In the realm of financial trading, understanding the intricacies of trading hours is crucial for success. Among the various futures options, ES futures stand out as a popular choice for traders seeking exposure to the S&P 500 index. Knowing when ES futures options markets are open and closed is essential for optimizing trading strategies and maximizing potential returns.

Image: eminiaddict.com

Unveiling ES Futures Options

ES futures options are standardized contracts that grant the buyer the right, but not the obligation, to buy or sell a specific amount of the S&P 500 index at a predetermined price on a specified date in the future. They provide traders with the flexibility to speculate on the index’s price movements without the need to directly buy or sell the underlying stocks.

Trading Hours: A Delicate Balance

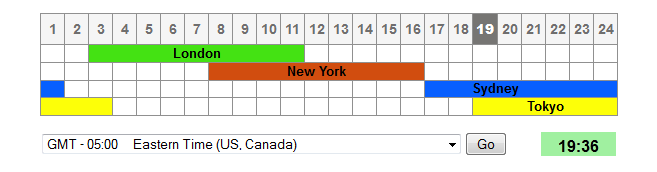

ES futures options trading hours are meticulously designed to accommodate the global nature of the market. The trading day officially commences at 9:30 AM Eastern Time (ET) and continues until 4:15 PM ET, with a one-hour break from 11:30 AM ET to 12:30 PM ET.

During this extended trading session, traders have ample time to execute trades, react to market news, and manage their positions. The extended hours allow traders to align their trading activities with major market events and economic releases, increasing their potential for profit.

Trading Time Zones: A Global Perspective

Understanding the trading time zones is critical for traders in different parts of the world. For traders in London, ES futures options trading hours align perfectly with the afternoon session, running from 2:30 PM to 9:45 PM Greenwich Mean Time (GMT). This allows them to actively participate in the market during their local business hours.

Traders in Tokyo, on the other hand, face a substantial time difference. ES futures options trading hours fall within the late evening and early morning hours in Tokyo, from 11:30 PM to 6:45 AM Japan Standard Time (JST). This time difference requires a strategic approach, with traders often relying on pre-market or post-market orders to navigate the market dynamics.

Image: aeromir.com

Holidays: A Pause in the Market’s Beat

As with any major financial market, ES futures options trading hours are subject to adjustments on certain holidays. The CME Group, which operates the ES futures and options markets, typically publishes a holiday schedule in advance.

Traders should be aware of these holiday closures and plan their trading strategies accordingly. It’s advisable to monitor official announcements from the CME Group to avoid unexpected market interruptions.

Es Futures Options Trading Hours

Image: www.xtremetrading.net

Conclusion

Grasping the nuances of ES futures options trading hours is an essential step towards unlocking the market’s true potential. By aligning trading strategies with the market’s rhythms, traders can optimize their decision-making and increase their chances of achieving success. Remember, understanding trading hours is not merely about following a schedule, but rather about mastering the market’s heartbeat and capitalizing on every opportunity it presents.