I recently found myself in a heated debate with a seasoned options trader. He argued that understanding option Greeks was crucial for success in this complex financial market. Having always relied on more intuitive methods, I was skeptical. However, after delving into the depths of option Greeks, I realized the profound impact they can have on trading strategies.

Image: www.americanbookwarehouse.com

Options, versatile financial instruments that grant the buyer the right but not the obligation to buy (call) or sell (put) an underlying asset at a predetermined price (strike price) on a specific date (expiration date), involve intricate calculations. Option Greeks, mathematical measures that quantify various aspects of an option’s risk and potential return, are essential tools for navigating this dynamic market.

Understanding Option Greeks

Delta, the most fundamental Greek, measures the sensitivity of an option’s price to changes in the underlying asset’s price. A positive Delta indicates the option’s price will rise when the stock rises, while a negative Delta indicates the opposite.

Gamma captures the rate of change in Delta as the underlying asset’s price fluctuates. Positive Gamma indicates increasing Delta, making the option more sensitive to price changes. Negative Gamma, on the other hand, means Delta is decreasing.

Theta measures an option’s price decay as time passes. Theta is always negative, meaning the option’s value decreases as expiration approaches. This decay is particularly pronounced for short-term options.

Vega quantifies the impact of implied volatility on an option’s price. Increasing implied volatility typically raises option prices, while decreasing volatility has the opposite effect. Vega is highest near the at-the-money strike prices.

Rho measures an option’s price sensitivity to changes in the risk-free interest rate. Positive Rho indicates that the option’s price will increase when interest rates rise. Conversely, negative Rho indicates a price decrease with increasing interest rates.

Practical Tips and Expert Advice

To effectively utilize option Greeks in trading:

- Calculate and comprehend Greeks: Calculate the Greeks for every option you consider trading. Understand how these values influence price movements.

- Use Greeks to hedge risk: Exploit negative correlations between different Greeks to construct hedging strategies. For instance, options with positive Delta and negative Vega offset each other during stock price fluctuations and volatility changes.

- Manage risk capital: Monitor the Greek values of your portfolio to assess risk exposure. Adjust positions based on market conditions to maintain manageable risk levels.

Frequently Asked Questions on Option Greeks

-

Q: What is the significance of Delta in options trading?

A: Delta represents the sensitivity of an option’s price to changes in the underlying asset’s price. It is crucial for understanding how an option’s value will fluctuate with the underlying asset’s movements.

-

Q: How does Gamma affect an option’s sensitivity to price changes?

A: Gamma reflects the rate of change in Delta. Positive Gamma indicates that Delta is increasing rapidly, while negative Gamma indicates a decreasing Delta. This provides insights into how an option’s price will respond to more significant market movements.

-

Q: Explain the relationship between Theta and Vega.

A: Theta measures the loss of an option’s value over time. Vega measures the impact of implied volatility on an option’s price. High Theta indicates rapid value decay, while high Vega signals significant sensitivity to volatility fluctuations.

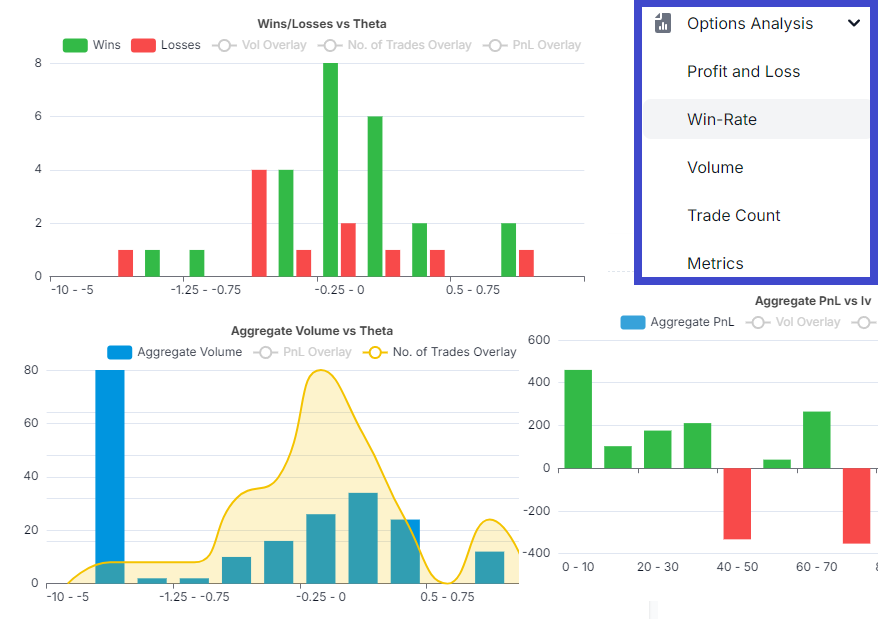

Image: www.tradesviz.com

Trading Option Greeks H

Image: www.americanbookwarehouse.com

Conclusion

Traders cannot afford to overlook the immense importance of option Greeks in the options market. These numerical measures provide invaluable insights into an option’s potential risk and reward. By understanding how Greeks interact and affect option prices, traders can bolster their trading strategies, hedge against adverse market conditions, and make more informed decisions that maximize profitability and minimize risk.

Are you intrigued by the concepts of option Greeks and their practical applications in the financial markets? Let us know if you’d like to explore this fascinating topic further.