In the intricate world of financial markets, where opportunities arise and vanish in the blink of an eye, there lies a strategy known as fair value gap options trading. It’s a technique that has the potential to yield significant returns, but only if traders possess a thorough understanding of its nuances. This article delves into the intricacies of fair value gap options trading, providing investors with the knowledge and insights they need to navigate this fascinating arena.

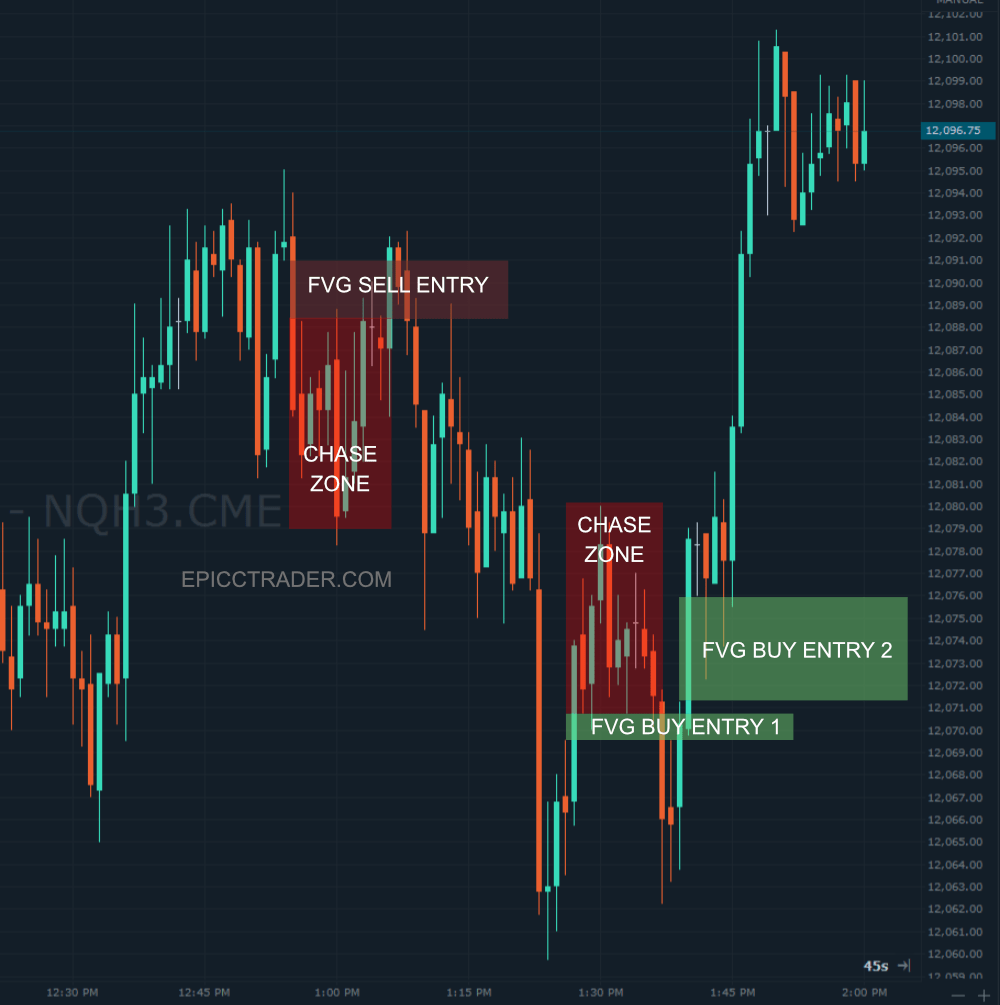

Image: epicctrader.com

What is Fair Value Gap Options Trading?

Fair value gap options trading is a strategy that revolves around exploiting the difference between the market price of an option and its fair value, which is derived from a pricing model. When the market price deviates significantly from the fair value, an opportunity arises for traders to capitalize on the discrepancy. By buying options that are undervalued or selling options that are overvalued, traders aim to profit from the convergence of the market price towards the fair value.

Understanding Fair Value

The key to successful fair value gap options trading lies in accurately estimating the fair value of the option. Pricing models, such as the Black-Scholes model, are commonly used to determine fair value based on factors like the underlying asset’s price, volatility, time to expiration, and interest rates. Traders must have a solid grasp of these models and the factors that influence them in order to make informed fair value assessments.

The Gap Between Market Price and Fair Value

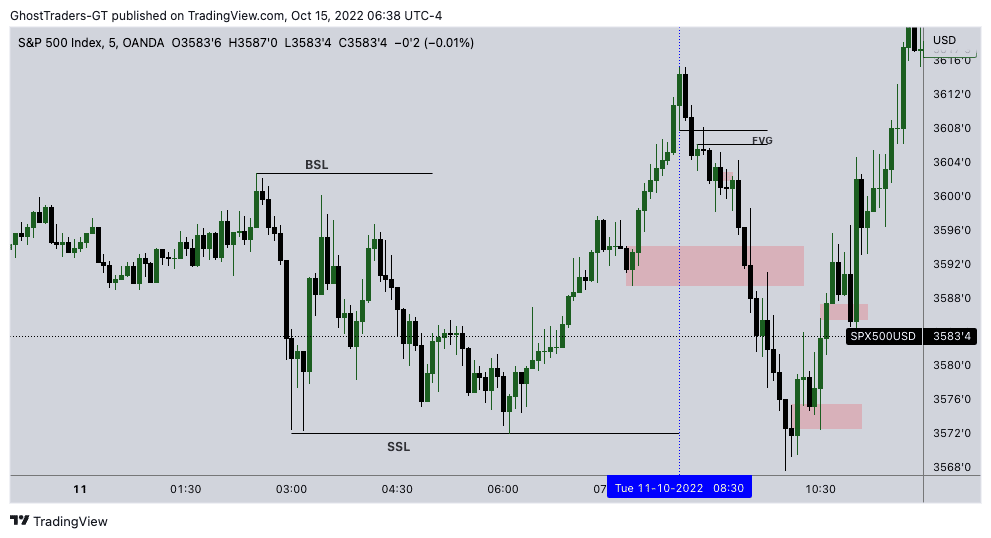

Market prices, often driven by investor sentiments and market inefficiencies, can deviate from fair values. These deviations create opportunities for traders to engage in fair value gap options trading. When the market price is below fair value, the option is considered undervalued, presenting a potential buy opportunity. Conversely, when the market price exceeds fair value, the option is overvalued, indicating a potential sell opportunity.

Image: trendspider.com

Exploiting the Gap

Traders can exploit the fair value gap by executing trades that align with the predicted convergence towards fair value. Buying undervalued options allows them to benefit from the anticipated appreciation in price as the market corrects the discrepancy. Selling overvalued options, on the other hand, provides the opportunity to profit from the decline in price as the market converges towards fair value.

Timing and Risk Management

Timing the trades is crucial in fair value gap options trading. Traders must monitor market conditions and identify the optimal entry and exit points. It’s also important to carefully manage risk by implementing strategies such as stop-loss orders to limit potential losses. Prudent diversification across different options and underlying assets can also help mitigate risks.

Tips for Success

To maximize potential returns and minimize risks in fair value gap options trading, traders should adhere to the following principles:

- Master the pricing models: Deepen your understanding of pricing models to improve your fair value estimations.

- Monitor market movements: Stay informed about market news, events, and volatility levels that may affect fair values.

- Use technical indicators: Incorporate technical analysis techniques to identify potential trading opportunities.

- Set realistic expectations: Understand that fair value gap options trading requires patience and discipline.

- Seek professional advice: Consider consulting with a financial advisor or specialist in options trading for guidance and support.

Fair Value Gap Options Trading

Image: ghosttraders.co.za

Conclusion

Fair value gap options trading offers a compelling opportunity for investors to leverage market inefficiencies and generate potential returns. By equipping yourself with the knowledge and skills outlined in this article, you can embark on this journey with greater confidence and understanding. Remember, successful trading requires a combination of technical expertise, risk management, and the ability to navigate the complexities of financial markets. Embrace the power of fair value gap options trading and unlock the myriad possibilities it holds.