In the bustling realm of financial markets, where time is of the essence, option traders in India find themselves operating within a carefully orchestrated schedule. Understanding the intricacies of these trading hours is crucial for maximizing opportunities and mitigating risks. This comprehensive guide will delve into the dynamics of option trading times in India, empowering traders with the knowledge they need to navigate the markets strategically.

Image: listwithsage.com

Historical Context and Role of the Exchanges

The Indian option market has its roots in the early 1990s when the National Stock Exchange (NSE) introduced index options. Since then, the market has witnessed consistent growth, with the establishment of additional exchanges like the Bombay Stock Exchange (BSE). These exchanges play a central role in determining and enforcing the trading hours for options.

The NSE and BSE have standardized the trading hours for equity options, ensuring a fair and orderly marketplace. These hours are aligned with the regular equity trading sessions, providing seamless integration for traders.

Current Option Trading Times in India

The trading hours for equity options in India are as follows:

Weekdays (Monday to Friday):

Pre-open session: 9:00 AM – 9:15 AM

Regular trading session: 9:15 AM – 3:30 PM

During the pre-open session, traders can place orders and modify existing orders. Execution of trades occurs at 9:15 AM, marking the start of the regular trading session. The regular trading session allows traders to enter, exit, and adjust their option positions throughout the day.

Exceptions and Considerations

It’s important to note certain exceptions to the standard trading hours:

Trading Holiday: NSE and BSE observe market holidays on weekends and notified public holidays, during which option trading is suspended.

Extended Trading Hours: On select days throughout the year, exchanges may extend trading hours to accommodate special events or high-impact economic data releases.

Varied Trading Hours for Different Expiry Series: Option contracts with different expiration dates may have slightly varied trading hours. Traders should always consult the exchange website for the specific trading hours of their intended contracts.

Furthermore, traders should be mindful of the settlement process associated with option trades. Typically, the settlement of option contracts occurs on the next business day after the contract expires. This process involves the delivery or receipt of the underlying asset (for in-the-money options) or the cash settlement based on the strike price.

Image: www.cashoverflow.in

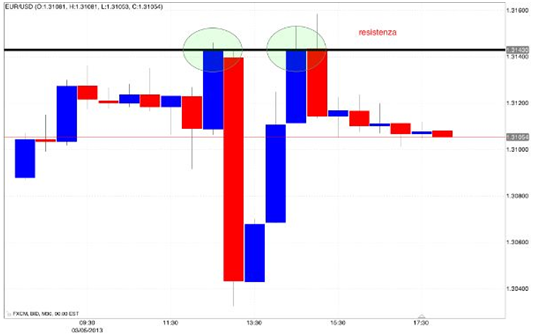

Influence of Market Conditions and Volatility

It’s worth noting that market conditions and volatility can impact the trading dynamics of options. In periods of high volatility, trading activity and liquidity may increase, leading to narrower bid-ask spreads and more frequent price fluctuations. Conversely, during periods of low volatility, trading may be more subdued with wider bid-ask spreads.

Traders should adjust their trading strategies and risk management measures accordingly, taking into account the prevailing market conditions and their impact on option pricing and liquidity.

Option Trading Time India

Additional Resources and Conclusion

To enhance their understanding and stay up-to-date with the latest developments in the Indian option market, traders are encouraged to access the following resources:

- National Stock Exchange (NSE): https://www.nseindia.com/option-market

- Bombay Stock Exchange (BSE): https://www.bseindia.com/derivatives/options

- Securities and Exchange Board of India (SEBI): https://www.sebi.gov.in/

Mastering the intricacies of option trading times in India is essential for successful navigation of this vibrant market. Traders who effectively leverage their knowledge of these timings can optimize their trading strategies, manage risks prudently, and capitalize on the opportunities presented by the financial markets.