Introduction

In the fast-paced world of options trading, keeping track of your trades is crucial for success. An Excel options trading journal can help you monitor your performance, identify patterns, and make informed decisions. This comprehensive guide will provide you with everything you need to know about creating and using an Excel options trading journal.

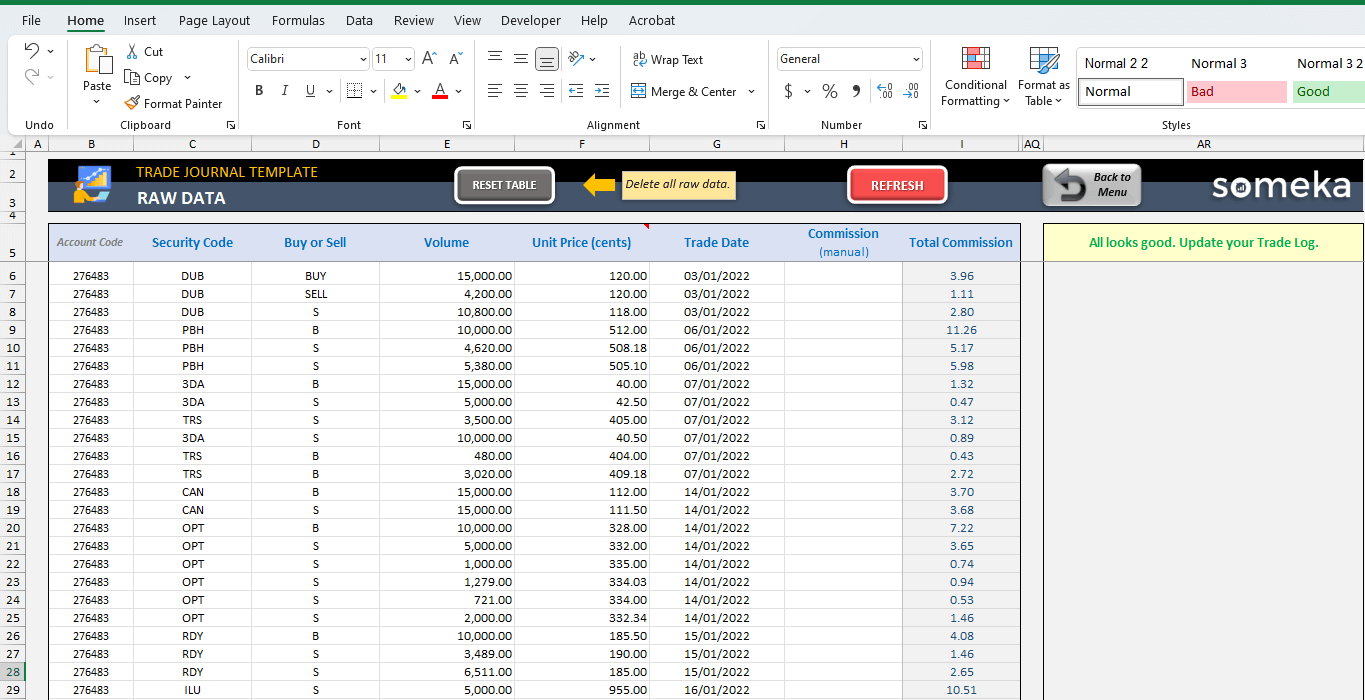

Image: www.tradingoptionscashflow.com

The Value of an Excel Options Trading Journal

An Excel options trading journal offers a multitude of benefits, including:

- Accurate Record-Keeping: Track your trades, orders, and account performance in one organized location.

- Performance Monitoring: Analyze your wins, losses, and risk-to-reward ratios to identify areas for improvement.

- Pattern Identification: Review your trading history to identify patterns in market behavior and your own trading approach.

- Tax Reporting: Generate tax reports easily with all necessary trading data in one accessible file.

Creating an Excel Options Trading Journal

To create an Excel options trading journal, follow these steps:

- Open a new Excel workbook and name it “Options Trading Journal.”

- Create multiple tabs for different categories, such as “Trade Log,” “Account Performance,” and “Risk Analysis.”

- Set up columns to capture important data points, including trade date, symbol, option type, strike price, premium, and profit/loss.

- Customize your journal to fit your specific trading strategy and preferences.

Trade Log

The Trade Log tab is the heart of your options trading journal. Here, you will record the following information for each trade:

- Trade Date: The date on which the trade was entered.

- Symbol: The ticker symbol of the underlying asset.

- Option Type: The type of option (call or put).

- Strike Price: The strike price of the option.

- Expiration Date: The expiration date of the option.

- Premium: The premium paid or received when entering the trade.

- Quantity: The number of contracts traded.

- Profit/Loss: The net profit or loss realized on the trade (calculated as the premium received minus the premium paid, plus or minus any market gain or loss).

Image: tradingqna.com

Using Your Excel Options Trading Journal

Once your journal is set up, start logging all of your trades and tracking your performance. Utilize the Trade Log to record detailed trading data, and use the other tabs for analysis and reporting.

Performance Analysis

The Account Performance tab allows you to track your overall performance over time. Calculate your average return on investment (ROI), win rate, and drawdown to assess your trading progress and identify areas for improvement.

Risk Analysis

The Risk Analysis tab helps you quantify your risk tolerance and manage your portfolio effectively. Calculate your maximum loss per trade, position size, and VaR (Value at Risk) to ensure your trades align with your risk appetite.

Tips and Expert Advice for Excel Options Trading Journal

To make the most of your Excel options trading journal, consider the following tips:

- Be Consistent: Log all of your trades, including both wins and losses. Consistency is key to effective performance analysis.

- Track Key Metrics: Focus on tracking the key metrics that matter most to your trading strategy, such as profit/loss, win rate, and average return.

- Review Your Journal Regularly: Set aside time each week or month to review your trading journal and identify trends and areas for improvement.

Conclusion

An Excel options trading journal is an indispensable tool for the serious options trader. By following the steps outlined in this guide, you can create a customized journal that will enable you to track your performance, identify patterns, and make informed trading decisions. Embrace the power of Excel and take your options trading to the next level.

Excel Options Trading Journal

Image: www.vlr.eng.br

FAQs

Q1: Why is an Excel options trading journal important?

A1: An Excel options trading journal allows you to track your performance, identify trends, and improve your trading strategy.

Q2: What should I include in my options trading journal?

A2: At a minimum, your journal should capture trade date, symbol, option type, strike price, premium, quantity, and profit/loss.

Q3: How often should I review my Excel options trading journal?

A3: Review your journal regularly, at least once a week or month, to identify patterns and areas for improvement.

Are you ready to enhance your options trading experience? Create your own Excel options trading journal today and elevate your performance!