The Elusive World of Option Contracts and Their Trading Timelines

In the realm of financial markets, option contracts play a pivotal role in empowering traders with the flexibility to capitalize on market fluctuations. These derivatives grant traders the right, but not the obligation, to buy or sell an underlying asset at a specified price within a predefined time frame. However, understanding the intricacies of option contract trading hours is paramount to navigating this dynamic landscape successfully. In this comprehensive guide, we will delve into the nuances of option trading hours, empowering you with the knowledge to optimize your trading strategies.

Image: www.researchgate.net

A Historical Perspective: The Genesis of Option Trading

The concept of options trading can be traced back to ancient Greece, where merchants engaged in informal contracts to hedge against price risks. The formalization of options trading took place in Amsterdam in the 17th century, where standardized options contracts were introduced for the trading of commodities. Over the centuries, option trading evolved, paving the way for the establishment of regulated exchanges and the development of complex trading strategies.

Unveiling the Mechanism of Option Contracts: A Balancing Act of Rights and Obligations

An option contract consists of two parties: the buyer and the seller. The buyer acquires the right to exercise the option, while the seller assumes the obligation to fulfill the contract if exercised. Options come in two flavors: calls and puts. Call options grant the buyer the right to buy the underlying asset, whereas put options provide the right to sell. The strike price, the price at which the option can be exercised, serves as an essential parameter in option contracts. By understanding these fundamental concepts, traders can harness the power of options to mitigate risks and optimize their trading endeavors.

Option Trading Hours: Unraveling the Interplay of Market Dynamics and Regulatory Frameworks

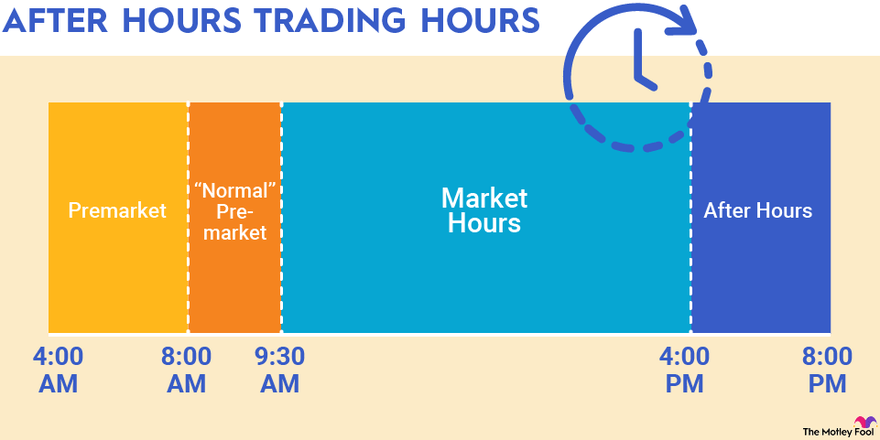

Option contract trading hours are influenced by a complex interplay of market dynamics and regulatory frameworks. Generally, options markets open at a specific time and close at a specified hour, with variations across exchanges. Trading hours may extend during special events or market volatility, allowing traders to respond to market conditions in real-time. These timings are often set to align with the trading hours of the underlying assets and to facilitate orderly market operations.

Image: tradeproacademy.com

Navigating the Nuances of Option Trading Hours: A Practical Approach

To capitalize on market opportunities effectively, traders must possess a thorough understanding of option trading hours. This requires diligent research to ascertain the specific trading hours for the options contracts they intend to trade. Up-to-date information can be obtained from the relevant exchanges, brokerages, and financial news sources. By adhering to these established trading hours, traders can minimize execution risks and maximize their trading efficiency.

Expert Insights: Unlocking the Secrets of Successful Option Trading

Seasoned traders often emphasize the significance of developing a comprehensive trading plan that outlines their trading goals, strategies, and risk management parameters. They recommend thorough due diligence on the underlying assets and the option contracts themselves. Additionally, they stress the need for continuous monitoring of market conditions, news events, and economic data that may impact the value of options. By embracing these strategies, traders can enhance their decision-making capabilities and navigate the complexities of option trading hours confidently.

General FAQ: Addressing Common Queries on Option Contract Trading Hours

Q: What are the typical trading hours for option contracts?

A: Option trading hours vary across exchanges. Traders should consult the relevant exchange websites for specific details.

Q: Can option contracts be traded after regular market hours?

A: Yes, some exchanges offer extended trading hours for option contracts, allowing traders to react to market events beyond standard trading hours.

Q: What factors can influence option contract trading hours?

A: Trading hours may be adjusted due to market holidays, significant news events, or changes in regulatory requirements.

Option Contract Trading Hours

Image: www.wallstreetzen.com

Conclusion: Embracing Option Contract Trading Hours for Informed Trading Decisions

In conclusion, option contract trading hours play a crucial role in the success of option traders. By becoming familiar with the trading hours, traders can optimize their trading strategies, minimize risks, and capitalize on market opportunities effectively. Embracing the knowledge presented in this comprehensive guide will empower traders to navigate the complexities of option trading hours and make informed trading decisions.

Would you like to delve deeper into the world of option contract trading hours? Share your questions and insights in the comments section below, and let’s continue the exploration together!