In the realm of finance, options trading stands as a complex yet lucrative domain, beckoning investors seeking greater rewards. Merrill Edge, a prominent investment firm, has carved a niche in this arena, offering an array of services tailored to option traders. But how does Merrill Edge stack up against its peers? Our in-depth review explores the intricacies of Merrill Edge’s option trading platform, examining its features, fees, and overall suitability for investors.

Image: themodestwallet.com

Navigating the Merrill Edge Options Platform: A Comprehensive Guide

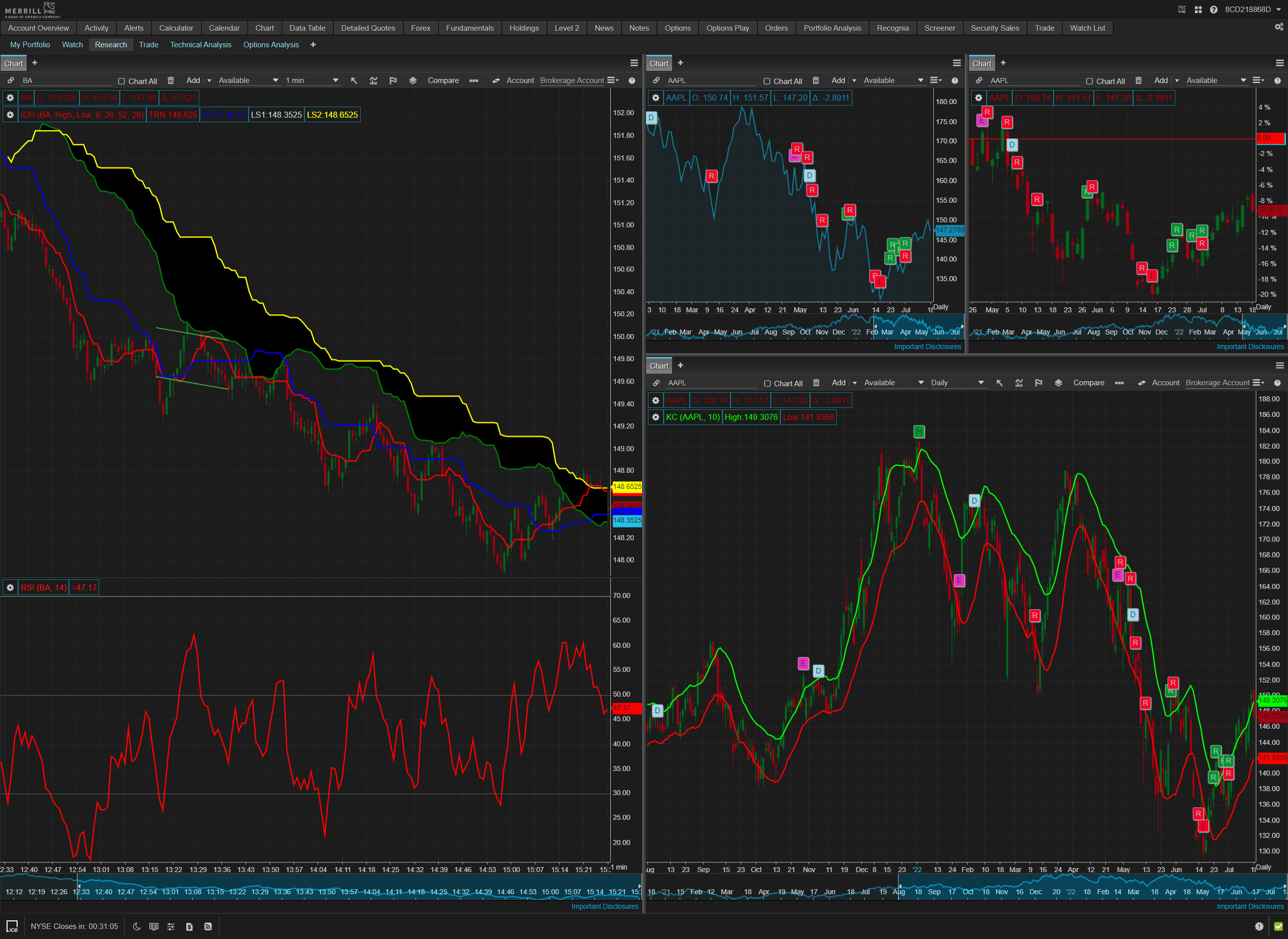

Merrill Edge’s option trading platform, adorned with an intuitive interface, empowers traders with an array of tools and resources. Its user-friendly design allows for seamless navigation, enabling even novice traders to confidently execute trades. The platform boasts a customizable workspace, allowing traders to tailor the interface to their preferred trading style.

At the heart of Merrill Edge’s platform lies the Option Chain, a comprehensive tool that provides real-time data on option contracts. Traders can swiftly evaluate bid-ask spreads, implied volatility, and other crucial metrics, ensuring informed decision-making. The platform’s robust charting capabilities further enhance analysis, empowering traders to identify trends and potential trading opportunities.

Unveiling Merrill Edge’s Pricing Structure: Striking the Right Balance

Merrill Edge’s fee schedule for option trades adheres to a tiered structure, varying based on the volume of trades executed. While per-contract fees may appear higher than those of some discount brokerages, Merrill Edge offers a key advantage: trade commissions decrease as trading volume increases. Active traders can thus benefit from reduced per-contract costs, making Merrill Edge a compelling choice for those seeking to maximize their trading returns.

In addition to the tiered commission structure, Merrill Edge imposes an exercise and assignment fee of $0.65 per contract. This fee, comparable to industry standards, is incurred when an option contract is exercised or assigned.

Educational Arsenal: Empowering Option Traders of All Levels

Merrill Edge recognizes the paramount importance of financial literacy, especially within the complex realm of options trading. To that end, the firm offers an expansive suite of educational resources, catering to the needs of both novice and seasoned traders.

Webinars, videos, and articles, meticulously crafted by financial experts, provide foundational knowledge on options trading concepts and strategies. Merrill Edge also hosts live workshops and seminars, enabling traders to interact with seasoned professionals in real-time, gaining invaluable insights and practical guidance.

Image: www.merrilledge.com

Beyond the Platform: Unveiling Merrill Edge’s Holistic Approach

Merrill Edge’s commitment to its clients extends beyond the boundaries of its platform. Dedicated support professionals, accessible via phone and secure messaging, stand ready to assist traders with any inquiries or issues. The firm’s personalized approach fosters a sense of partnership, ensuring that traders feel supported throughout their trading journey.

Furthermore, Merrill Edge integrates seamlessly with Bank of America, enabling clients to manage their trading accounts alongside their broader financial portfolio. This interconnected ecosystem offers a holistic approach to wealth management, providing a unified view of one’s financial standing.

Merrill Edge Option Trading Review

Image: www.stockbrokers.com

Conclusion: Embracing Merrill Edge for Options Trading Success

Merrill Edge’s option trading platform stands as a powerful tool that caters to traders of all levels. Its user-friendly interface, coupled with comprehensive tools and educational resources, empowers traders to navigate the complexities of options trading with confidence. While the tiered fee structure may deter some, the potential for reduced costs as trading volume increases makes it an attractive option for active traders.

Backed by the personalized support of dedicated professionals and the convenience of seamless integration with Bank of America, Merrill Edge provides a holistic solution for investors seeking to unlock the potential of options trading. Whether you’re a seasoned pro or just starting your options trading journey, Merrill Edge offers a compelling platform that can elevate your trading endeavors to new heights.