Have you ever been fascinated by the intricate world of options trading, where complex strategies and calculated risks intertwine? Among the various options strategies, butterfly options trading stands out as a technique that offers a unique blend of high-profit potential and controlled risk.

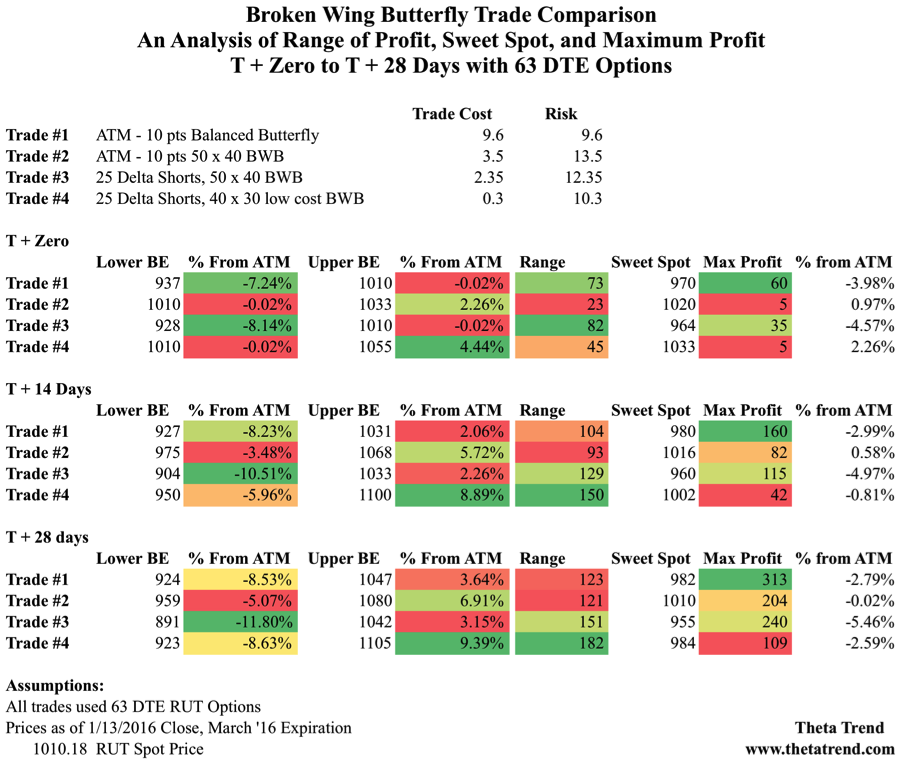

Image: www.thetatrend.com

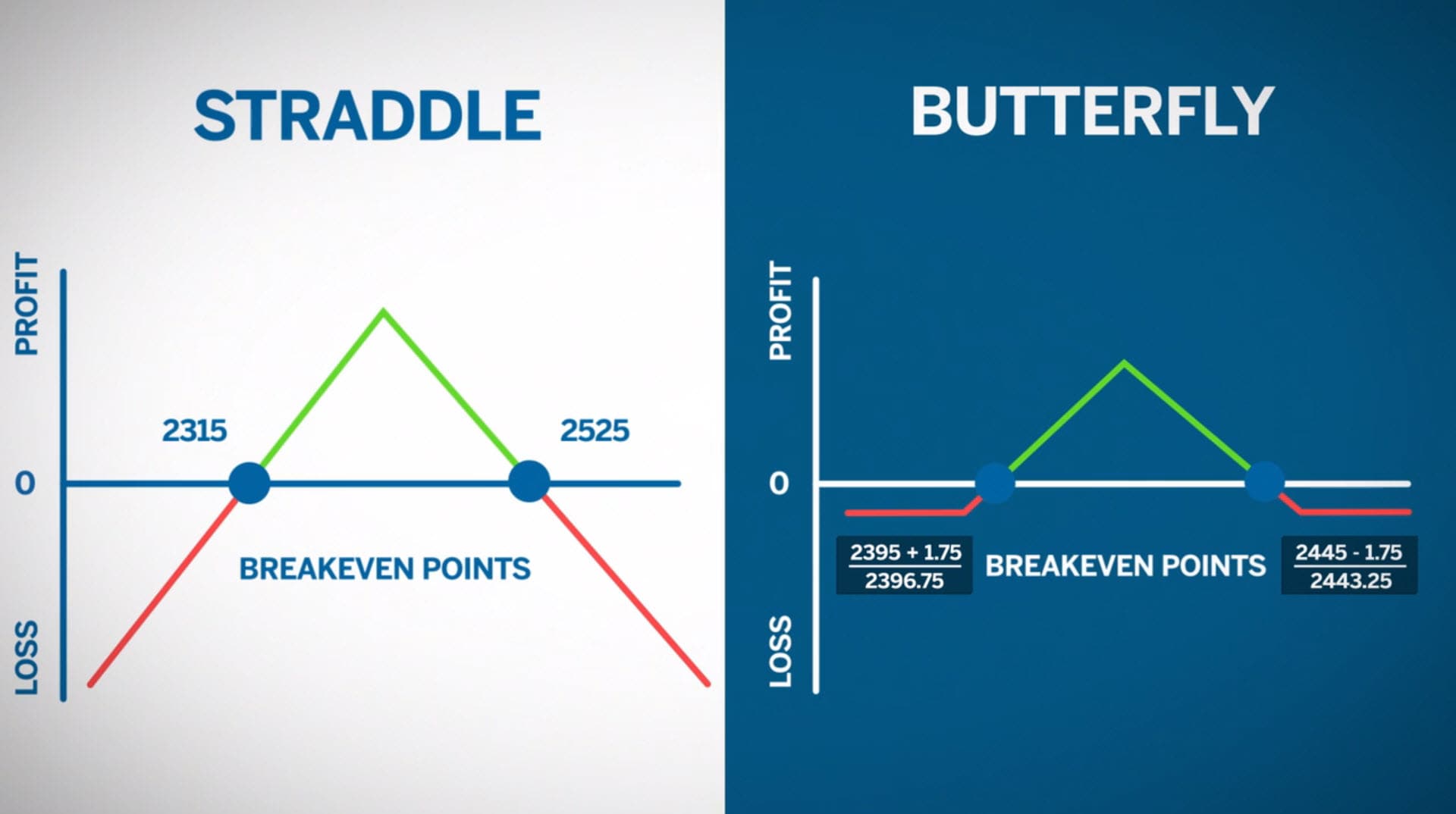

Butterfly options trading involves the simultaneous purchase and sale of three options with different strike prices. By carefully positioning these options, traders aim to create a profit zone that captures market movements within a specific range. The strategy is aptly named “butterfly” due to the shape of its profit graph, resembling the wings of a butterfly.

Understanding Butterfly Options Trading

Components of a Butterfly Spread

A butterfly spread consists of the following options:

- Bought butterfly wings: Two options with the same strike price, bought at or below market price.

- Sold butterfly wings: One option with a strike price in between the bought wing prices, sold at or above market price.

Profit Potential and Risk

The profit potential of butterfly options trading lies within a specific price range. When the underlying asset price moves towards the sold wing strike price, the trader profits from the increase in the sold wing’s value while balancing out the losses on the bought wings.

The risk is limited to the net premium paid, which is the sum of the bought wing premiums minus the sold wing premium. This controlled risk allows traders to explore higher reward potential while managing their exposure.

Image: www.simplertrading.com

Strategy Deployment

Traders can deploy butterfly options strategies in various market conditions, including neutral to slightly bullish or bearish markets. The optimal strike prices and direction of the trade depend on the trader’s market outlook and risk tolerance.

By adjusting the strike prices and the number of contracts, traders can customize the butterfly spread to suit their specific goals and risk profile. This flexibility makes butterfly options trading a versatile strategy that can be tailored to different market scenarios.

Butterfly Options Trading in Practice

For instance, consider a trader purchasing two Call options with a strike price of $100 at $5 each and selling one Call option with a strike price of $105 at $2. The net premium paid for this butterfly spread would be $7.

If the underlying asset price closes at $103 by the expiration date, the trader would profit $4 on each bought wing and lose $2 on the sold wing. This results in a net profit of $6 per butterfly spread, providing a return of over 85% on the net premium invested.

Expert Tips and Advice

- Choose the right underlying asset: Select assets with moderate volatility and a defined trend.

- Proper strike price selection: Ensure the sold wing strike price is in line with the expected market direction and the bought wings are sufficiently far from it.

Explanation of Tips

By carefully selecting the underlying asset and strike prices, traders can increase their chances of capturing profitable price movements while reducing the impact of market fluctuations beyond their anticipated range.

Frequently Asked Questions

Q: What is the optimal time to enter a butterfly spread?

A: Entry points should be determined based on technical analysis and market conditions. Traders should consider support and resistance levels, trend momentum, and volatility indicators.

Q: How long should I hold a butterfly spread?

A: The holding period depends on the underlying asset’s expected price movement. Most butterfly spreads are short-term strategies, expiring within a few weeks or months.

Butterfly Options Trading

Image: www.socratesperezmd.com

Conclusion

Butterfly options trading is a sophisticated and potentially lucrative strategy that offers a blend of high-profit potential and controlled risk. By understanding its components, deployment techniques, and expert tips, traders can leverage this strategy to enhance their trading results. Remember, the key to successful butterfly options trading lies in meticulous planning, proper execution, and constant monitoring.

Would you like to delve deeper into the world of options trading, including butterfly spreads? Let us know in the comments below, and we’ll be happy to provide further insights and resources.