Imagine harnessing the potential of financial markets to generate a consistent weekly income. Enter the captivating world of options trading, an arena where savvy investors navigate the delicate dance of risk and reward to reap financial gains. Join us as we delve into the intricacies of this lucrative strategy, empowering you to transform market volatility into a steady stream of income.

Image: www.learningonlinecourse.com

Unveiling the Essence of Options Trading

Options, the versatile derivatives of the financial realm, grant traders a unique opportunity to speculate on future price movements of underlying assets without the obligation to buy or sell. These contracts confer the quyền to buy (call option) or sell (put option) the underlying asset at a predefined price (strike price) on or before a specified date (expiration date). By strategically combining options with different strike prices and expiration dates, traders can craft tailored strategies to capitalize on market trends.

Weekly Income Strategies: A Blueprint for Success

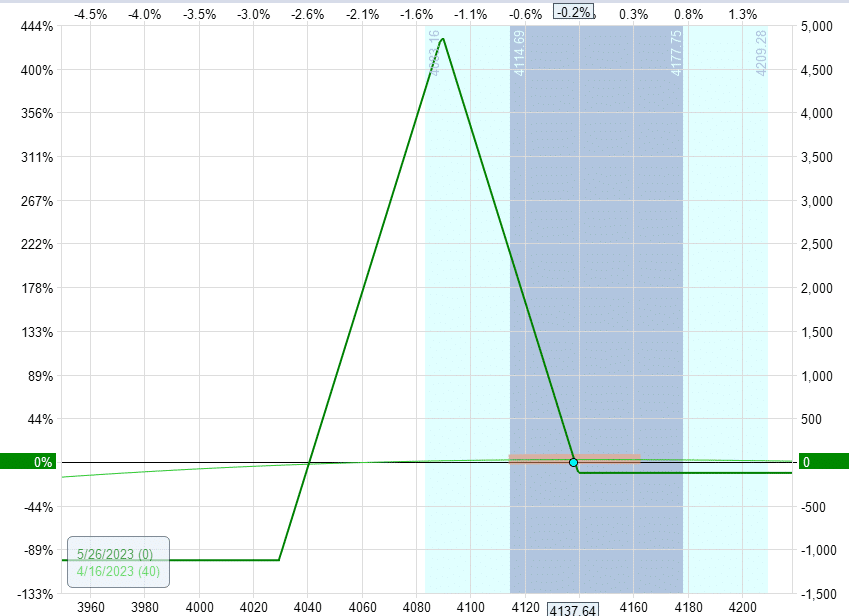

The beauty of options trading lies in its adaptability, allowing traders to mold strategies to fit their risk tolerance and market outlook. Weekly income strategies harness the power of options to generate a regular stream of income, exploiting short-term price movements. One popular strategy involves buying a deep in-the-money call option with an expiration date within a week. This strategy thrives on modest price increases in the underlying asset, offering a limited profit potential but a high probability of success.

Alternatively, traders can opt for selling out-of-the-money put options, seeking to profit from a sideways or slightly down-moving market. This strategy benefits from selling options at a higher premium compared to buying, increasing the potential for profit. However, it carries a higher risk as the market may move against the trader’s position.

Mastering the Art of Option Selection

Navigating the options market demands a discerning eye capable of identifying suitable contracts for weekly income strategies. Several key factors guide this selection process, including:

- Underlying Asset: Choose assets with high liquidity and volatility, as they offer a wider range of options and greater trading opportunities.

- Strike Price: Carefully determine the strike price based on the expected price movement of the underlying asset.

- Expiration Date: Weekly income strategies typically utilize options with short expiration dates, usually within a week, to maximize the frequency of income generation.

Image: optionstradingiq.com

The Power of Diversification: Mitigating Market Swings

As in any investment endeavor, diversification remains a vital tool for managing risk in options trading. By spreading investments across multiple options contracts with varying underlying assets, strike prices, and expiration dates, traders can reduce the impact of any single trade on their overall portfolio. This strategy enhances the likelihood of consistent income generation while safeguarding against market downturns.

Trading Options For Weekly Income

Embark on Your Weekly Income Journey

The allure of trading options for weekly income lies in its potential to transform market fluctuations into a steady stream of financial gains. However, it’s crucial to approach this endeavor with a well-defined strategy, thorough research, and unwavering discipline. By embracing the guiding principles outlined above, you can embark on a profitable journey in the dynamic world of options trading. Remember, knowledge is power, and continuous learning is the key to unlocking the full potential of this lucrative strategy.