Prepare to delve into the fascinating world of weekly options trading, where time literally is money! These short-lived yet potent financial instruments offer a unique opportunity for savvy traders to magnify gains and hedge risks within shorter timeframes. In this comprehensive guide, we will peel back the layers of this dynamic trading strategy, empowering you with the essential knowledge to navigate its thrilling complexities. So, brace yourself and fasten your seatbelts as we embark on this enthralling journey through the intricacies of weekly options.

Image: www.xtremetrading.net

1. Unveiling the Essence of Weekly Options

Imagine options as financial contracts that grant you the “right” but not the obligation to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) before a specified expiry date. Unlike their longer-term counterparts, weekly options condense their lifespan into just five trading days, from Monday to Friday. This rapid-fire trading style can amplify both rewards and risks, making it a preferred choice for traders seeking nimble strategies.

2. Delineating Option Prices: An Equation of Greek Premiums

The price of an option, often referred to as its premium, is meticulously crafted by a delicate balancing of various factors, each represented by its own Greek premium. Delta measures the responsiveness of the option price to shifts in the underlying asset’s value, while theta captures the relentless decay of time value as expiry draws near. Vega quantifies the impact of volatility on the option premium, and rho gauges the influence of interest rate fluctuations. Understanding these Greeks will equip you to skillfully navigate the option pricing landscape.

3. Striking the Optimal Expiry: A Delicate Balance

Selecting an appropriate expiry date for your weekly options is a balancing act. Opt for an expiry too far into the future, and you risk the uncertainty of distant market fluctuations diminishing your potential gains. Conversely, picking an expiry too close might limit your ability to capture significant price movements. The sweet spot lies in harmonizing your trading strategy with the underlying asset’s volatility and your risk tolerance.

Image: www.binoption.net

4. Managing Risks: A Prudent Ladder to Success

In the exhilarating realm of options trading, risk management is your unwavering companion. Employing a sound risk management strategy is not a mere precaution but a proactive investment in your trading endeavors. Prudently limiting your trades, diversifying your portfolio across multiple options, and exercising discipline in position sizing will empower you to mitigate potential losses and enhance your overall trading performance.

5. Profiting from Volatility: Embracing the Dynamics of Risk

Volatility, the ever-erratic heartbeat of the market, can be both a formidable foe and a lucrative ally for options traders. When volatility spikes, so does the potential for substantial gains. However, embracing these risks requires a clear understanding of how volatility can amplify both profits and losses. Mastering the art of managing volatility will give you an edge in this dynamic trading arena.

6. Decoding Option Strategies: The Art of Combinations

The world of options trading is not limited to simple call or put orders. Enter the realm of combination strategies, where multiple options are meticulously intertwined to create complex trading tactics. Spreads, straddles, strangles, and butterflies are but a glimpse into the vast array of strategies that astute traders wield to enhance their returns. Unraveling the nuances of these strategies will elevate your trading acumen to unprecedented heights.

7. Disciplined Trading: A Path to Triumph

Successful options trading is not a sprint but a marathon, and discipline is your unwavering compass along this arduous journey. Resist the allure of impulsive trades, meticulously plan your trading strategy, and adhere to strict risk management protocols. Emotional trading is the quicksand that can engulf even the most promising traders, so maintaining a level head will be your guiding light to consistent success.

8. Continuous Education: A Lifelong Pursuit of Knowledge

In the ever-evolving landscape of financial markets, knowledge is not a stagnant pool but a perpetually flowing river. Embrace the role of an eternal student, dedicating yourself to continuous learning. Explore online resources, attend seminars, engage with experienced traders, and delve into the vast repository of books and articles. Each nugget of knowledge you acquire will refine your trading skills, empowering you to adapt and thrive amidst market uncertainties.

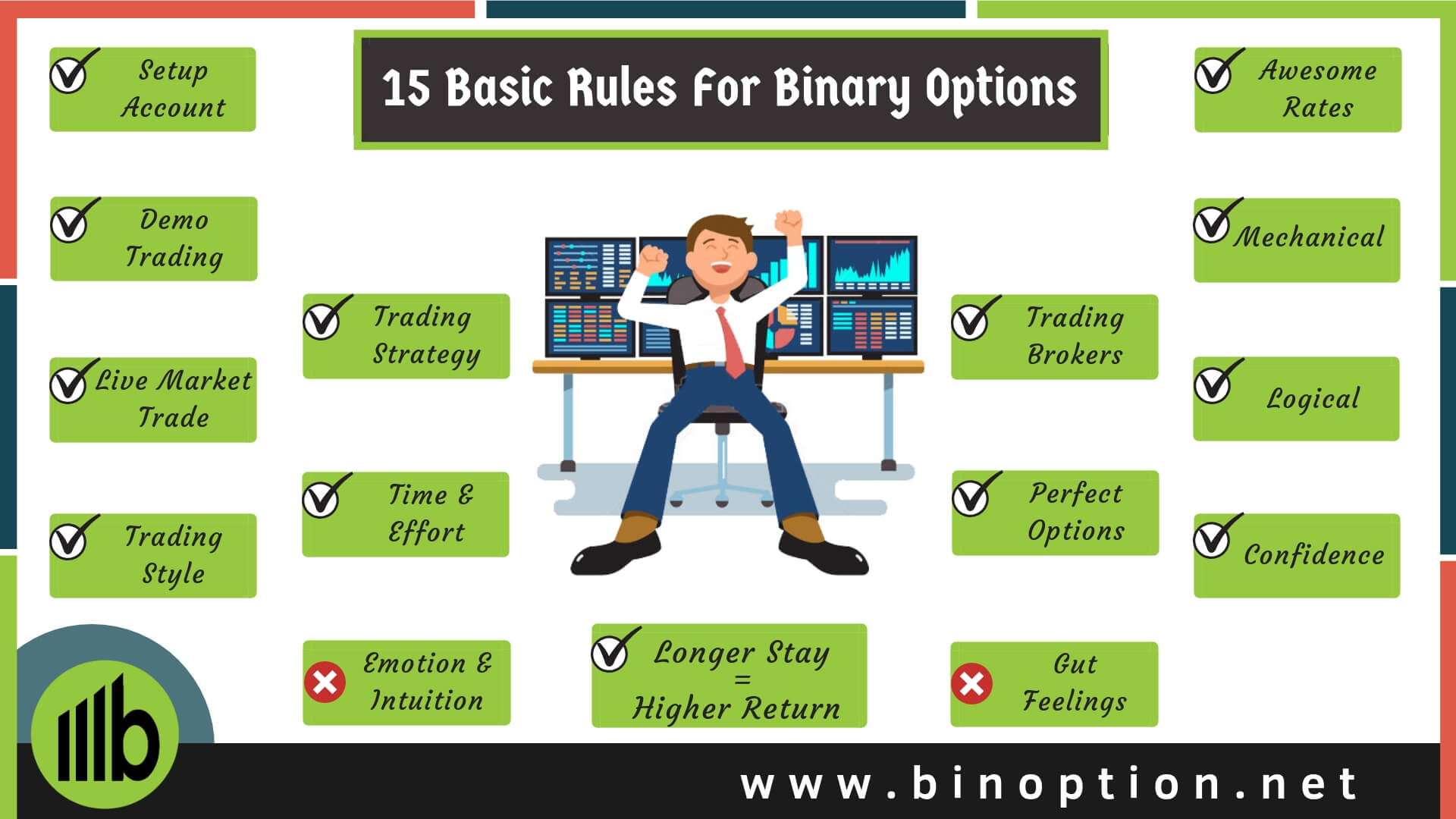

Basic Rules Of Trading Weekly Options

Conclusion: A Path to Empowerment and Financial Freedom

Engaging in the exhilarating realm of weekly options trading can be a path to financial empowerment and the realization of your financial goals. By mastering the fundamental principles outlined in this comprehensive guide, you will gain the confidence to navigate this dynamic market, uncovering opportunities to multiply your trading potential. However, remember that responsible trading practices, continuous learning, a disciplined approach, and a prudent understanding of risks are the cornerstones of long-term success. With this newfound knowledge, you are well-equipped to embark on your options trading journey with greater clarity and an unwavering commitment to excellence. May your trading endeavors yield abundant rewards, both financial and personal.