What is a Trailing Stop?

A trailing stop is a type of stop order that automatically moves with the price of a stock to secure profits or limit losses. It is designed to protect profits by automatically selling a stock when it falls below a certain percentage or amount from its current price.

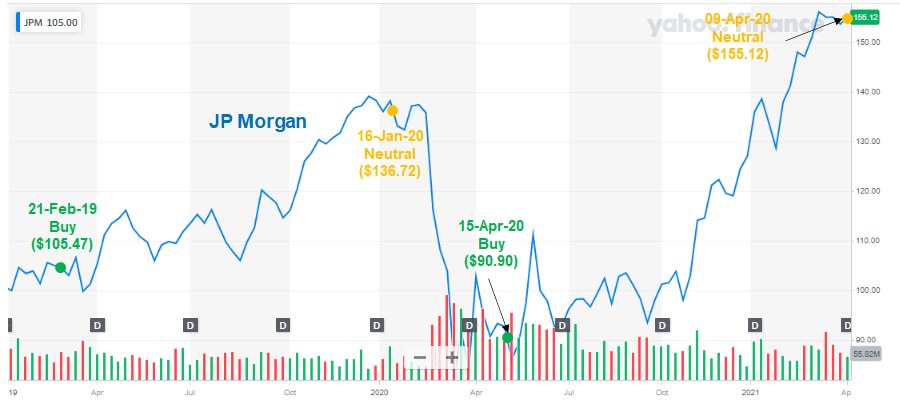

Image: seekingalpha.com

How Does a Trailing Stop Work?

When you place a trailing stop order, you specify a percentage or amount below the current market price. As the stock price rises, the stop price will follow, but it will not move up if the stock price falls. If the stock price falls below the trailing stop price, a sell order is triggered to protect your profits and prevent further losses.

Trailing Stops for Beginners

Benefits of Using Trailing Stops

- Protect profits: Trailing stops help you lock in profits by automatically selling a stock when it falls below a certain level.

- Limit losses: Trailing stops can also be used to minimize losses by automatically selling a stock if it falls too far below your purchase price.

- Reduce emotions: Trailing stops can help you avoid making emotional trading decisions by automatically executing trades based on predefined rules.

Image: www.quora.com

How to Set a Trailing Stop on Chase Investments

- Log in to your Chase Investments account.

- Go to the “Order” tab.

- Select “Stop Order” from the dropdown menu.

- Enter the symbol for the stock you want to trade.

- Select “Trailing Stop” from the “Type” dropdown menu.

- Specify the trailing stop percentage or amount.

- Choose the order quantity.

- Review the order details to ensure its accuracy.

- Click “Submit” to place your trailing stop order.

Expert Tips for Using Trailing Stops

Determine an Appropriate Trailing Stop Percentage

Setting too tight a trailing stop can trigger premature sales, while setting it too wide can lead to the loss of profits. Experiment with different trailing stop percentages based on the volatility of the stock and your risk tolerance.

Consider the Stock’s History

Analyze the stock’s historical price movements to determine a reasonable trailing stop range. Avoid setting trailing stops too close to recent support or resistance levels, as the stock may experience temporary pullbacks before continuing its trend.

Monitor the Market

Even with a trailing stop in place, it’s important to monitor the market to ensure the stock is moving as expected. If the market conditions change, consider adjusting your trailing stop accordingly to protect your profits.

FAQ on Trailing Stops

Q: What is the difference between a trailing stop and a stop-limit order?

A: A trailing stop automatically adjusts its stop price as the stock price moves, while a stop-limit order triggers a sell order only if the stock price falls below a specific price point.

Q: Can I use trailing stops on all types of stocks?

A: While trailing stops can be effective for various stocks, they may not be suitable for highly volatile stocks as they may trigger frequent trades.

Q: Are trailing stops guaranteed to protect my profits?

A: No, trailing stops are not foolproof. Market conditions can change rapidly, and a sudden price drop may exceed the trailing stop, resulting in losses.

Chase Investments Trading Options Trailing Stop

Image: media.chase.com

Conclusion

Trailing stops are a useful tool for protecting profits and limiting losses in stock trading. While not a guarantee against market risks, they can provide peace of mind and reduce emotional decision-making. By understanding the basics of trailing stops and implementing them effectively, you can enhance your trading strategy and improve your chances of long-term trading success.

Do you have any further questions or insights about the use of trailing stops in stock trading? Please share them in the comments below.