In the realm of financial markets, where the tides of volatility surge and investment strategies ebb and flow, trading options has emerged as a lucrative avenue for generating steady income. Like a skilled navigator, options traders chart their course through complex market waters, seeking to capitalize on the inherent potential of this versatile financial instrument.

Image: unbrick.id

At its core, options trading empowers investors to leverage the inherent volatility of underlying assets, such as stocks, currencies, or commodities. Through carefully calculated bets on the price movements of these assets, options traders create a potential stream of income, transcending the traditional boundaries of passive investment strategies.

**Embracing Options Trading: A Comprehensive Understanding**

To fully comprehend the essence of options trading, unraveling its historical roots and grasping the fundamental principles is paramount. Options trace their lineage back to the 17th century, where they emerged as a means to facilitate structured risk management and speculation in the burgeoning markets of Amsterdam. Over time, options trading evolved, embracing advanced mathematical models and sophisticated trading strategies, transforming into the multifaceted tool it is today.

At its core, an option contract represents the right, not the obligation, to either buy (in the case of a call option) or sell (in the case of a put option) an underlying asset at a predetermined price (strike price) before a specified date (expiration date). This flexibility imbues options trading with a unique advantage, allowing traders to tailor their risk-to-reward ratio to match their specific investment objectives.

**Options Trading Strategies: Charting a Course for Income**

The world of options trading is a vast expanse of strategies, each designed to navigate the mercurial market landscape and yield potential income. Among the most popular approaches are:

- Covered Calls: A strategy wherein an investor sells (writes) call options against an underlying asset they already own. By receiving a premium for selling the option, the trader generates immediate income while retaining the potential for further gains in the underlying asset.

- Cash-Secured Puts: Similar to covered calls, this strategy involves selling (writing) put options against cash reserves. By doing so, the trader earns a premium and simultaneously commits to buying the underlying asset at the strike price if the option is exercised.

- Vertical Spreads: A more advanced strategy that involves combining multiple options contracts with different strike prices and expiration dates. Vertical spreads offer a more nuanced approach to managing risk and capturing market movements while potentially generating income.

**Mastering the Extricacies of Options Trading**

Venturing into the realm of options trading requires a blend of knowledge, strategic thinking, and a disciplined approach. To enhance your chances of success, consider the following tips:

- Thorough Research: Conduct extensive research on the underlying assets, market conditions, and historical option pricing data. Knowledge is power in this arena.

- Risk Management: Understand the inherent risks associated with options trading and implement sound risk management strategies to mitigate potential losses.

- Practice Discipline: Avoid emotional trading and adhere to predetermined strategies. Discipline is the bedrock of successful options trading.

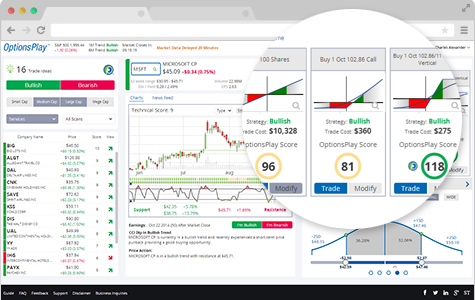

Image: www.optionsplay.com

**FAQs: Demystifying Options Trading**

To alleviate any lingering uncertainties, here are some frequently asked questions about options trading:

What is the minimum capital required for options trading?

The minimum capital required varies depending on the brokerage and trading strategy employed. It’s advisable to start with a manageable amount and scale up gradually as you gain experience

Is options trading a get-rich-quick scheme?

Options trading is not a quick path to riches but rather a skill that requires dedication and perseverance. Building a consistent income stream takes time and effort

Can beginners engage in options trading?

While options trading can be complex, beginners can start with basic strategies and gradually progress to more advanced ones. Education and practice are key

What Is Trading Options For Income

Image: avxgfx.com

**Conclusion: Empowering Financial Independence**

Trading options for income presents a compelling opportunity to establish a passive income stream, unlocking financial freedom and personal empowerment. By embracing the principles of options trading, mastering effective strategies, and adhering to sound risk management practices, individuals can navigate market fluctuations and position themselves for financial prosperity.

Are you ready to embark on the journey of options trading and unlock your financial potential? Join the ranks of savvy investors who have harnessed the power of this versatile financial instrument to create a sustainable flow of income.