Are you curious about options trading but intimidated by its complexities? Fear not, my friend! This comprehensive guide will demystify the world of options and provide you with a simple explanation that will have you trading like a pro in no time.

Image: voxt.ru

What Are Options?

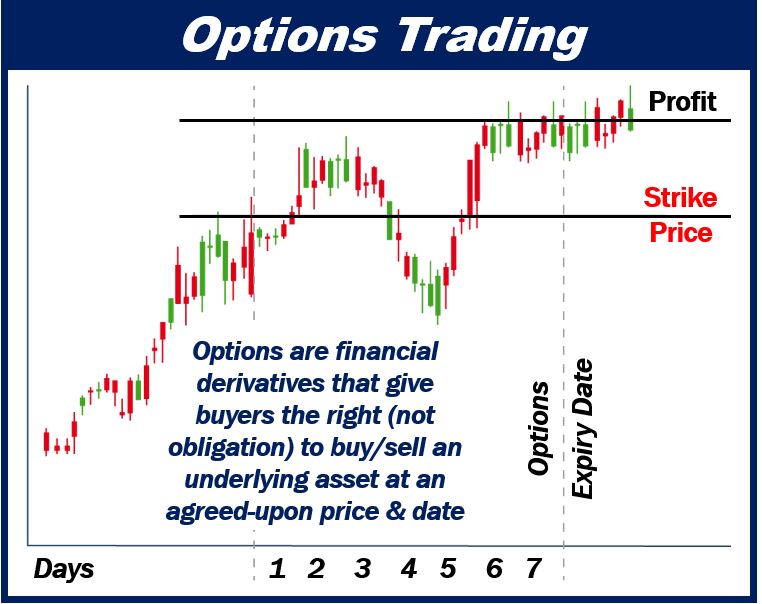

Imagine a world where you can control your destiny, where you can buy or sell something without actually owning it, all while maximizing your potential profits. That’s the world of options trading. An option gives you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specific date. It’s like having a superpower that allows you to predict the future and capitalize on market movements.

Types of Options

There are two main types of options: calls and puts. A call option gives you the right to buy the underlying asset, while a put option gives you the right to sell it. The price you’re willing to pay or receive is known as the strike price, and the date on which the option can be exercised is called the expiration date.

How Options Work

Let’s use a real-life example. Imagine you believe the stock of Apple (AAPL) will rise in value. You can buy a call option with a strike price of $150 and an expiration date of one month from now. If AAPL’s stock price climbs above $150 before the expiration date, you can exercise your right to buy the stock at $150, even if the market price has soared to $200. This gives you the potential to make a hefty profit.

On the other hand, if AAPL’s stock price drops, you can simply let your option expire worthless, losing only the premium you paid for it. The premium is a small price to pay for the potential rewards an option can offer.

Image: marketbusinessnews.com

Benefits of Options Trading

Options trading offers a wealth of advantages, including:

-

Flexibility: Options allow you to tailor your trades to your specific goals.

-

Leverage: With options, you can control a significant amount of the underlying asset with a relatively small investment.

-

Limited Risk: Unlike owning the underlying asset directly, options limit your risk to the premium you pay.

-

Profit Potential: Options provide the potential for unlimited profits if you make accurate market predictions.

Expert Insights

“Options trading is not a get-rich-quick scheme,” says renowned options trader Jake Bernstein. “It takes time, knowledge, and patience to succeed.”

Kathy Lien, CEO of Forex.com, advises beginners to “start with small positions and gradually increase your exposure as you gain experience.”

Tips for Beginners

-

Educate Yourself: Immerse yourself in books, articles, and videos about options trading to build a solid foundation.

-

Choose a Broker: Select a reputable broker that offers a user-friendly trading platform and educational resources.

-

Practice in a Demo Account: Before trading with real money, familiarize yourself with options trading through a paper trading account.

-

Manage Your Risk: Never put all your eggs in one basket and diversify your investments.

Options Trading Simple Explanation

Conclusion

Options trading can be a powerful tool for savvy investors who want to maximize their profits and manage their risk. By understanding the basics of this exciting market, you can unlock your trading potential and embark on a journey to financial freedom. Remember, knowledge is power, and with the right education and a disciplined approach, you too can become a master of options trading.