In the world of options trading, butterflies flutter with the potential for significant profits. However, these strategies require a delicate touch and a deep understanding of market dynamics. If you’re an aspiring options trader or looking to expand your trading repertoire, this guide will provide you with a comprehensive overview of butterfly trading.

Image: insights.deribit.com

What is Butterfly Trading?

A butterfly spread is a neutral options strategy that involves buying one option at a middle strike price and selling two options at higher and lower strike prices. This strategy creates a profit zone where the underlying asset price remains within a specific range between the two outer strike prices.

Consider the following example:

- Buy one call option at a strike price of $100

- Sell two call options at a strike price of $105

- Sell two call options at a strike price of $95

If the underlying asset’s price closes between $100 and $105 at the expiration date, the trader will profit. However, if the price falls below $95 or rises above $105, the trader will lose money.

Advantages and Disadvantages of Butterfly Trading

Advantages:

- Limited risk compared to other options strategies

- Potential for higher returns than covered calls

- Profitable in ranging markets

Disadvantages:

- Requires a higher up-front investment

- Complex strategy that may be difficult to understand for beginners

- Lower probability of profit compared to other strategies

How to Implement a Butterfly Spread

- Determine the expected price range of the underlying asset: This is crucial for setting the strike prices of your options.

- Choose the number of contracts to buy and sell: The number of contracts will impact the potential profits and losses.

- Calculate the net premium: This is the difference between the premiums paid for the bought option and the premiums received for the sold options.

- Monitor the market closely: Butterfly spreads are time-sensitive, so it’s essential to monitor the underlying asset’s price throughout the life of the trade.

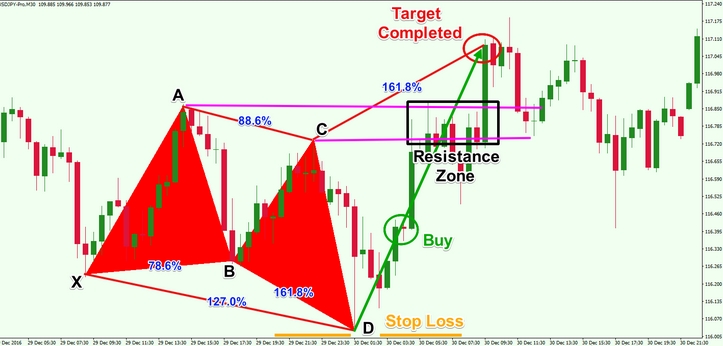

Image: forexpops.com

Expert Insights and Actionable Tips

- Consider the volatility of the underlying asset: Higher volatility increases the likelihood of the asset’s price moving outside the profit zone.

- Set realistic profit targets: Don’t expect to make a fortune overnight. Focus on small, consistent profits.

- Use a trading platform with advanced charting tools: This will help you analyze price movements and identify potential trading opportunities.

Trading Options Butterfly

Image: www.thetatrend.com

Conclusion

Butterfly trading can be a powerful tool for experienced options traders seeking higher returns with limited risk. However, it’s essential to approach this strategy with caution and a thorough understanding of the market. By following the guidance outlined in this article, you can increase your odds of success and potentially reap the rewards of this intricate trading strategy.