Navigating the intricate world of options trading can be daunting, but understanding vega is crucial for success. In this comprehensive guide, I’ll delve into the intricacies of vega, empowering you to make informed decisions and potentially maximize your returns.

Image: brilliant.org

Vega, a Greek letter measure, signifies the amount an option’s price changes for every 1% increase in implied volatility. It measures the sensitivity of an option’s price to changes in volatility. A higher vega indicates a greater sensitivity to volatility fluctuations, making it an essential consideration when strategizing your trades.

Implications of Vega in Options Trading

The interplay between vega and volatility is pivotal in options trading. When implied volatility rises, options with higher vega values tend to experience a substantial increase in their prices. Conversely, a decrease in implied volatility may lead to a significant drop in their prices. Understanding vega allows traders to capitalize on potential opportunities and manage risk effectively.

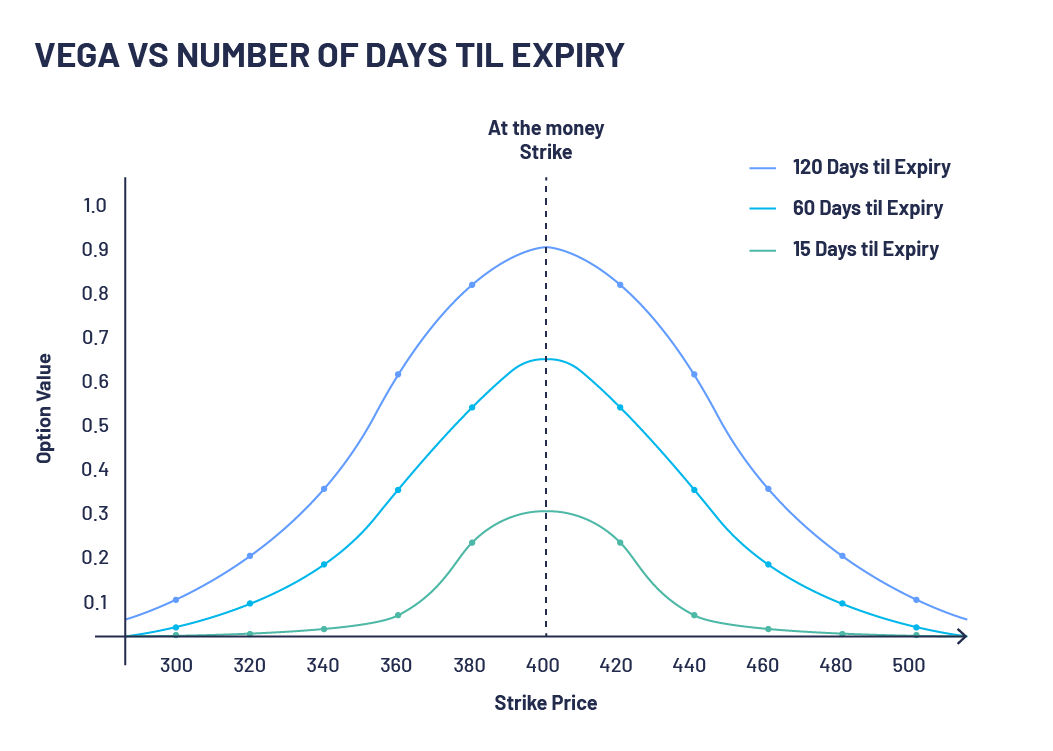

Options with long expirations generally carry higher vega values. This is because longer-term options are more exposed to potential volatility fluctuations. Traders seeking high-vega exposure can consider purchasing longer-term options to amplify their returns. Conversely, if volatility remains steady or declines, they may want to choose options with lower vega values to minimize losses.

Vega can also play a decisive role in hedging strategies. By incorporating options with different vega profiles, traders can tailor their hedging strategy to suit their risk appetite and investment goals. This enables them to potentially mitigate downside risks and enhance overall portfolio performance.

Latest Trends and Developments

The ever-evolving options market has witnessed notable advancements in recent times. Complex options products, such as variance swaps and volatility indices, have emerged as valuable tools for sophisticated traders seeking to manage volatility exposure. These instruments provide diversified investment opportunities and offer greater flexibility in adapting to changing market conditions.

Technological advancements have also revolutionized options trading. The advent of high-frequency trading algorithms and algorithmic option pricing models has enabled traders to execute complex trading strategies with greater precision and efficiency. These tools empower traders with timely market insights, allowing them to make informed decisions and potentially optimize their returns.

Tips and Expert Advice

1. **Assess Implied Volatility:** Evaluate implied volatility before purchasing options with high vega values. If implied volatility is already elevated, further increases may not yield substantial gains.

2. **Diversify Vega Exposure:** Incorporate options with different vega profiles into your portfolio to balance risk and maximize potential returns. This diversification strategy can help mitigate losses in case of adverse volatility shifts.

3. **Monitor Volatility Metrics:** Track key volatility indices, such as the VIX (Volatility Index), to gauge market sentiment and forecast future volatility levels.

Image: optionsdesk.com

Frequently Asked Questions

- Q: What is the significance of vega in options trading?

A: Vega measures the sensitivity of an option’s price to changes in implied volatility, providing insights into potential price fluctuations and hedging opportunities.

- Q: How can traders benefit from vega options trading?

A: Understanding vega can enable traders to capitalize on volatility fluctuations, optimize their hedging strategies, and potentially maximize their returns.

- Q: What factors can influence vega values?

A: Vega is primarily influenced by the option’s time to expiration, the strike price, and prevailing market volatility levels.

Vega Options Trading

Conclusion

Vega options trading is a powerful tool when wielded with knowledge and precision. By understanding vega’s implications, monitoring market volatility, and incorporating expert advice, you can unlock the potential for substantial gains. Remember, as the financial landscape continues to evolve, it is crucial to stay informed about the latest trends and advancements to navigate the complexities of the options market effectively.

Are you interested in learning more about vega options trading and exploring the endless possibilities it offers to enhance your trading strategies? Connect with us to delve deeper into this captivating topic and empower your investment decisions with informed insights.