In the intricate world of financial markets, option trading offers a vast scope for profit and structured risk-taking. An option is a contract that grants the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date. Options trading provides numerous strategies for investors to enhance their portfolio performance.

Image: www.newtraderu.com

Embarking on an option trading journey requires a solid understanding of its nuances. This comprehensive exercise aims to equip you with the essential concepts, strategies, and practical applications of option trading. Dive deep into the realms of options theory, gain insights into market trends, and emerge as a proficient option trader.

Decoding the Mechanics of Options Trading

An option contract comprises four key elements: the underlying asset, the strike price, the expiration date, and the premium. The underlying asset can be a stock, bond, currency, or commodity. The strike price is the price at which the holder can buy or sell the underlying asset. The expiration date determines the timeframe within which the option can be exercised. Lastly, the premium is the price paid by the buyer to acquire the option contract.

Types of Options: Navigating the Options Market

Options are broadly classified into two types: **calls** and **puts**. Call options grant the holder the right to buy the underlying asset, while put options grant the right to sell. Call options are typically employed in bullish markets when investors anticipate an upward movement in the underlying asset’s price. Conversely, put options are utilized in bearish markets when investors expect a decline in the underlying asset’s price.

Strategic Option Trading: Mastering the Art of Profitability

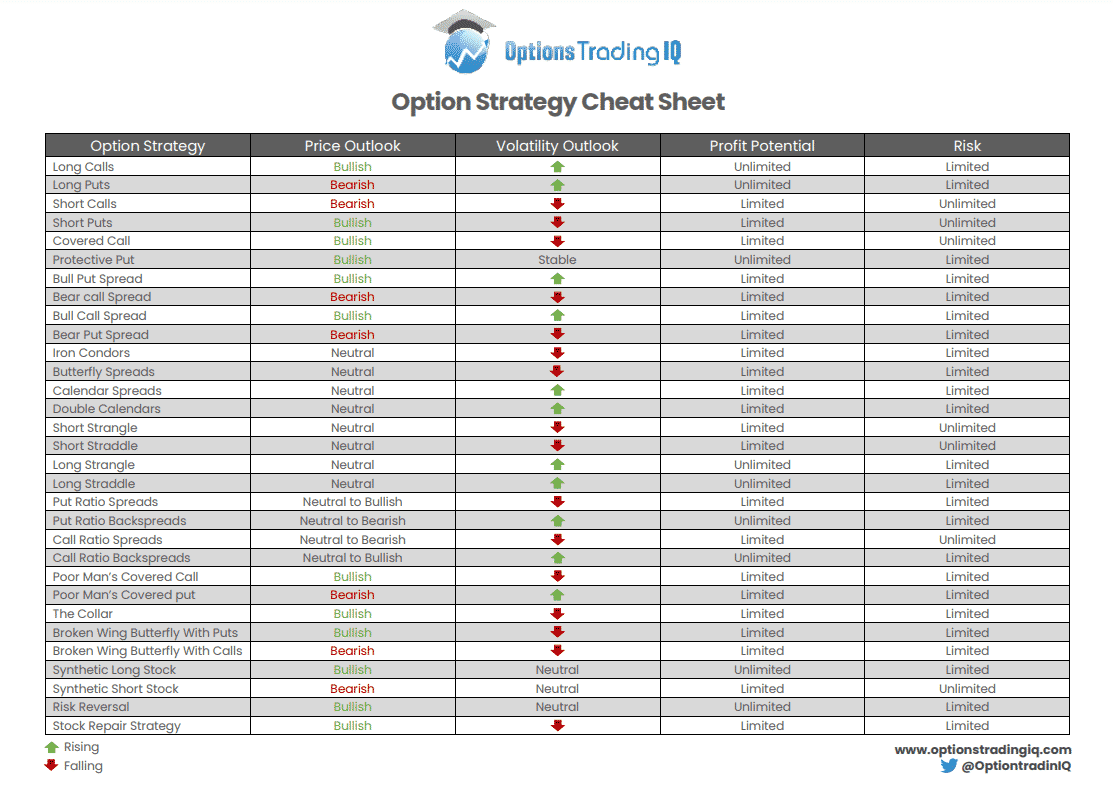

Option trading strategies vary in complexity and risk-reward profiles. Some common strategies include:

- Covered Call: Selling a call option against shares owned to generate income while limiting potential upside.

- Protective Put: Purchasing a put option to protect against downside risk in a long stock position.

- Bull Call Spread: Buying a call option and simultaneously selling a call option with a higher strike price to capitalize on a moderate increase in the underlying asset’s price.

- Bear Put Spread: Selling a put option and buying a put option with a lower strike price to profit from a decline in the underlying asset’s price.

Image: www.myfinopedia.com

Recent Trends and Innovations in Option Trading

The option trading landscape is constantly evolving, driven by technological advancements and market innovations. Some of the notable trends shaping the industry include:

- Growth of Retail Option Trading: Increased accessibility and awareness have led to a surge in retail participation in option markets.

- Artificial Intelligence and Machine Learning: Sophisticated algorithms are being employed to optimize option trading strategies and enhance decision-making.

- Exchange-Traded Funds (ETFs) for Options: ETFs that track options indices provide convenient and diversified exposure to options strategies.

Expert Tips for Successful Option Trading

Seasoned option traders offer valuable insights to navigate the intricacies of option markets effectively:

- Understand Your Risk Tolerance: Before delving into option trading, assess your risk tolerance and align your strategies accordingly.

- Learn Technical Analysis: A solid understanding of technical analysis can provide insights into market trends and assist in identifying potential trading opportunities.

- Manage Your Position Size: Allocate appropriate capital to each trade and avoid overextending your financial capacity.

- Use Limit Orders: Utilizing limit orders helps execute trades at desired price levels, mitigating potential losses.

FAQs on Option Trading: Your Queries Answered

Q: What is the key to successful option trading?

A: A combination of knowledge, experience, risk management, and patience is crucial for consistent profitability in option trading.

Q: Can options trading make you rich?

A: While options trading offers the potential for significant profits, it also involves substantial risk. Manage your expectations and invest wisely.

Option Trading Exercise

Conclusion: Embarking on Your Option Trading Journey

Understanding option trading is a journey that requires dedication, learning, and practice. By grasping the concepts, analyzing market trends, implementing proven strategies, and utilizing expert advice, you can navigate the world of options trading with confidence. Are you ready to unlock the potential of option trading?