Understanding the Role of Options in the Financial Landscape

In the realm of finance, options trading plays a pivotal role in providing investors with opportunities for managing risk and enhancing returns. As a financial regulatory body, the Securities and Exchange Commission (SEC) oversees the options markets, ensuring their integrity and protecting investors’ interests. But why does the SEC allow options trading in the first place? This article delves into the reasons behind the SEC’s decision to embrace options trading, exploring its multifaceted benefits and potential risks.

Image: www.simplertrading.com

Origins of Options Trading: A Historical Perspective

The history of options trading dates back to ancient Greece, where merchants used a rudimentary form of options to hedge their risks in maritime trade. Over the centuries, options trading evolved into a sophisticated financial tool, embraced by investors seeking to mitigate risk, speculate on price fluctuations, and generate income.

In the United States, options trading gained prominence in the mid-20th century, with the establishment of the Chicago Board Options Exchange (CBOE) in 1973. As options trading became increasingly popular, the SEC assumed the responsibility of regulating this market to protect investors from fraudulent practices and ensure fair and transparent trading.

The Benefits: A Risk-Management Tool and Opportunity for Return

One key reason why the SEC allows options trading is its inherent value as a risk-management tool. Options provide investors with the flexibility to protect their portfolios against potential losses and hedge against adverse market conditions. For instance, an investor holding a stock portfolio can purchase a put option to establish a price floor, limiting their potential losses if the stock price declines.

Furthermore, options trading offers opportunities for investors to enhance their returns. By correctly speculating on the direction of an underlying asset’s price movement, investors can potentially generate substantial profits. The sale of options can also yield income, providing an additional source of revenue for investors.

SEC’s Regulatory Role: Ensuring Market Integrity and Investor Protection

To ensure the fair and orderly functioning of options markets, the SEC has implemented a comprehensive regulatory framework. This framework encompasses:

• Registration and Disclosure Requirements: Investment firms and brokers involved in options trading must register with the SEC, providing transparency and accountability. They are also obligated to disclose material information to investors, ensuring informed decision-making.

• Market Surveillance: The SEC monitors options markets in real-time, using advanced technology to detect and prevent fraudulent activities. The Commission has the authority to investigate suspected violations and impose penalties on wrongdoers.

• Education and Investor Awareness: The SEC actively promotes financial literacy, providing investors with comprehensive resources and guidance on options trading. The Commission aims to empower investors with the knowledge and skills necessary to participate in options markets responsibly.

Image: www.thestreet.com

Why Does Sec Allow Options Trading

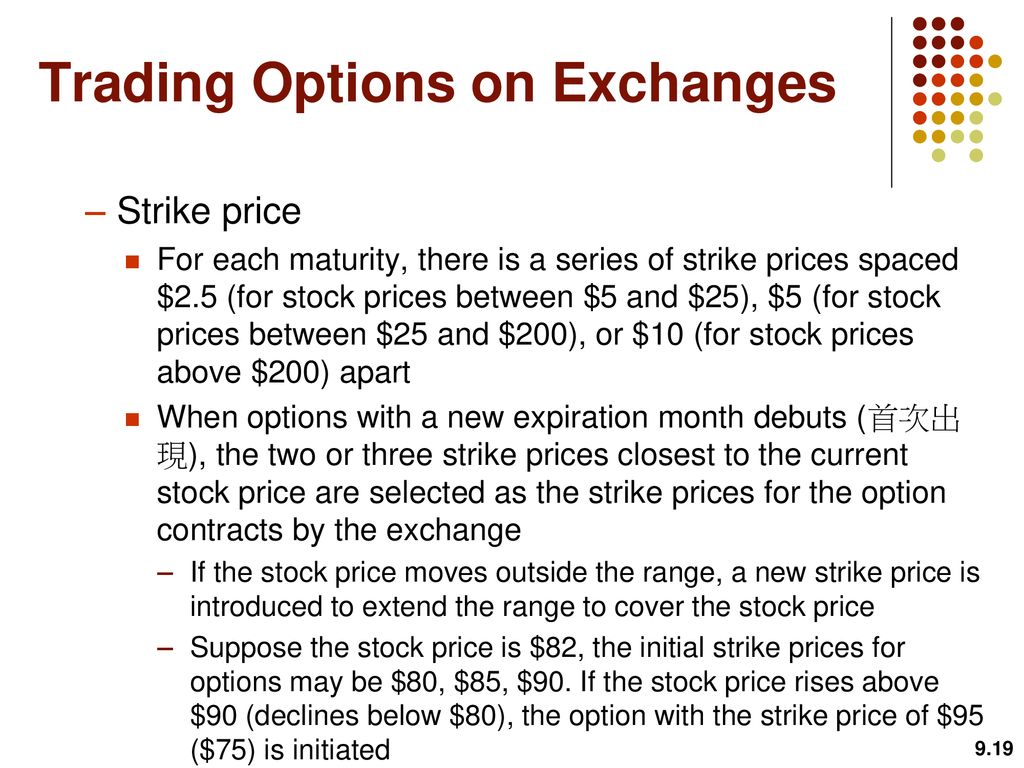

Image: slideplayer.com

Conclusion: Striking a Balance between Risk and Reward

In summary, the SEC’s decision to allow options trading stems from the belief that these instruments provide valuable risk-management tools and opportunities for return enhancement for investors. However, the SEC recognizes the potential risks associated with options trading and has established a stringent regulatory framework to ensure market integrity and investor protection. By striking a balance between risk and reward, the SEC fosters a fair and transparent options market, empowering investors to make informed decisions and participate in this dynamic financial instrument.