Unveiling the Art of Risk-Free Options Trading Practice

Embarking on the exhilarating journey of options trading can be daunting, but with paper trading, you can hone your skills without risking a single penny. Immerse yourself in the intricacies of options trading within the immersive TradingView platform, a renowned haven for traders seeking a vast arsenal of tools and resources.

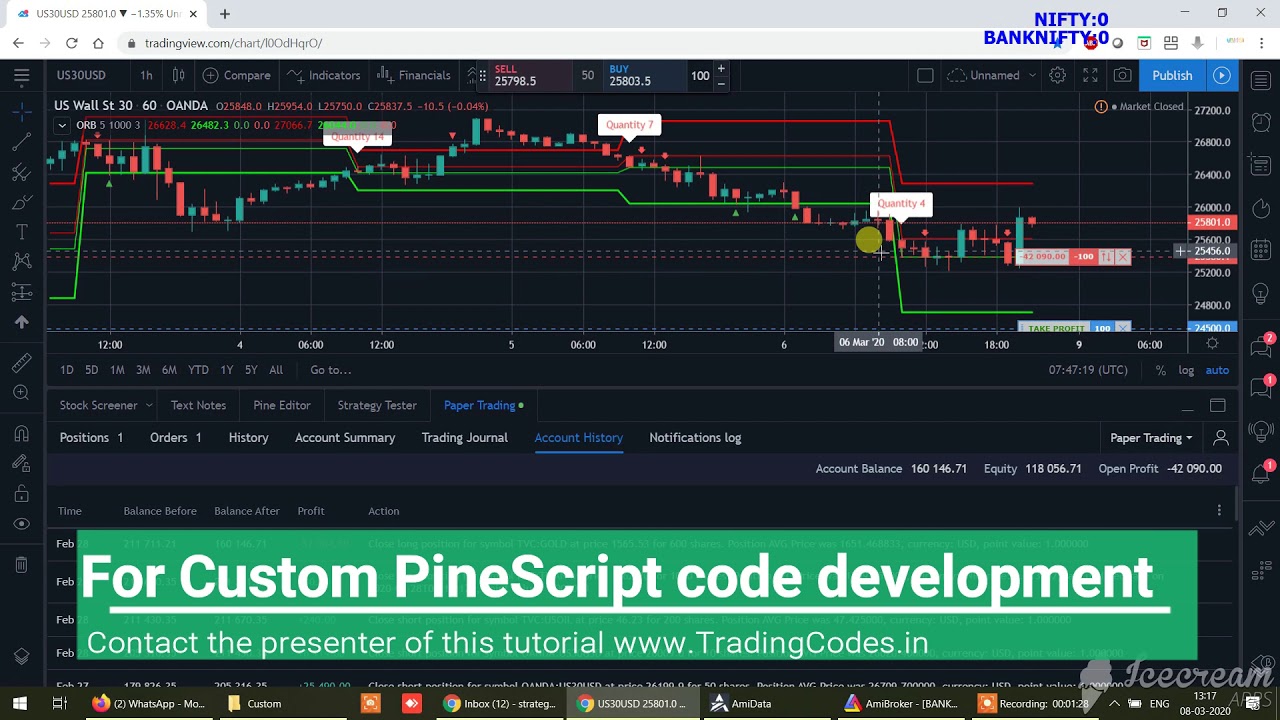

Image: www.youtube.com

In this comprehensive guide, we’ll delve into the realm of options paper trading in TradingView, empowering you with the knowledge and strategies to navigate this dynamic market with confidence. So, fasten your seatbelts and embark on a transformative learning experience!

TradingView Options Paper Trading: A Primer

Options paper trading mimics real-world options trading but without the financial risk. It allows traders to test their strategies, refine their decision-making, and develop a robust understanding of options dynamics. In TradingView, you can create a paper trading account to practice trading options without committing any capital.

The TradingView platform provides an incredibly user-friendly interface, customizable charts, and a plethora of technical indicators to enhance your trading experience. You can access real-time market data, simulate trades, and evaluate your performance in a risk-free environment.

Mastering Options Paper Trading in TradingView

To master options paper trading in TradingView, begin by familiarizing yourself with the platform and its features. Explore the available options contracts, study the underlying assets, and gain a solid comprehension of options pricing and volatility. Practice using different order types, including market orders, limit orders, and stop orders.

As you become more comfortable with the platform, experiment with various trading strategies. Test different strike prices, expiration dates, and option types to understand how they influence your potential profit and loss. Analyze the impact of market conditions, such as news events and economic indicators, on options prices.

The Latest Trends in Options Paper Trading

The world of options paper trading is constantly evolving, with new trends emerging to enhance the trading experience. One notable trend is the growing popularity of automated paper trading strategies. These strategies utilize algorithms to identify potential trading opportunities, automate trade execution, and manage risk effectively.

Another trend gaining traction is the integration of artificial intelligence (AI) in paper trading platforms. AI-powered tools can assist traders with sentiment analysis, pattern recognition, and predictive modeling, providing valuable insights for decision-making.

Image: www.youtube.com

Expert Tips for Effective Options Paper Trading

To enhance your options paper trading experience and maximize your learning potential, consider the following expert tips:

- Keep a Trading Journal: Document your trades, including your strategy, rationale, and results. This will help you identify patterns in your trading behavior and make improvements over time.

- Manage Risk Wisely: Always define your risk tolerance and trade within your limits. Paper trading allows you to experiment without financial consequences, so take advantage of this opportunity to test different risk management techniques.

- Seek Education and Mentorship: Continuously expand your knowledge through books, online courses, and mentorship programs. Learn from experienced traders and incorporate their insights into your trading approach.

- Q: Can I use options paper trading to learn real-world trading?

- A: Yes, options paper trading provides a valuable training ground to develop your skills and strategies without risking real capital.

- Q: How do I create a paper trading account on TradingView?

- A: Sign up for a TradingView account and select the “Paper Trading” option when creating your account. You can then select the starting balance for your paper trading account.

- Q: What are the benefits of using TradingView for options paper trading?

- A: TradingView offers a comprehensive suite of tools and resources, including real-time market data, advanced charting capabilities, and technical indicators, to enhance your trading experience.

Frequently Asked Questions (FAQs) on Options Paper Trading

Options Paper Trading In Tradingview

Conclusion

Options paper trading in TradingView provides a secure and effective environment for traders to hone their skills, experiment with strategies, and improve their decision-making. By following the guidance outlined in this comprehensive guide, you can unlock the full potential of options paper trading and embark on a journey towards successful options trading.

So, are you ready to delve into the exciting world of options paper trading? Embark on this remarkable learning journey today and witness your trading skills soar to new heights!