Introduction

As an avid trader, I’ve delved into the dynamic world of option trading, where volatility can paint a canvas of opportunities. India, with its burgeoning stock market, offers a treasure trove of stocks that are tailor-made for this exciting financial endeavor. In this article, I will unveil my research-backed insights on the best stocks for option trading in India, empowering you to navigate the market with confidence.

Image: www.pinterest.com

Before we dive into the specifics, let’s first understand what options are. Options are financial derivatives that grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price within a predetermined time frame. This versatility makes options an ideal tool for both hedging risks and capturing market swings.

Navigating the Options Landscape

The Indian stock market boasts a diverse ecosystem of companies across various sectors, including finance, technology, energy, and pharmaceuticals. When selecting stocks for option trading, it’s crucial to consider factors such as liquidity, volatility, and underlying fundamentals. The higher the liquidity, the easier it is to enter and exit trades. Volatility indicates potential price swings, which can amplify profits but also magnify risks. Finally, strong fundamentals, such as a growing business, healthy financials, and positive earnings prospects, serve as a solid foundation for stock selection.

Based on these criteria, I have compiled a list of the best stocks for option trading in India:

- Reliance Industries (RELIANCE): A behemoth in the Indian market, Reliance is a leader in sectors ranging from petrochemicals to retail. Its high liquidity and steady growth make it a prime candidate for option strategies.

- Infosys (INFY): As India’s second-largest IT company, Infosys has established itself as a global tech giant. Its consistent revenue streams and commitment to innovation create a favorable environment for option trading.

- HDFC Bank (HDFCBANK): Dominating the Indian banking sector, HDFC Bank offers a wide range of products and services. Its robust financial performance and extensive branch network translate into ample liquidity and predictable price movements.

- Tata Consultancy Services (TCS): Another IT powerhouse, TCS is renowned for its customer-centric approach and extensive presence in international markets. Its strong balance sheet and growing order book make it a stable option for option trading.

- Maruti Suzuki (MARUTI): As the largest carmaker in India, Maruti Suzuki benefits from strong domestic demand and a wide product portfolio. Its relatively low volatility and high liquidity make it an attractive option for beginners.

Mastering the Art of Option Trading

To maximize your potential in option trading, it’s paramount to adopt proven strategies and heed the wisdom of experienced traders. Here are some tips to enhance your trading journey:

- Understand your risk tolerance: Before venturing into option trading, it’s crucial to assess your risk tolerance and determine how much capital you’re willing to potentially lose.

- Choose strategies that align with your goals: Option trading offers a myriad of strategies, from simple premiums to spread and arbitrage plays. Select the ones that best suit your risk profile and trading objectives.

- Manage your trades diligently: Active monitoring of your positions is essential to adjust your strategy as market conditions evolve. Disciplined risk management techniques can help minimize losses and protect your trading capital.

- Stay informed about market trends: Keep a close eye on economic news, company announcements, and industry developments that may impact the performance of your chosen stocks.

- Learn from experts: Seek guidance from seasoned traders, attend webinars, and read financial publications to enhance your knowledge and decision-making abilities.

Common FAQs about Option Trading

- Q: Are options suitable for all investors?

A: Option trading involves inherent risks and should only be considered by experienced and knowledgeable investors who are comfortable with losing their invested capital. - Q: Is technical analysis helpful in option trading?

A: Technical analysis, which studies historical price movements and patterns, can provide insights into potential price trends. While not a foolproof predictor, it can complement fundamental analysis. - Q: What are the different types of options?

A: Options can be classified based on the underlying asset, expiration date, and type of contract. Common types include call options, put options, and various spreads. - Q: How do I place an option trade?

A: To place an option trade, you need to open a brokerage account and have sufficient funds. Contact your chosen broker for specific instructions and requirements.

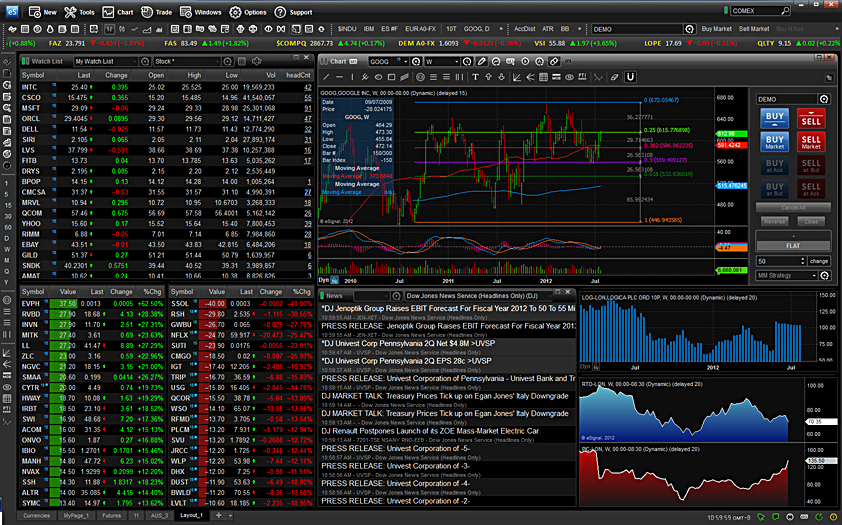

Image: niyudideh.web.fc2.com

Best Stock For Option Trading In India

Conclusion

Navigating the world of option trading in India requires a well-informed and strategic approach. By understanding the intricacies of options, carefully selecting stocks that meet specific criteria, and adhering to sound trading principles, you can increase your chances of success. While risk is an inherent part of option trading, it’s not insurmountable if you proceed cautiously and seek guidance when needed.

I would love to hear your thoughts on option trading in India. Do you have any favorite stocks for this purpose? Share your experiences and insights in the comments below and let’s explore the exciting opportunities in this dynamic market together.