the burden of ownership.

Delving into the Mechanics of Bitcoin Options Trading

Bitcoin options trading is similar to options trading in traditional markets. Buyers of options pay a premium to the seller in exchange for the option contract. The option’s value is derived from the difference between the underlying asset’s current price and the strike price. If the market price moves in the direction predicted by the buyer, the option can be exercised, leading to potential gains; otherwise, the option expires worthless.

Call Options: Betting on Price Appreciation

Call options allow the holder to purchase Bitcoin at a specified strike price until the expiration date. If the price of Bitcoin rises above the strike price, the option holder can exercise the option and buy Bitcoin at a lower price than the prevailing market rate, resulting in a profit.

Image: 101trading.co.uk

Put Options: Capitalizing on Price Declines

Put options grant the holder the right to sell Bitcoin at a set strike price before the expiration date. When the market price falls below the strike price, the option holder can exercise the put option and sell Bitcoin at a higher price than its current market value.

Unveiling the Advantages of Bitcoin Options Trading

Bitcoin options trading offers a plethora of benefits, including:

- Profitable speculation: Profit from price movements without owning Bitcoin.

- Leverage: Control a larger position size with a relatively small investment.

- Hedging: Protect your Bitcoin investments against price fluctuations.

- Flexibility: Tailor strategies to suit specific market conditions.

Navigating the Complexities of Bitcoin Options Trading

While options trading offers significant potential, it also involves complexities. It’s imperative to consider the following factors before venturing into this realm:

- Expiration dates: Options expire on a specific date. Failing to exercise or sell the option before this date renders it worthless.

- Implied volatility: A measure of expected price fluctuations. High implied volatility increases option premiums.

- Margin trading: Leverage is available, but it amplifies potential losses.

- Exchange risk: Options are traded on exchanges, exposing you to exchange-specific risks.

Expert Advice to Elevate Your Bitcoin Options Trading Strategy

Seasoned traders recommend the following strategies to enhance your Bitcoin options trading experience:

- Understand the risks: Thoroughly comprehend the potential risks involved.

- Manage your emotions: Don’t let emotions cloud your trading decisions.

- Start small: Gradually increase position size as you gain experience.

- Use stop-loss orders: Limit potential losses in an adverse market scenario.

Frequently Asked Questions on Bitcoin Options Trading

Q: What is the difference between a call and a put option?

A: A call option gives the right to buy, while a put option grants the right to sell.

Q: When does an option expire?

A: Options typically expire on a specified date, usually every month or two.

Q: What is the premium for an option?

A: The premium is the price paid to the option seller for the contract.

Option Trading On Bitcoin

Image: www.quoteinspector.com

Conclusion

Mastering Bitcoin options trading can be a lucrative endeavor, but it requires a deep understanding of the concepts and potential risks involved. By following the insights provided in this guide, you can navigate the complexities of Bitcoin options trading with confidence. Whether you’re a seasoned trader or just starting out, the world of Bitcoin options trading offers ample opportunities for growth and profit maximization.

Have you considered incorporating Bitcoin options trading into your investment strategy? Share your thoughts and experiences in the comments below.