As a seasoned investor, I’m always seeking ways to enhance my portfolio’s growth potential. One avenue that has piqued my interest is options trading. With its ability to amplify gains while managing risk, I found myself drawn to the world of options.

Image: trading-market.org

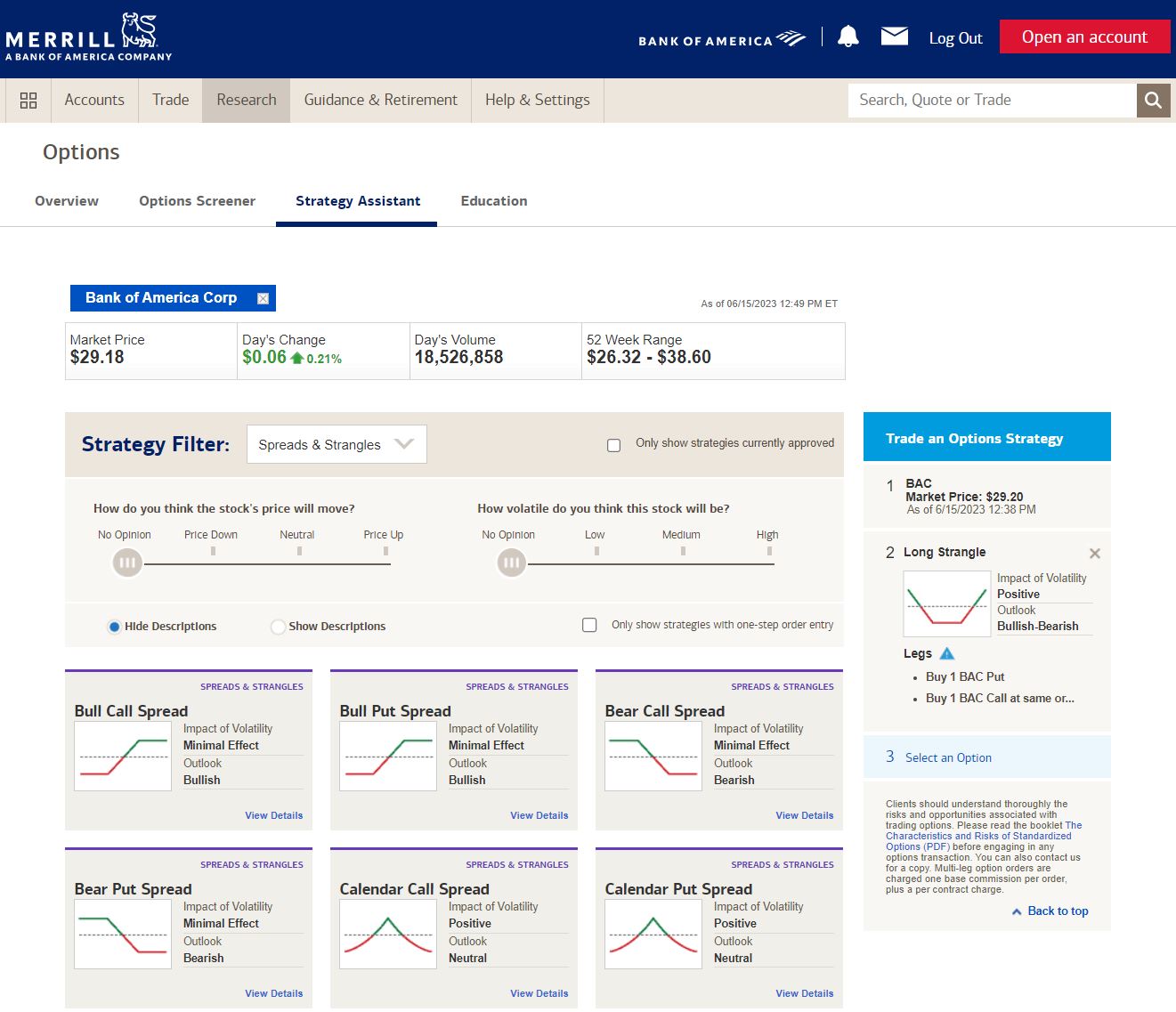

Empowering Options Traders with Merrill Edge

After extensive research, Merrill Edge emerged as a compelling platform for my options trading endeavors. Its user-friendly interface, robust trading tools, and tailored educational resources provide a comprehensive solution for investors of all experience levels.

A Comprehensive Overview of Options

In the realm of finance, options serve as contracts that grant the buyer the right—but not the obligation—to buy (call options) or sell (put options) an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date).

Options trading offers a spectrum of strategies, from conservative hedging to aggressive speculation. Whether you aim to protect your investments, generate income, or leverage market trends, options provide a versatile tool to tailor your investment approach.

Navigating the Nuances of Options Trading

To achieve success in options trading, a firm understanding of its intricacies is paramount. Volatility, time decay, and liquidity play crucial roles in determining the value and behavior of options. Additionally, selecting the appropriate options strategy for your investment goals and risk tolerance is essential.

Merrill Edge offers a plethora of educational resources, including webinars, videos, and articles, to guide you through the fundamentals of options trading and equip you with the knowledge to make informed decisions.

Image: www.ira-reviews.com

Capturing the Latest Market Developments

Staying abreast of current market trends and developments is essential for successful options trading. By closely monitoring news updates, monitoring forums, and engaging with social media platforms, you can derive valuable insights into market sentiment and potential trading opportunities.

This continuous learning journey empowers you to adapt to changing market conditions and refine your trading strategies accordingly.

Tips for Enhancing Your Trading Skills

Based on my experience as a blogger and avid options trader, I’ve compiled a few valuable tips to elevate your trading skills:

- Define your investment goals and risk tolerance: Before venturing into options trading, establish clear objectives and assess your risk appetite.

- Thoroughly research and understand the underlying asset: Gain in-depth knowledge of the company, industry, and economic factors that affect the asset’s price movements.

- Choose your options strategy wisely: Carefully evaluate the available strategies and select the one that aligns with your investment goals and risk tolerance.

- Monitor your trades regularly: Keep a close eye on your open positions and make adjustments as market conditions evolve.

- Limit your exposure: Diversify your portfolio and avoid excessive risk exposure by trading options in small sizes.

Frequently Asked Questions about Options Trading

- Q: What is the difference between a call and a put option?

A: A call option grants the buyer the right to buy an underlying asset, while a put option gives the buyer the right to sell an underlying asset. - Q: How does volatility affect options prices?

A: Increased volatility leads to higher options prices, as it implies greater uncertainty and potential for larger price fluctuations. - Q: What is time decay?

A: As an option approaches its expiration date, its value gradually decreases, a phenomenon known as time decay. - Q: How do I calculate the profit or loss on an options trade?

A: Subtract the premium paid from the difference between the strike price and the market price of the underlying asset (for call options) or the market price of the underlying asset and the strike price (for put options), taking into account any closing fees.

Merrill Edge Trading Options

Image: brokerchooser.com

Conclusion: Embark on Your Options Trading Journey

Options trading presents a dynamic and potentially lucrative avenue for investors seeking to enhance their portfolio’s growth potential. By partnering with a reputable platform like Merrill Edge, equipping yourself with knowledge, and implementing sound trading strategies, you can navigate the world of options with confidence.

Are you ready to embark on your options trading journey and explore the opportunities that this versatile financial instrument holds?