Introduction

The world of finance can be daunting, especially for those venturing into the exciting but often complex realm of options trading. Options trading hours futures, in particular, hinge upon a meticulous understanding of market dynamics and timing nuances. In this article, we will delve into the intricacies of options trading hours futures, providing you with a comprehensive guide to navigate this essential aspect of financial markets with confidence and success.

Image: insigniafutures.com

Demystifying Options Trading Hours Futures

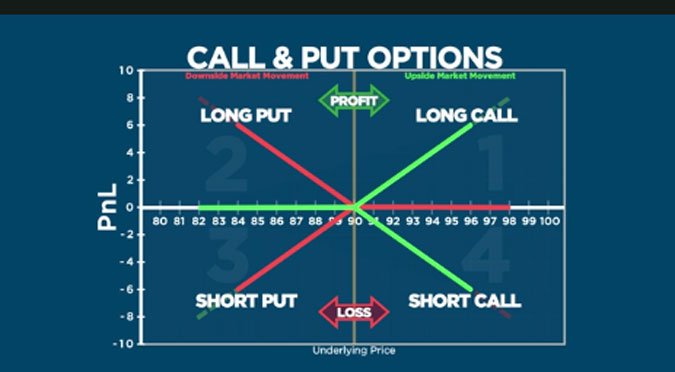

Options are derivative contracts that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified timeframe. Futures, on the other hand, are standardized contracts that commit the buyer to purchase a certain quantity of an underlying asset at a set price on a future date. By combining these two concepts, options trading hours futures allow investors to speculate on the future price movements of an underlying asset while mitigating the risk of unexpected market shifts.

Key Features of Options Trading Hours Futures

- Fixed Expiration Dates: Options trading hours futures conclude on predefined expiration dates, ensuring clarity in contract timelines and risk management.

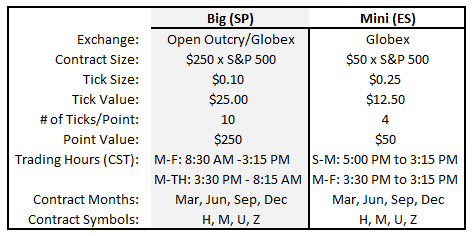

- Standardized Contracts: These contracts adhere to standardized specifications, including contract size, underlying asset, and expiration date, simplifying trading and risk assessment.

- Leveraged Exposure: Futures provide leverage, enabling traders to control a substantial underlying asset position with a relatively small amount of capital.

- Potential Profit & Loss: Futures offer the potential for both substantial profits and significant losses, depending on accurate price predictions and market movements.

Understanding Options Trading Hours

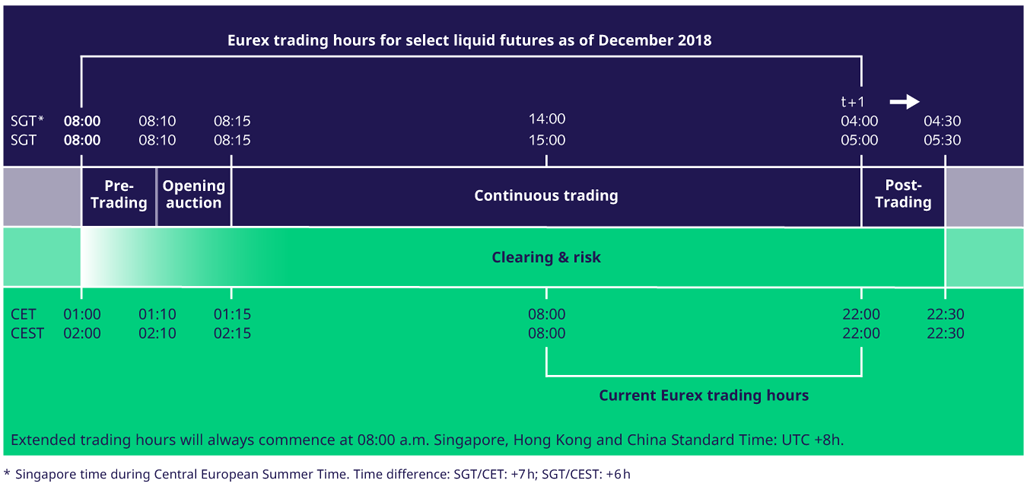

Options trading hours vary depending on the underlying asset and exchange. Typically, options trading hours align with the trading hours of the underlying asset’s exchange. However, it’s important to note that options trading hours may extend beyond the underlying asset’s trading hours on specific exchanges. For instance, options on major stock indices often trade for longer hours than the underlying stock markets.

Image: www.victoriana.com

Trading Strategies for Futures Options

Traders employ various strategies when navigating futures options, each with its own risk-reward profile. Some common strategies include:

- Bull Call Spread: A bullish strategy that aims to capitalize on an expected increase in the underlying asset’s price, involving buying a lower-strike call option and selling a higher-strike call option.

- Bear Put Spread: A bearish strategy that speculates on a decline in the underlying asset’s price, entailing buying a higher-strike put option and selling a lower-strike put option.

- Iron Condor: A neutral strategy designed to profit from low volatility, comprising buying a put option and a call option at lower strike prices while simultaneously selling a put option and a call option at higher strike prices, creating a range-bound trading scenario.

Expert Insights and Actionable Tips

“Options trading hours futures provide traders with tactical flexibility to capitalize on market movements,” says Andrew Clarke, an experienced options trader. “Understanding the nuances of trading hours and employing appropriate trading strategies can enhance profitability and risk management.”

Here are a few actionable tips to consider:

- Monitor Trading Hours: Pay close attention to options trading hours for different exchanges and contracts to maximize trading opportunities and avoid missed execution.

- Stay Informed: Follow market news and economic events that can impact the underlying asset’s price, as these factors can influence trading hours and volatility.

- Practice Risk Management: Understand the potential risks involved in futures options trading and employ appropriate risk management techniques to mitigate losses.

Options Trading Hours Futures

Image: wunesajoc.web.fc2.com

Conclusion

Options trading hours futures offer a sophisticated yet rewarding approach to speculate on market movements. By grasping the intricacies of trading hours, leveraging expert insights, and implementing sound trading strategies, individuals can harness the power of futures options to achieve their financial objectives. Remember, as in any financial endeavor, education, cautiousness, and a steadfast approach are paramount to navigating the dynamic world of options trading hours futures.