Introduction

Image: www.researchgate.net

In the realm of financial markets, the ability to decipher trading hours can be the key to unlocking profitable opportunities. Call option trading, a potent strategy for investors seeking leverage, hinges on understanding the dynamics of these time constraints. This comprehensive guide will delve into the intricacies of call option trading hours, empowering you with the knowledge to navigate this market with confidence and precision.

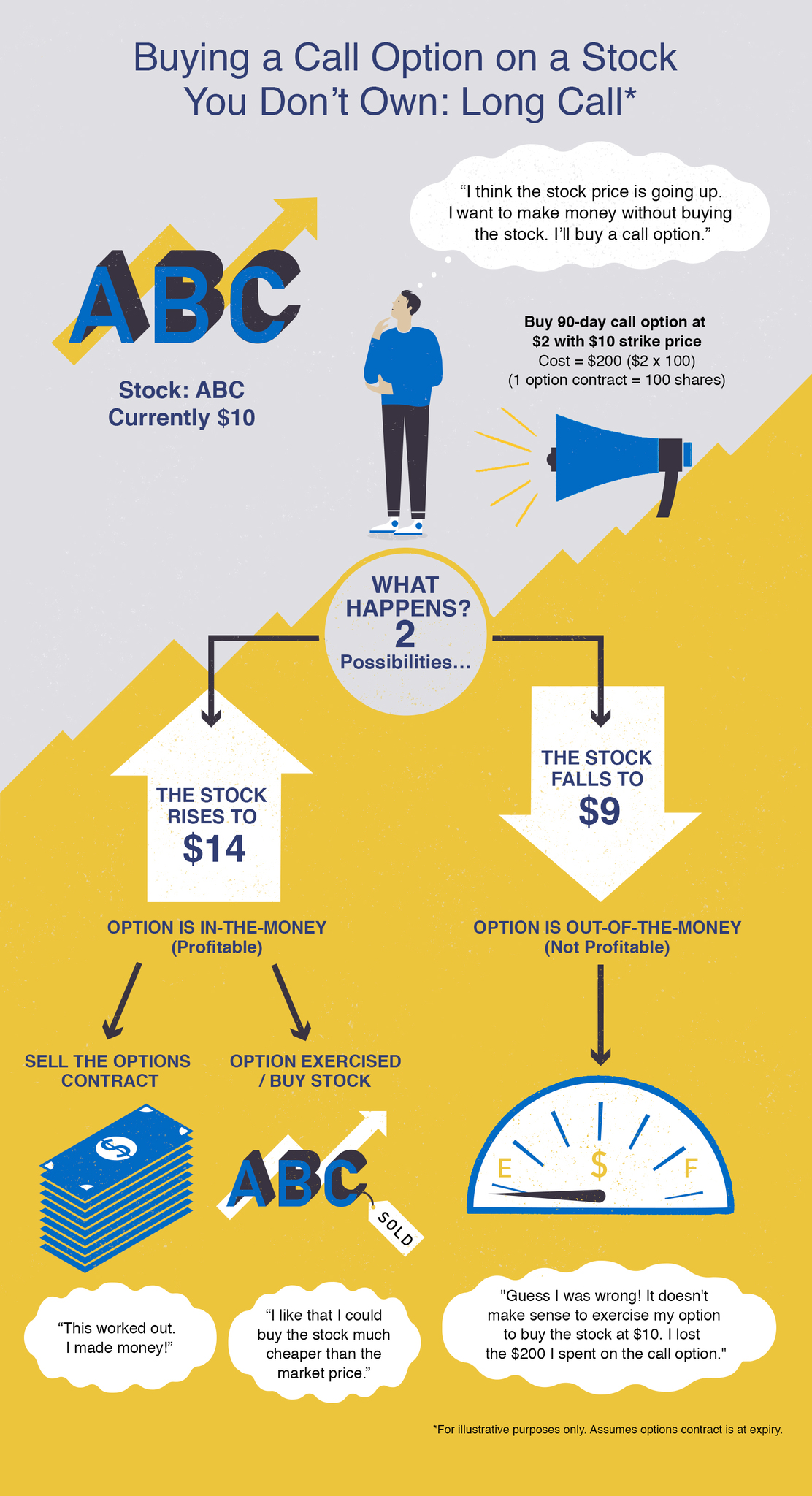

Defining Call Options and Their Role

A call option grants the holder the right, but not the obligation, to purchase an underlying asset at a predetermined price (the strike price) before a specific date (the expiration date). They represent a versatile tool that enables investors to speculate on the future price movements of stocks, indices, commodities, and other assets.

Understanding Call Option Trading Hours

Call option trading hours vary across exchanges and asset classes. Typically, for equities in the United States, trading commences at 9:30 AM Eastern Time (ET) and concludes at 4:00 PM ET on weekdays. However, it’s essential to note that these hours may differ for other markets, such as foreign exchanges or options on futures contracts.

Market Open:

The market open marks the start of active trading for the day. During this period, investors can initiate new call option positions or adjust their existing ones. It’s a time of high volatility as traders react to overnight news and economic data.

Regular Trading Hours:

Following the market open, trading proceeds through regular trading hours. This period witnesses a steady stream of orders as analysts evaluate market conditions and make trading decisions. While volatility may be lower than during the market open, there’s still ample liquidity to facilitate efficient trade executions.

Market Close:

As the trading day draws to a close, call option trading gradually winds down. However, it’s crucial to remember that the market close does not signify an end to all option trading activity.

Extended Trading Hours:

In recent years, several exchanges have introduced extended trading hours, allowing investors to trade certain options contracts beyond the regular closing bell. These hours typically span from 4:00 PM ET to 8:00 PM ET.

Expiration Friday:

The expiration date marks the culmination of a call option contract. On this day, the right to exercise the option expires, and the contract ceases to hold any value. It’s a crucial date for investors holding open positions as they must decide whether to exercise, sell, or let the option expire worthless.

Expert Insights and Actionable Tips

-

Trade during periods of high volatility: Increased volatility often presents opportunities for profit. Market openings and major news announcements can trigger price fluctuations that can be exploited with carefully timed call option trades.

-

Set realistic strike prices: Don’t get caught up in aspirations of unrealistic gains. Select strike prices that align with your investment objectives and risk tolerance.

-

Manage your risk: Call options can amplify market swings. Implement prudent risk management strategies, such as hedging and stop-loss orders, to safeguard your capital.

Conclusion

Mastering call option trading hours empowers investors with the ability to optimize their trading decisions and navigate market fluctuations effectively. By comprehending the nuances of these timeframes, you can identify opportunities, manage risks, and maximize your profit potential. Remember, the financial markets are a dynamic landscape, and it’s through continuous learning and diligent execution that you can achieve lasting success as a call option trader.

Image: speedtrader.com

Call Option Trading Hours

Image: www6.royalbank.com