Welcome to the realm of options trading, where risks and rewards dance hand in hand. As a seasoned trader, I’ve embarked upon countless adventures in the options market, and today, I’m here to share my insights on how you can navigate this dynamic landscape.

Image: brokerchooser.com

Before we delve into the intricacies of options trading, let’s rewind to my first foray into this captivating world. As a newbie, I was intrigued by the allure of potentially massive gains. However, without proper guidance, I soon realized that options trading is not a walk in the park. It demands a thorough understanding of the underlying mechanics and a disciplined approach.

**Understanding Options Trading: The Basics**

Options are financial contracts that provide the buyer or seller with the right, but not the obligation, to engage in a specific transaction involving an underlying asset, such as a stock or bond, at a predetermined price within a defined time frame.

Options are classified into two main types: calls and puts. Call options give the buyer the right to buy, while put options confer the right to sell. The strike price refers to the specified price at which the buyer can exercise their right. The expiration date determines the duration of the contract, after which the option becomes worthless.

**Diving Deeper into Options Trading: Placing Orders and Managing Risk**

To place an options order, you must specify the type of option (call or put), the underlying asset, the strike price, the expiration date, and the number of contracts. Each contract represents 100 shares of the underlying asset.

Risk management is paramount in options trading. Leverage, the use of borrowed capital to increase your buying power, can amplify both profits and losses. It’s essential to assess your risk tolerance and trade within your limits. Careful stop-loss orders can help mitigate potential losses.

**Options Trading: Latest Trends and Innovations**

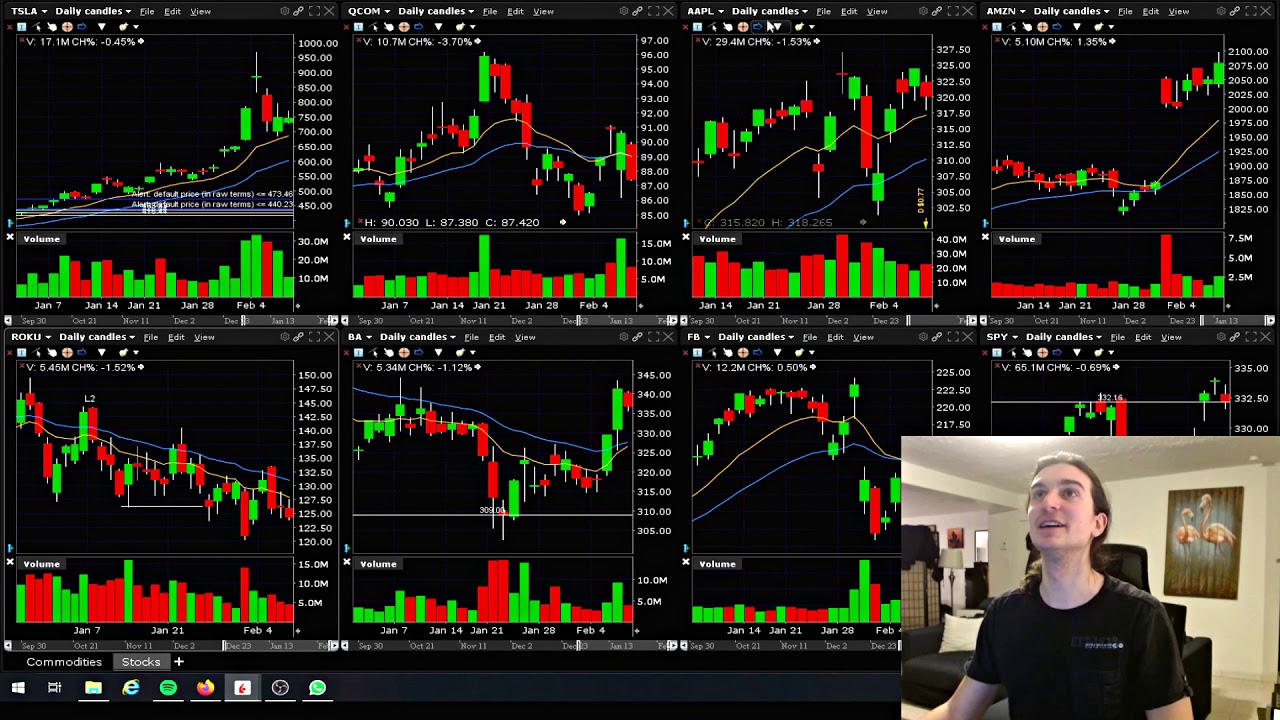

The options market is constantly evolving, with new developments and technologies emerging. Volatility indices, such as the CBOE Volatility Index (VIX), gauge market sentiment and play a key role in pricing options. Advanced trading platforms offer tools that enhance order execution and risk management.

Image: www.youtube.com

**Tips and Expert Advice for Successful Options Trading**

Success in options trading requires a combination of skill and experience. Here are some tips from seasoned traders:

- Start small and gradually increase trade size as you gain confidence.

- Thoroughly research the underlying asset and market conditions.

- Understand the Greeks (measures of risk and sensitivity) associated with options.

- Embrace volatility as an opportunity rather than an obstacle.

- Emotional discipline is paramount to avoid irrational decision-making.

**FAQ on Options Trading**

Q: Why is options trading considered risky?

A: Options trading involves leverage, which increases both potential profits and losses. It’s crucial to trade within your limits and manage risk effectively.

Q: Can options trading be profitable?

A: Yes, options trading can be profitable if done correctly. However, it requires a deep understanding of the market and a sound trading strategy.

Ibkr Options Trading Tutorial

Image: www.youtube.com

**Conclusion: Embrace the Limitless Possibilities**

Whether you’re a seasoned trader or just starting your journey, options trading presents endless opportunities for growth and financial success. By embracing the principles outlined in this tutorial, you can navigate the complexities of the market with confidence. Are you ready to unlock the boundless potential of options trading?