In the labyrinthine world of financial markets, options trading represents a cornerstone for astute investors seeking to harness the potential of volatility. Amidst the array of strategies that populate this realm, the diagonal option trading strategy emerges as a versatile approach that empowers traders with both income generation and hedging capabilities.

Image: yoyofabol.web.fc2.com

Imagine embarking on a journey to conquer a mountain, but instead of a treacherous ascent, you discover a serpentine path that gently guides you to the summit. This is akin to the diagonal option trading strategy: it offers a measured and methodical path toward investment success.

The Diagonal Option Trading Strategy: Unraveled

The diagonal option trading strategy is a non-directional strategy that involves the simultaneous sale and purchase of options with different expiration dates but the same underlying asset. Here’s how it works:

- Sell a Near-Term Option: Begin by selling an option with a relatively short expiration date, such as one month.

- Buy a Further-Out Option: Simultaneously, purchase an option with a longer expiration date, perhaps six months or a year from the near-term option.

- Alignment of Strike Prices: The strike prices of both options should be the same or slightly out of the money, providing a buffer against price fluctuations.

The Advantages of a Diagonal Strategy

The diagonal option trading strategy offers several notable advantages:

- Income Generation: Selling the near-term option generates a premium, which constitutes an immediate source of income.

- Hedging Protection: Buying the further-out option provides hedging protection against adverse price movements, reducing the risk associated with the short-term option.

- Flexibility and Adaptation: The diagonal strategy allows for flexibility in adjusting strike prices and expiration dates based on changing market conditions.

Recent Trends and Expert Insights

The diagonal option trading strategy has gained traction in recent times, with traders recognizing its income-generating potential. Social media platforms and forums buzz with discussions on the strategy’s effectiveness.

Expert Advice: Seasoned traders emphasize the importance of meticulous risk management. They advise setting clear profit targets and monitoring market conditions closely to minimize potential losses.

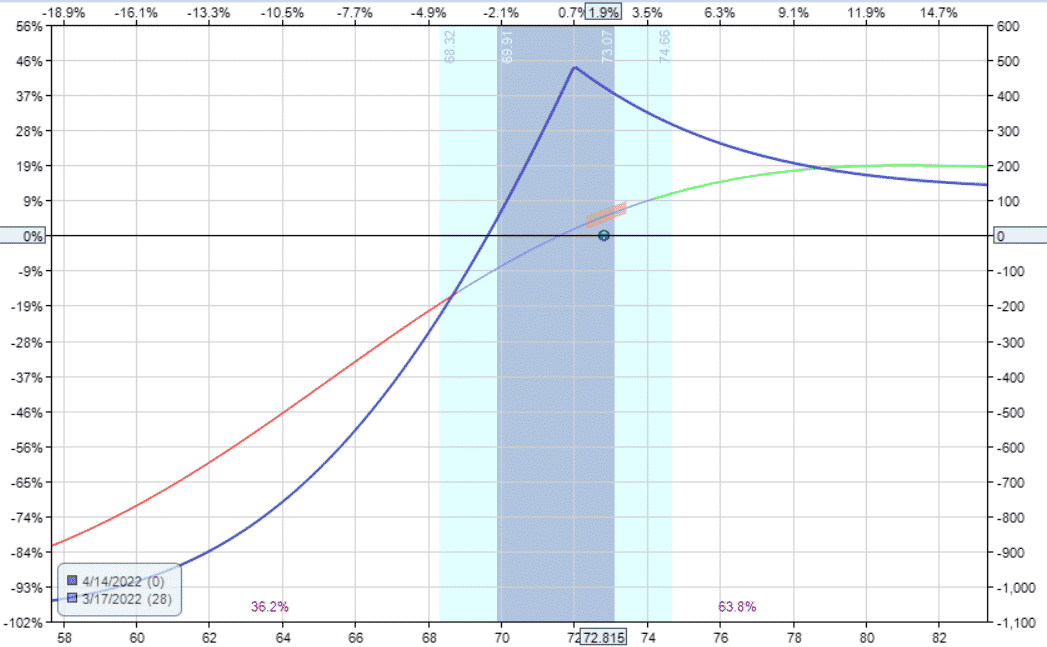

Image: optionstradingiq.com

Tips for Success with Diagonal Options

- Choose High-Liquidity Assets: Opt for underlying assets with substantial trading volume to ensure option availability and liquidity.

- Consider Strike Prices Strategically: Select strike prices that align with your market outlook and risk tolerance.

- Manage Expiration Dates Wisely: Ensure the expiration dates of the options are spaced adequately to capture potential price movements.

- Monitor Risk Regularly: Track market conditions diligently and adjust your strategy promptly based on observed changes.

Frequently Asked Questions

- Q: Is the diagonal strategy suitable for beginners?

A: While not overly complex, the diagonal strategy requires some understanding of options trading fundamentals. - Q: What is the profit potential of this strategy?

A: Profits depend on market conditions and the strategy’s implementation, but the strategy primarily aims for modest but consistent income. - Q: Can the diagonal strategy be used in any market environment?

A: The strategy is adaptable to various market conditions, although it may be more suitable in sideways or trending markets.

Diagonal Option Trading Strategy

Conclusion: Embarking on the Diagonal Path

In the vast expanse of options trading, the diagonal option trading strategy stands as a beacon of methodical investment. By harnessing its income-generating and hedging capabilities, investors can navigate market volatility with greater confidence. The article’s comprehensive insights and guidance equip you with the knowledge and tools to explore this strategy effectively. Embark on the diagonal path and unlock the potential of options trading today!

Are you eager to delve into the world of diagonal option trading? Share your thoughts and experiences in the comments below!