In the ever-evolving world of finance, options trading has emerged as a powerful tool for investors seeking both profit and portfolio diversification. At its core, options trading involves the interplay of mathematical principles and market dynamics, offering traders the ability to speculate on future price movements without owning the underlying asset.

Image: tradepsychology.com

Math options trading, a specialized field within options trading, delves into the quantitative aspects of this complex financial instrument. By understanding the mathematical foundations of options pricing and trading strategies, investors can make informed decisions and enhance their potential for success.

Exploring the Fundamentals of Math Options Trading

The Black-Scholes model, developed by Fischer Black and Myron Scholes in 1973, serves as the cornerstone of modern math options trading. This groundbreaking model quantifies the relationship between option price, underlying asset price, time to expiration, volatility, and risk-free interest rate.

To illustrate, consider a call option, which grants the buyer the right but not the obligation to purchase an asset at a predetermined strike price on or before the expiration date. The Black-Scholes model calculates the fair value of this call option based on the likelihood of the underlying asset price rising above the strike price by expiration.

In practice, math options trading involves a multitude of strategies, each tailored to specific market conditions and risk tolerance. Covered calls, naked calls, bull spreads, and bear put spreads are just a few examples of these strategies. By leveraging mathematical equations and probability distributions, traders can assess the potential profit and loss of each strategy before execution.

Expert Insights and Actionable Tips

Renowned options trader Nassim Taleb emphasizes the importance of managing risk in the face of uncertainty. He advocates for robust trading strategies that withstand market volatility and potential black swan events. His work inspires traders to adopt a disciplined approach, understanding the limitations of quantitative models and the crucial role of intuition and experience.

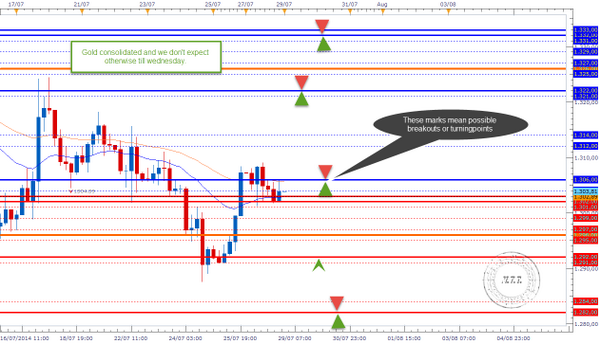

Jeffrey Augen, another leading options trading expert, highlights the benefits of using technical indicators in conjunction with math models. He advises traders to observe price charts and volume patterns to identify trends, potential reversals, and areas of support and resistance. Combining quantitative and qualitative analysis enhances decision-making and increases the likelihood of success.

Empowering Investors Through Education

Math options trading can be a rewarding endeavor, but it requires a strong foundation in both mathematics and market knowledge. Traders are encouraged to engage in continuous learning through books, online courses, and seminars dedicated to options pricing, trading strategies, and risk management.

By investing in their education, traders empower themselves to make well-informed decisions, navigate market fluctuations, and achieve their financial goals.

Image: twitter.com

Math Options Trading

Image: tacticaltradingstrategies.com

Conclusion

Math options trading offers investors a powerful tool for speculating on future market movements and enhancing portfolio diversification. Through a deep understanding of the mathematical foundations and expert insights, traders can develop robust strategies and maximize their potential for success.

Remember, while mathematical models provide valuable guidance, intuition, experience, and continuous learning are essential for thriving in the ever-evolving landscape of options trading. Embrace the power of mathematics and market knowledge to unlock the full potential of this exciting financial instrument.