Have you ever wondered what secrets lie beneath the surface of the bustling financial markets? Within the intricate dance of stock prices and the whispers of market sentiment, options trading volume emerges as an often overlooked, yet powerful indicator. It’s not just about the number of contracts traded; it’s about understanding the story behind the numbers, deciphering the motivations of traders, and gleaning insights that can tip the scales in your favor.

Image: dotnettutorials.net

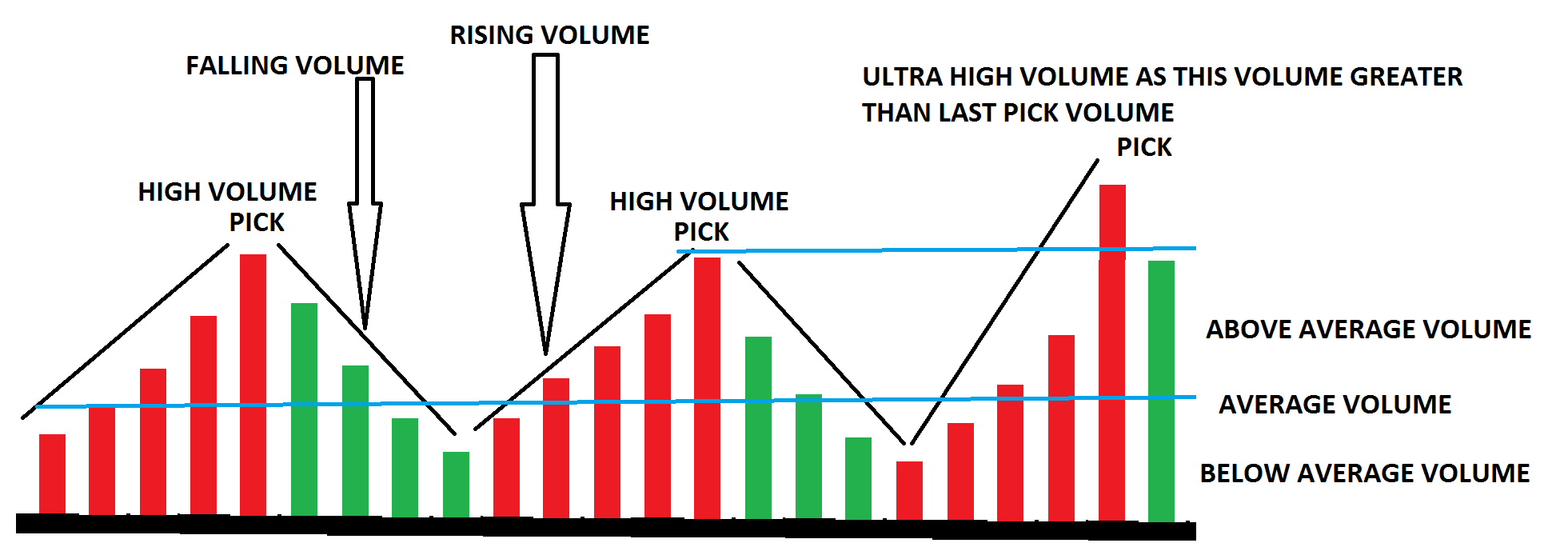

Options trading volume, simply put, is the measure of how many options contracts are bought and sold within a specific timeframe. It’s a metric that reflects the market’s sentiment, the level of volatility, and the expectations of future price movements. A surge in options volume can signal heightened interest in a particular underlying asset, hinting at potential shifts in market dynamics. But delving into the intricacies of options volume goes beyond a simple count; it requires deciphering the nuances, patterns, and implications behind the numbers.

The Language of Options Volume

Options trading volume speaks a unique language, one that requires careful interpretation to unlock its secrets. Here’s a breakdown of key aspects to consider:

1. Call vs. Put Volume

A crucial aspect is understanding the ratio of call options volume to put options volume. Call options give the holder the right to buy an underlying asset at a specific price, while put options grant the right to sell. A surge in call volume often suggests bullish sentiment, anticipating price increases, while a spike in put volume points towards bearish expectations, anticipating price declines.

Imagine a scenario where a company announces a groundbreaking new product. The anticipation of positive news potentially driving up the stock price could lead to a surge in call options volume, as speculators attempt to capitalize on the anticipated price rise. Conversely, if a company faces a regulatory investigation, the potential negative impact on its stock price might fuel an increase in put options volume, as traders seek to protect themselves against potential losses.

2. Implied Volatility

Options pricing is heavily influenced by implied volatility, which reflects the market’s perception of volatility in the underlying asset. High implied volatility suggests that investors believe significant price fluctuations are likely in the near future, driving up the price of options contracts. A surge in options volume often accompanies a jump in implied volatility, signifying that traders are actively trading on the anticipation of increased volatility.

Imagine a situation where a major geopolitical event throws the global markets into turmoil. The uncertainty surrounding the potential impact of the event could lead to a surge in both options volume and implied volatility as traders strive to hedge their positions against anticipated market swings.

Image: erokytumak.web.fc2.com

3. Open Interest

Open interest is the total number of outstanding options contracts at any given time. It reflects the overall level of activity and the appetite for options trading. A jump in open interest can signify growing interest in the underlying asset and potential for further price movements. But it’s important to remember that high open interest doesn’t necessarily imply a direction for the market. It simply indicates that traders are actively participating in the options market, holding positions that could exert significant influence on price dynamics.

Unlocking the Insights: Real-World Applications

Understanding options volume and its various facets offers a valuable toolset for investors and traders. Here are some real-world applications of this knowledge:

1. Identifying Potential Market Shifts

By monitoring changes in options volume, traders can often anticipate market shifts before they materialize in the broader market. A sudden spike in call volume for a particular stock might indicate a shift in investor sentiment towards bullishness. This information empowers traders to adjust their strategies, potentially capitalizing on the emerging trend or hedging against potential risks.

2. Gauging Market Sentiment

Options volume provides insights into the overall market sentiment. Periods of high volume often accompany periods of heightened volatility and uncertainty, signaling that traders are actively seeking to manage their risk and capital. This understanding can guide investment decisions and help traders navigate volatile market conditions with greater confidence.

3. Recognizing Unusual Activity

Deviations in options volume from historical patterns can signal unusual activity, potentially indicating a shift in market dynamics. An unexpected spike in put volume for a particular stock might suggest that large institutional investors are taking a bearish stance on the asset, potentially indicating a looming price decline. This information can be invaluable for traders, allowing them to make informed decisions based on the actions of other market participants.

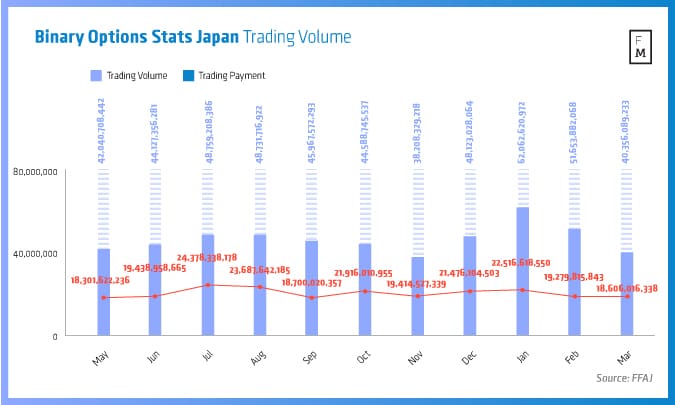

The Evolving Landscape

Options trading volume is not static; it constantly evolves in response to market dynamics, technological advancements, and the changing preferences of investors. Some of the most notable trends impacting the options market include:

1. Growth of Retail Trading

The rise of retail trading platforms and the democratization of access to investment tools have led to a significant surge in retail participation in the options market. This influx of new traders has brought a greater focus on options trading volume, as retail investors increasingly seek to leverage options strategies to manage risk and enhance returns.

2. Advancements in Options Trading Technology

Innovative trading platforms and sophisticated tools for options analytics are empowering investors with greater access to real-time market data and advanced analysis capabilities. This technological evolution has transformed the options market, fostering a more active and informed trading environment.

3. Increased Volatility

In recent years, global markets have experienced significant volatility, driven by factors such as geopolitical events, economic uncertainty, and technological disruptions. These heightened levels of volatility have fueled increased activity in the options market, as investors seek protection against potential price swings.

Navigating the Complexities

Understanding options trading volume is a valuable skill for any trader or investor looking to enhance their market insights. While it’s a powerful tool, it’s important to remember that it’s just one piece of the puzzle. Successfully using options volume requires:

1. Contextual Understanding

It’s crucial to analyze options volume within the broader context of the market. Consider factors such as market trends, economic fundamentals, and news events to interpret the signals from options volume.

2. Diversification

Don’t solely rely on options volume as the sole indicator for your trading decisions. Utilize other technical and fundamental analysis techniques to create a comprehensive understanding of the market.

3. Continuous Learning

The options market is constantly evolving. Stay informed about new trends, innovations, and developments in the market to refine your understanding of options volume and its implications.

Options Trading Volume

Conclusion

Options trading volume offers a fascinating window into the inner workings of the market. By deciphering the language of options volume, you can gain valuable insights into market sentiment, volatility, and the motivations of other traders. Embrace the power of options volume, but remember its limitations. Combine it with informed analysis, strategic thinking, and a commitment to continuous learning to enhance your trading journey.

The world of options trading is vast and intricate. This article has merely scratched the surface, revealing some of the hidden gems and mysteries contained within options trading volume. As you explore this fascinating realm, remember that the journey is just as important as the destination. So, embark on your own adventure, gather more knowledge, and discover the secrets that lie within the whispers of options volume.