Unraveling the Secrets of Implied Volatility: A Journey to Option Trading Mastery

In the realm of financial markets, options emerge as versatile instruments that empower traders to shape their financial destinies. At the heart of these enigmatic contracts lies a fundamental concept – implied volatility (IV). Understanding IV is akin to unlocking a treasure map, guiding traders through the complexities of option pricing to reap substantial rewards.

Image: forums.babypips.com

Decoding Implied Volatility: A Definition

Implied volatility, often abbreviated as IV, is a forward-looking metric that seeks to gauge the expected volatility of the underlying asset. It captures the market’s perception of the potential price swings that lie ahead. This crucial parameter forms the cornerstone of option pricing, as it directly influences the premiums that traders pay or receive.

The Significance of IV in Option Trading

IV serves as a guiding light for traders, illuminating the path to informed decision-making in option strategies. By comprehending IV, traders can:

-

Assess Market Sentiment: High IV signals that the market anticipates significant price fluctuations, while low IV suggests a period of relative stability.

-

Estimate Option Premiums: IV is a primary determinant of option prices. Higher IV translates to higher premiums, while lower IV yields lower premiums.

-

Manage Risk: Understanding IV helps traders evaluate the potential risks associated with options and devise appropriate risk management strategies.

A Deep Dive into the Nuances of Implied Volatility

Grasping the complexities of IV requires a deeper understanding of its foundational elements and real-world implications. Let’s embark on this journey, dissecting the concept through a series of interconnected perspectives:

1. Historical Volatility vs. Implied Volatility

Historical volatility (HV) measures the actual price fluctuations of an asset over a specific period. In contrast, IV represents the market’s forecast of future volatility. Traders often compare HV and IV to gauge the market’s sentiment and identify potential trading opportunities.

2. Calculating Implied Volatility

The Black-Scholes model is a widely-used method to calculate IV. This equation incorporates factors such as the underlying asset’s price, strike price, time to expiration, risk-free rate, and dividend yield.

3. Factors Influencing Implied Volatility

Numerous factors sway IV, including:

-

News and Events: Major market events, earnings reports, and economic data releases can significantly impact IV.

-

Time to Expiration: IV tends to be higher for options with shorter time to expiration, as uncertainty increases closer to the maturity date.

4. The Role of Fear and Greed

Fear and greed are powerful emotions that can drive IV. During periods of market uncertainty, fear increases IV as investors seek protection through options. Conversely, greed leads to lower IV when the market is optimistic.

5. Trading Strategies Using Implied Volatility

Armed with the knowledge of IV, traders can devise effective trading strategies:

-

Selling Options with High IV: When IV is high, traders can sell options to collect substantial premiums.

-

Buying Options with Low IV: When IV is low, traders can buy options at a discounted price, anticipating a future increase in volatility.

Expert Insights and Actionable Tips: Harnessing Implied Volatility

Harnessing the power of IV requires a blend of knowledge and practical application. Heed the advice of industry experts and adopt these actionable tips:

-

Use IV as a Market Indicator: Track IV trends to gauge market sentiment and identify potential trading opportunities.

-

Consider IV When Pricing Options: Adjust option strategies based on IV to optimize premiums and manage risk.

-

Monitor IV Changes: Stay vigilant of sudden changes in IV, as these may signal impending market shifts.

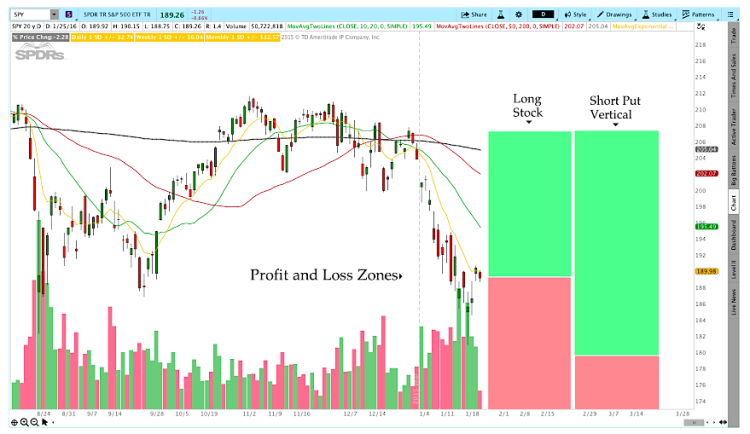

Image: www.seeitmarket.com

What Is Imp Vol In Option Trading

Conclusion: Unlocking the Potential of Implied Volatility

Embracing the intricacies of implied volatility empowers traders to navigate the option markets with confidence. By deciphering IV’s influence on option pricing and harnessing its predictive capabilities, traders can refine their strategies, enhance decision-making, and unlock the full potential of this versatile instrument. Remember, the journey to option trading mastery is an ongoing pursuit, where each step brings newfound knowledge and the opportunity for financial growth.